Justin Menard and James Wiley are in San Antonio this week for the Educause conference and hope to see many of you there. Don’t hesitate to reach out to Justin and James.

The fall tradition returns with our latest analysis of the Educause exhibitor floorplan. Before we dive into this year’s trends, let’s revisit why we started this project. As regular attendees of Educause—one of the largest edtech conferences—we wanted to know if the exhibitor floorplan reflects real market trends in HigherEd. We launched this analysis in 2021, just one year after the pandemic hit, during a challenging time to gauge the market. This year, we not only continue to ask if the floorplan aligns with HigherEd trends, but we also explore whether Educause has fully bounced back from the pandemic.

Research Methodology

We’ve gathered floor plans and exhibitor lists dating back to 2012 (except for 2017 -unavailable- and 2020 -not an in-person conference). Our focus is on the biggest booths, those covering at least 600 sq ft or more. The smaller booths (100-599 sq ft) and start-ups with tables in the central sections are excluded from this analysis.

General Findings

Educause is regaining its position as the go-to HigherEd event of the fall. For 2024, there are 25 large exhibitors (600 sq ft or more)—the highest since the pandemic—compared to 23 in 2022 and 2023 and 21 in 2021. If we look at even bigger exhibitors (1,200 sq ft or more), we see eight massive booths this year, compared to just seven or six in the past few years. Before the pandemic, the average was nine massive exhibitors (2017-2019). While this year shows a slight increase, these large booths still make up a small fraction of total exhibitors. However, Educause has gained 16 more exhibitors across all sizes, signaling that companies still value face-to-face connections to build relationships and find new clients.

Since 2012, Educause has had nine core loyal big exhibitors. These companies span five main categories: ERP (Anthology, Ellucian, Oracle), hardware (Dell, Extron Electronics, HP), integrated edtech suites (Microsoft, Google), learning management systems (Instructure) and conferencing (Cisco Systems). This year, they make up 32% of the large exhibitor group, a slight shift from previous years (26% in 2023, 35% in 2022, 32% in 2021).

The pandemic had a major impact on the exhibitor lineup. Three major companies (Jenzabar, Unit4, Workday) with booths over 1,200 sq ft pre-pandemic are no longer in the big exhibitor group. Jenzabar and Workday have downsized but still attend with smaller booths, while Unit4 has vanished after its acquisition by TA Associates in March 2021.

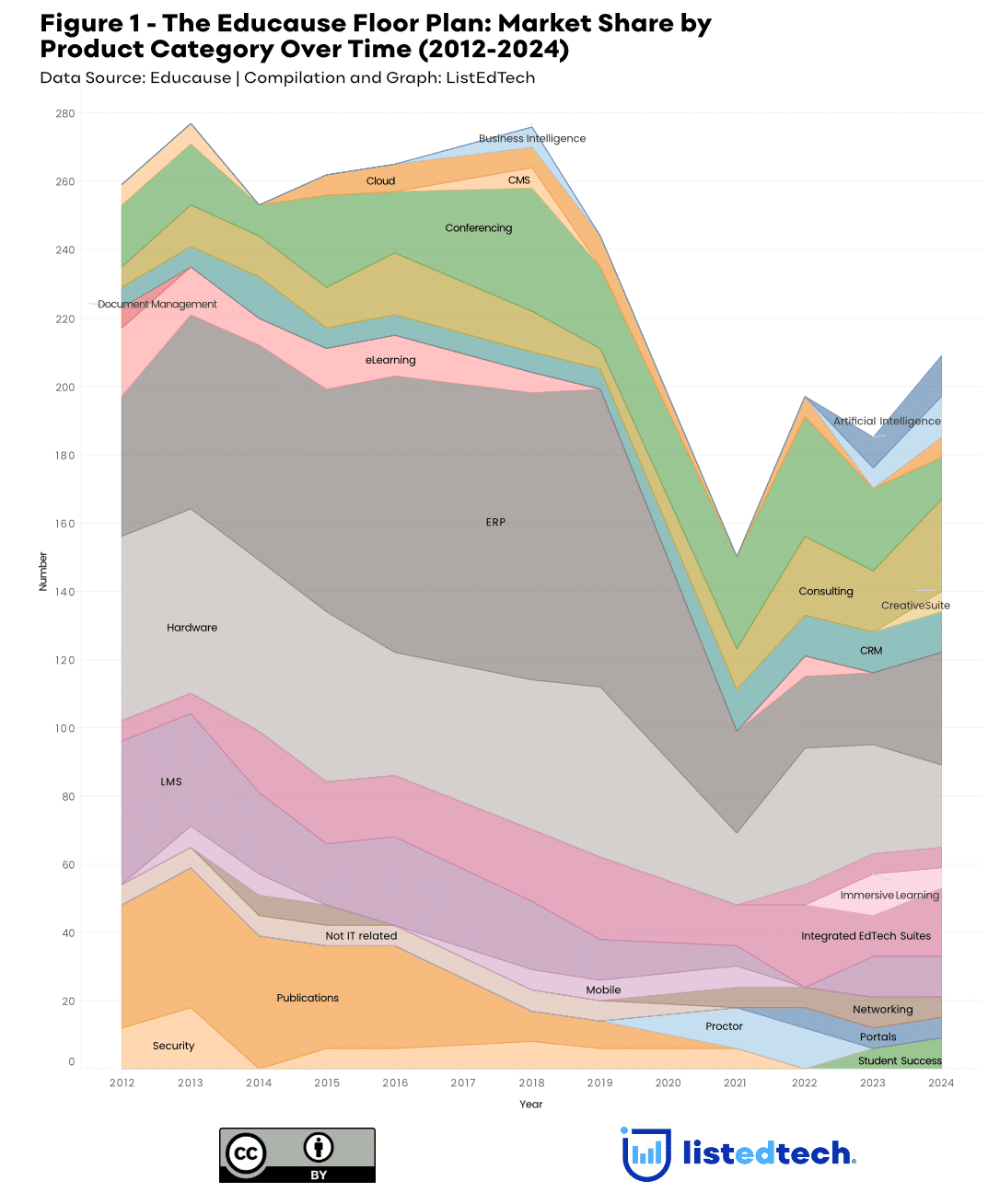

Product Variety

One bright spot is the range of product categories represented. In 2024, there are 16 different categories—the most we’ve seen since 2012. Some categories, like Publications, have naturally faded from the big exhibitor list, but it’s surprising that neither security nor proctoring solutions made it this year.

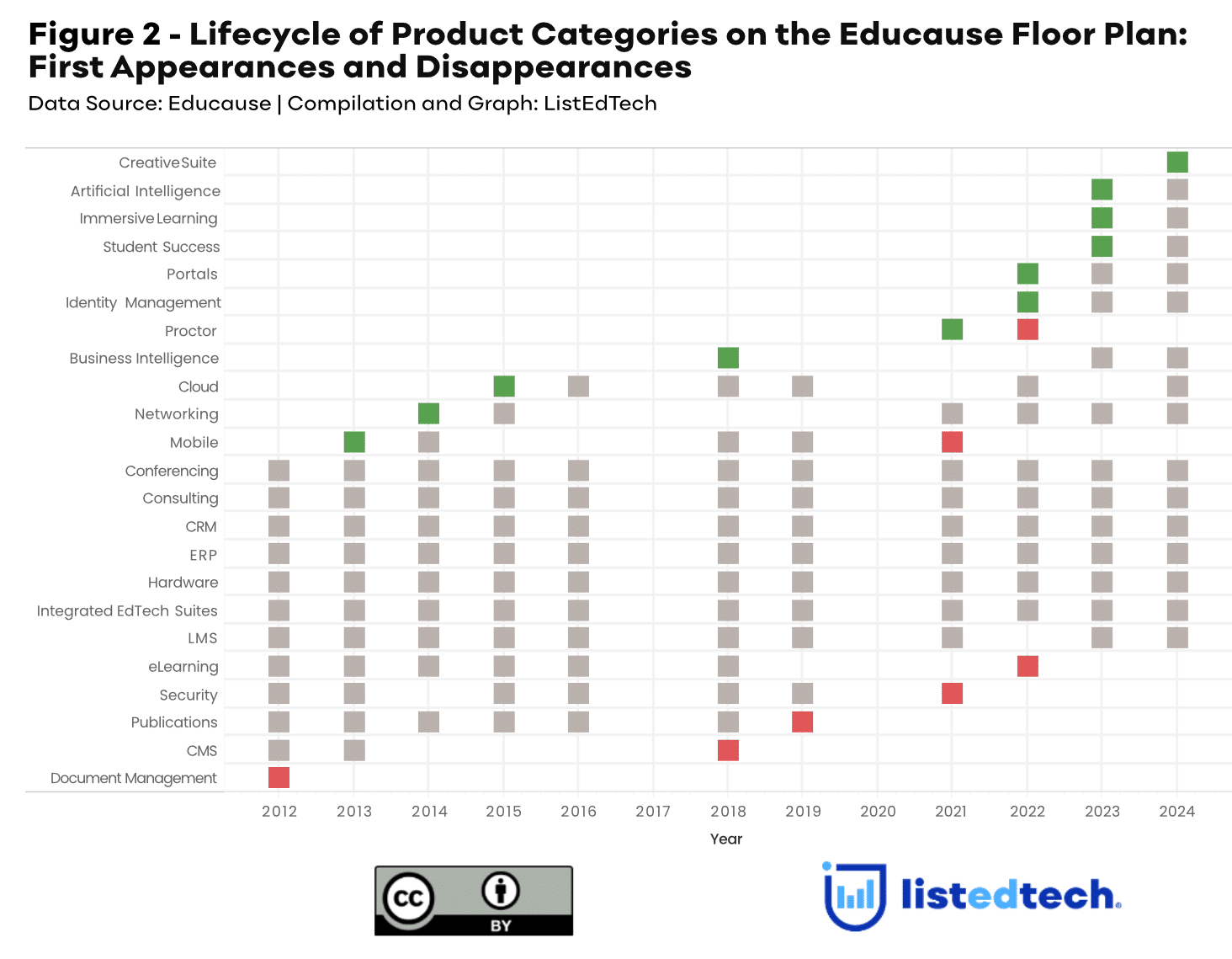

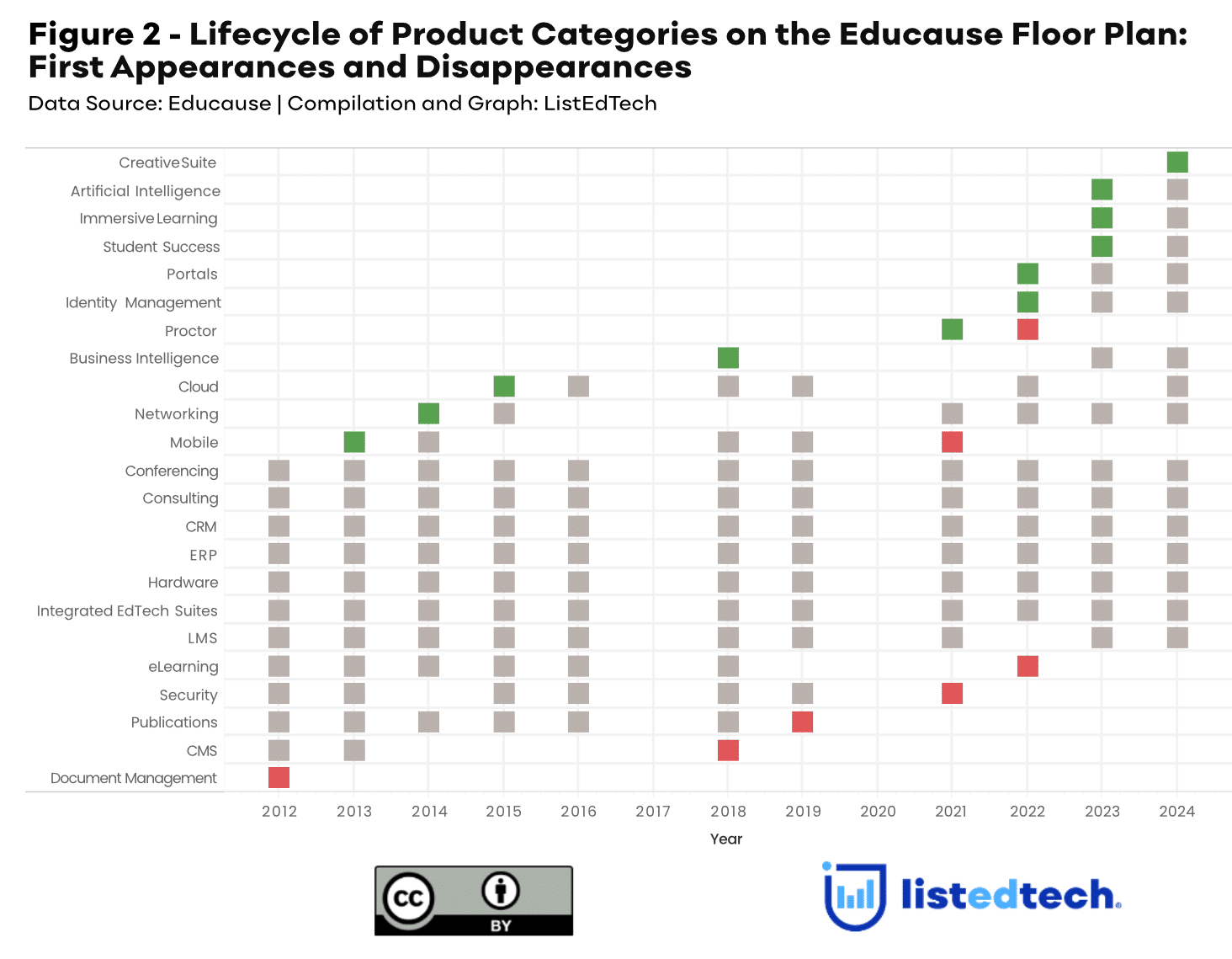

Product Category Lifecycle

To assess whether the floorplan reflects market trends, we examined when the product category first emerged as big exhibitors on the Educause floor plan. To identify the first appearance, we used the median for product categories with more than one large exhibitor. This graph has to be analyzed with market trends in mind, as we used a measure of central tendency. As expected, some categories, like eLearning, showed up before Learning Management Systems (LMS). ERP companies secured big booths ahead of business intelligence vendors.

Here are some key points for some product category:

- Creative Suites: Adobe and Canva have maintained a presence at Educause for several years, though previously with smaller booths. This changed recently when Canva expanded its space after acquiring Sherif (Affinity products) and Leonardo.AI. This also coincided with more universities signing agreements with Adobe for the use of its suite, despite the fact that Adobe remains in a smaller booth in 2024.

- Artificial Intelligence, Immersive Learning, and Student Success are among the hottest trends. The launch of ChatGPT in late 2022 and Meta Quest 3 in 2023, coupled with growing concerns around student retention, have driven a surge in exhibitors in these categories. It’s no surprise that, since 2023, more vendors are seizing the opportunity to showcase their innovations at larger booths.

- Proctor solutions: this category had a short lifespan as big exhibitors on the Educause floor plan. Similar to the inevitable rise of conferencing systems during the pandemic, proctor solutions were necessary while students were learning from home. With the massive return to campuses since 2022, these providers transformed their offerings, but they might not be as needed as before.

- Cloud Platforms vendors have been big exhibitors since 2015, in line with the growing shift toward cloud-based email solutions (like Gmail and Outlook Live) and other product categories also adopting the cloud.

- Mobile Solutions: While mobile technology remains integral to daily life, dedicated mobile apps are now a thing of the past. As smartphone adoption surged in the late 2000s, companies developed apps to help institutions connect with their students. But with the arrival of responsive websites and mobile-friendly systems like LMS and SIS, these standalone apps are no longer essential.

- ERP, LMS, CRM, Conferencing, considered as core systems, are present for the whole period of our analysis. We haven’t indicated a first appearance for these categories as we suspect they were on the floor plan already due to the nature of the services they provide.

- Publications vanished from the floor plan in 2020, coinciding with the shift to nearly 100% online formats during the pandemic. Publishers have since adopted new strategies to engage with educational institutions.

- Document Management saw a quick exit after our first year of analysis, as ERP and SIS vendors began integrating these features directly into their platforms, reducing the need for standalone solutions.

Summary

In conclusion, our analysis indicates that the Educause exhibitor floor plan does again, to a significant extent, reflect market trends in HigherEd. The presence and evolution of product categories like cloud platforms, AI, immersive learning, and ERP systems align with broader trends in the sector. The resurgence of large exhibitors since the pandemic further suggests that companies continue to recognize the value of in-person events for networking and sales. However, the fluctuating presence of certain categories, such as proctor solutions and mobile platforms, highlights that some pandemic-driven needs were temporary and have since diminished as institutions return to more traditional operations.

Educause has also shown clear signs of recovery following the pandemic. The increase in both the number of exhibitors and the size of booths, particularly in emerging categories, suggests a renewed confidence in the event’s role as a key networking platform for HigherEd technology. The floor plan may not yet fully mirror the pre-pandemic landscape, but with more companies returning, it is on a path toward regaining its former scale. The disappearance of certain categories, such as publications and document management, further reflects shifts in technological demands and integrations in HigherEd over the last decade.

Previous posts on the same topic: