Key Takeaways

- Modernization continues to shape the floor: Hardware, Cloud, ERP, and Security expand steadily, reflecting institutions’ sustained focus on infrastructure renewal and digital transformation.

- AI becomes a connective layer: Artificial Intelligence gains visibility, but primarily as an embedded capability across platforms rather than a standalone product category.

- Support and efficiency gain ground: Help Desk and Productivity solutions grow sharply, signaling renewed investment in user experience, service design, and operational effectiveness.

A Brief History of Our Analysis

Since 2021, ListEdTech has analyzed the Educause exhibitor floor to better understand how product categories evolve year after year. This long-term tracking provides a unique lens on the education technology landscape, highlighting not just who’s exhibiting, but what kinds of solutions vendors prioritize.

In our previous analyses, we focused primarily on the largest exhibitors, using booth size as a proxy for market maturity and influence. That approach helped identify dominant players and the broad direction of EdTech investment. However, as the market continues to fragment and new entrants emerge, we believe that real signals of change (especially early ones) are visible across all booth sizes.

Methodology

To capture this nuance, this year’s compilation includes every booth from 2021 to 2025, regardless of size. Each exhibitor was mapped to a combined product category, allowing us to compare the evolution of both number of kiosks and total booth size over time.

By examining both metrics together, we can distinguish breadth (how many companies are active in a space) from depth (how much they are investing to be noticed). When the number of kiosks stabilizes while booth size increases, it often signals a phase of consolidation and maturity, where fewer but larger vendors dominate.

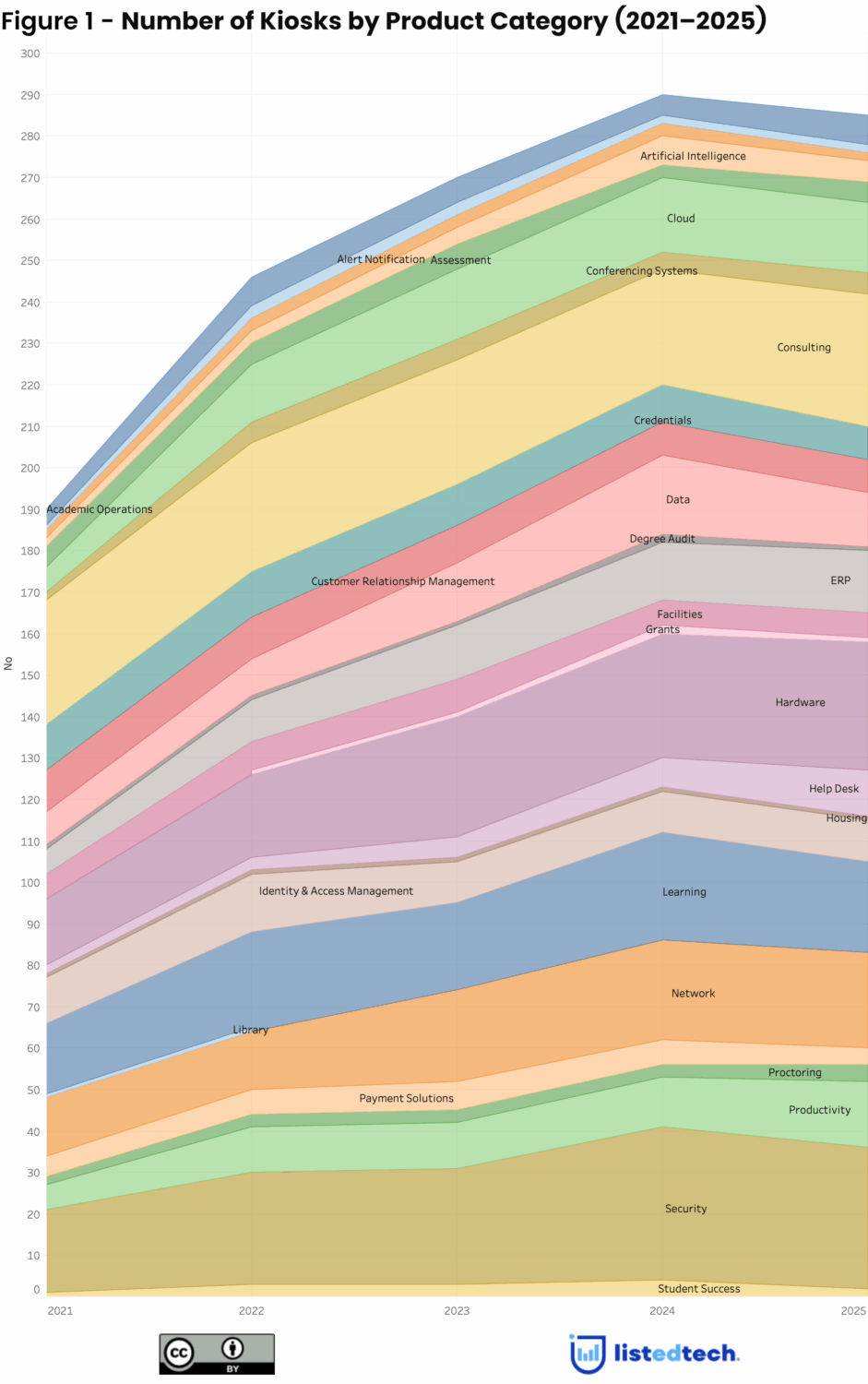

Between 2021 and 2025:

- The number of kiosks rose from 190 to 285, peaking in 2024. This is a sign that the difficult years tied to the pandemic are now behind us, even if pre-pandemic levels have yet to return.

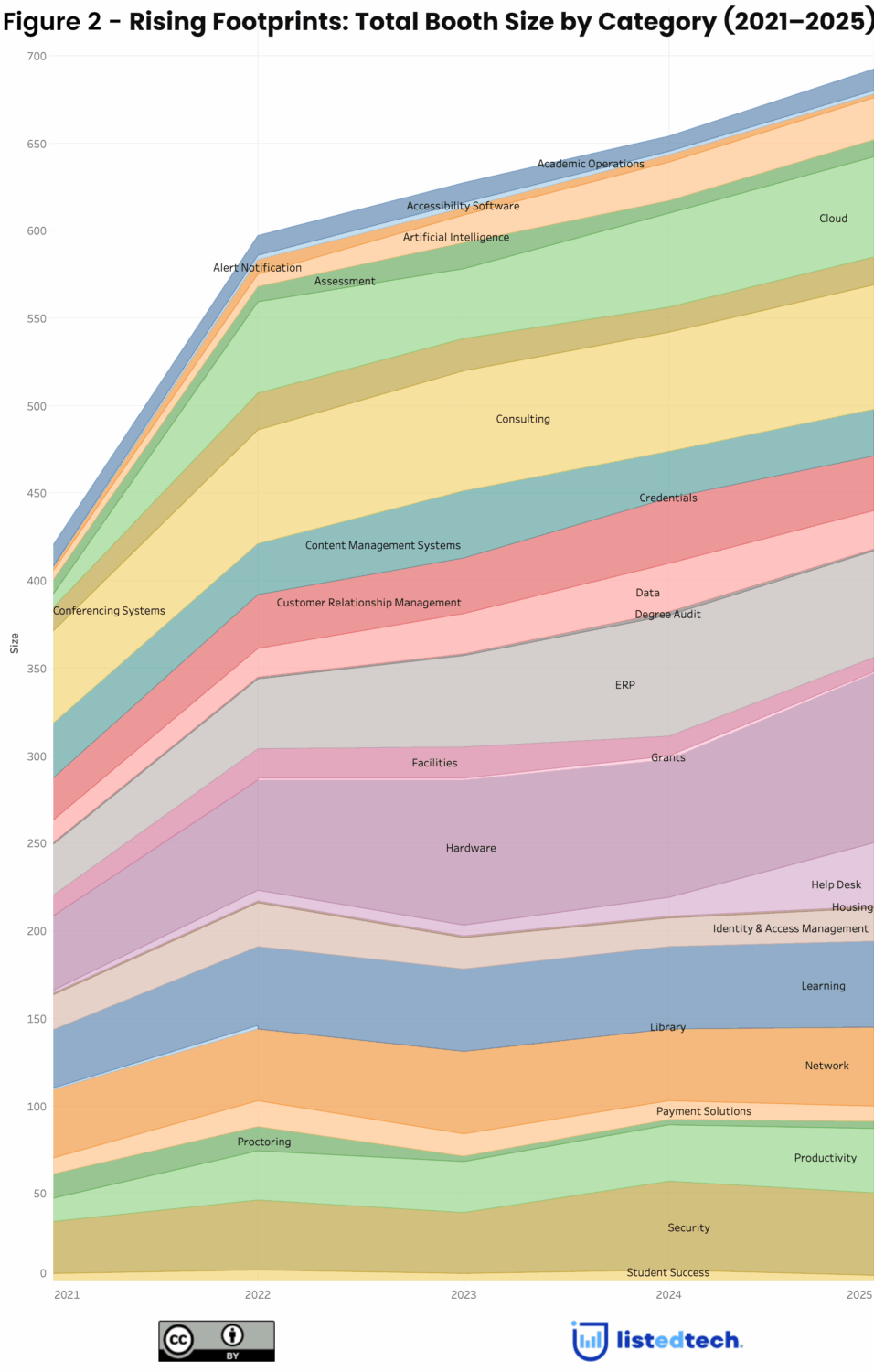

- The total floor size increased from 420 to 692, showing continued expansion even as the exhibitor count leveled off.

This suggests a sector where technology ecosystems are deepening rather than widening. Vendors are investing more heavily to maintain presence and visibility.

The Macro Picture

The Educause floor continues to reflect higher education’s evolving priorities. The overall pattern since 2021 shows a shift from pandemic-driven technologies toward core modernization, integration, and artificial intelligence.

Infrastructure and Modernization Drive Growth

The most visible expansion comes from Hardware, Cloud, and ERP. These categories together represent the backbone of digital transformation. Hardware booths nearly doubled in presence and more than doubled in size, while Cloud solutions surged sixfold. ERP remains one of the few product types showing consistent, year-over-year growth. These movements align with the modernization wave we’ve observed in institutional IT systems, where cloud migration and system renewal remain central themes.

Security Remains a Steady Anchor

Security solutions continue to occupy a strong and stable position. With both kiosk counts and floor space increasing since 2021, the data confirms the centrality of cybersecurity, identity management, and resilience in campus operations. The consistency of this category also indicates that institutions are expanding partnerships rather than replacing them.

Service and Support Step Forward

The Help Desk category shows one of the sharpest increases in footprint, growing from negligible representation to a notable mid-tier presence. This rise likely reflects an operational pivot: as technology ecosystems grow more complex, institutions are investing in better user support, managed services, and workflow automation.

Artificial Intelligence Takes Its Place Everywhere

AI’s growth is undeniable, though still modest in absolute terms compared to foundational systems. Its fourfold increase in booth size reveals a category still in motion: less a standalone market and more a layer that now underpins analytics, automation, and personalization features across the floor.

Pandemic Peaks Fade

Meanwhile, categories that surged during the pandemic (Proctoring and Library Technologies) continue to contract. Their shrinking presence suggests a normalization of teaching and learning infrastructure, as hybrid delivery becomes routine rather than exceptional.

Reading the Charts

Two complementary views help clarify these movements:

- Number of kiosks (left graph) — representing the breadth of participation within each category.

- Total booth size (right graph) — reflecting depth of investment and exhibitor prominence.

Together, they reveal a maturing landscape: while the diversity of vendors remains high, the largest categories are consolidating into fewer, more established presences. Growth in booth size outpacing kiosk counts points to strategic scaling, not just new entry.

Category Trajectories in Context

| Rising Categories | Interpretation |

|---|---|

| Hardware | Renewed infrastructure investment and lifecycle refresh post-pandemic. |

| Cloud & ERP | Core modernization efforts tied to system replacement and interoperability. |

| Help Desk & Productivity | Operational efficiency, automation, and improved user experience. |

| Artificial Intelligence | Growing as a cross-functional enabler embedded across product lines. |

| Declining Categories | Interpretation |

|---|---|

| Proctoring | Return to on-campus and hybrid learning models. |

| Mobile & Library | Market saturation and integration into broader platforms. |

These category shifts show higher education moving past the reactive spending of the early 2020s toward strategic digital renewal, a phase defined by integration, optimization, and measurable value.

Looking Ahead to 2026

The past five years of Educause data suggest a sector balancing consolidation with cautious innovation. As we head into 2026, a few themes stand out:

- AI maturity and specialization: Will AI remain a supporting capability, or will it evolve into a clearly defined product category with dedicated vendors and ecosystems?

- Cloud adoption deepening, not broadening: Expect continued growth in Cloud, ERP, and Consulting as institutions move from planning to execution. This phase favors interoperability and vendor ecosystems over one-off deployments.

- Operational intelligence and support: The steep rise in Help Desk and Productivity offerings reflects a renewed emphasis on service design, analytics-driven support, and seamless user experience. These areas are likely to continue expanding.

- Infrastructure as a differentiator: Persistent growth in Hardware and Network underscores the role of physical and digital infrastructure as needed in higher education IT strategy.

Conclusion

The Educause exhibitor floor remains a reliable mirror of EdTech priorities. Between 2021 and 2025, its evolution reflects a clear transition, from emergency adaptation to deliberate modernization. Booths are getting larger, categories are consolidating, and the technologies shaping higher education are now less about novelty and more about integration, scalability, and resilience. As 2026 approaches, the floor will likely continue to embody that shift: fewer logos, bigger footprints, and smarter ecosystems built to last.

Previous posts on the Educause conference: