Key Takeaways:

- Refocused Around Blackboard Core: Anthology will emerge from Chapter 11 as a leaner company centered on Blackboard and its teaching and learning solutions.

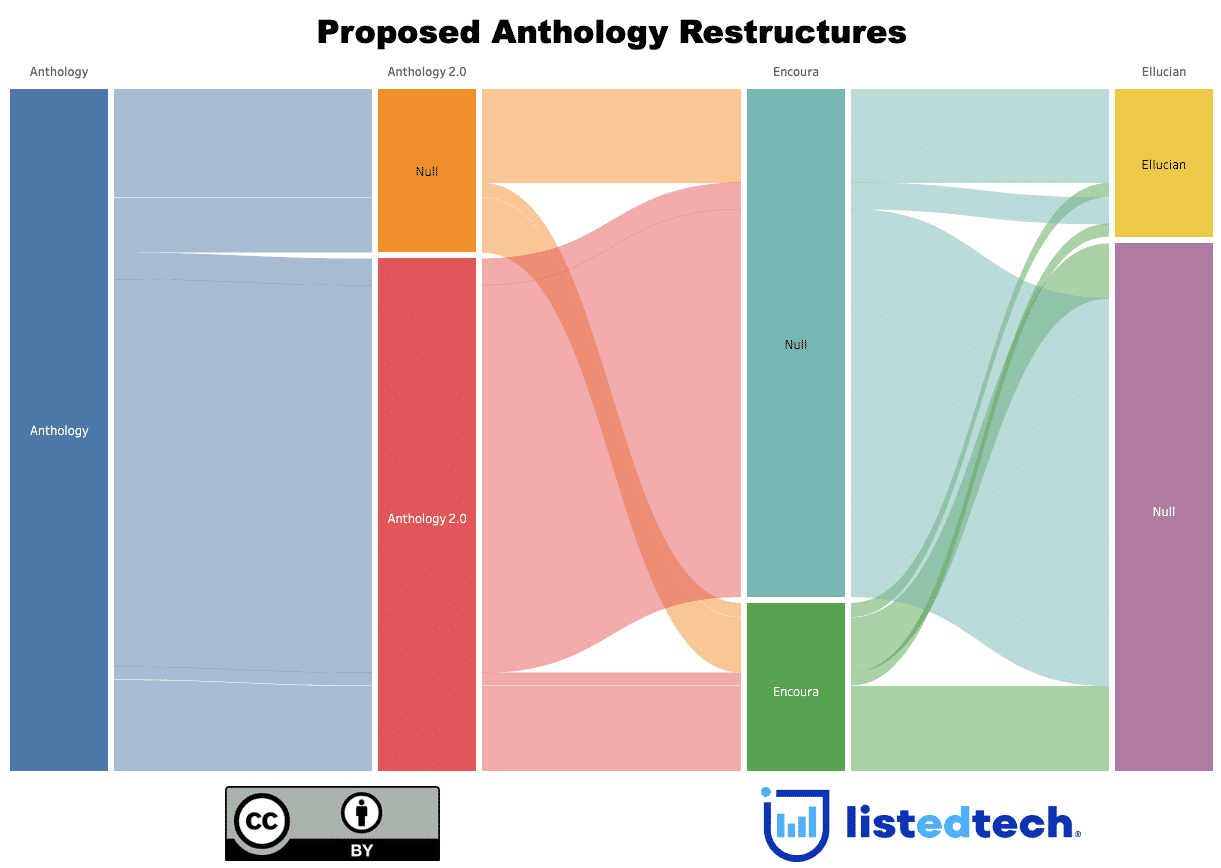

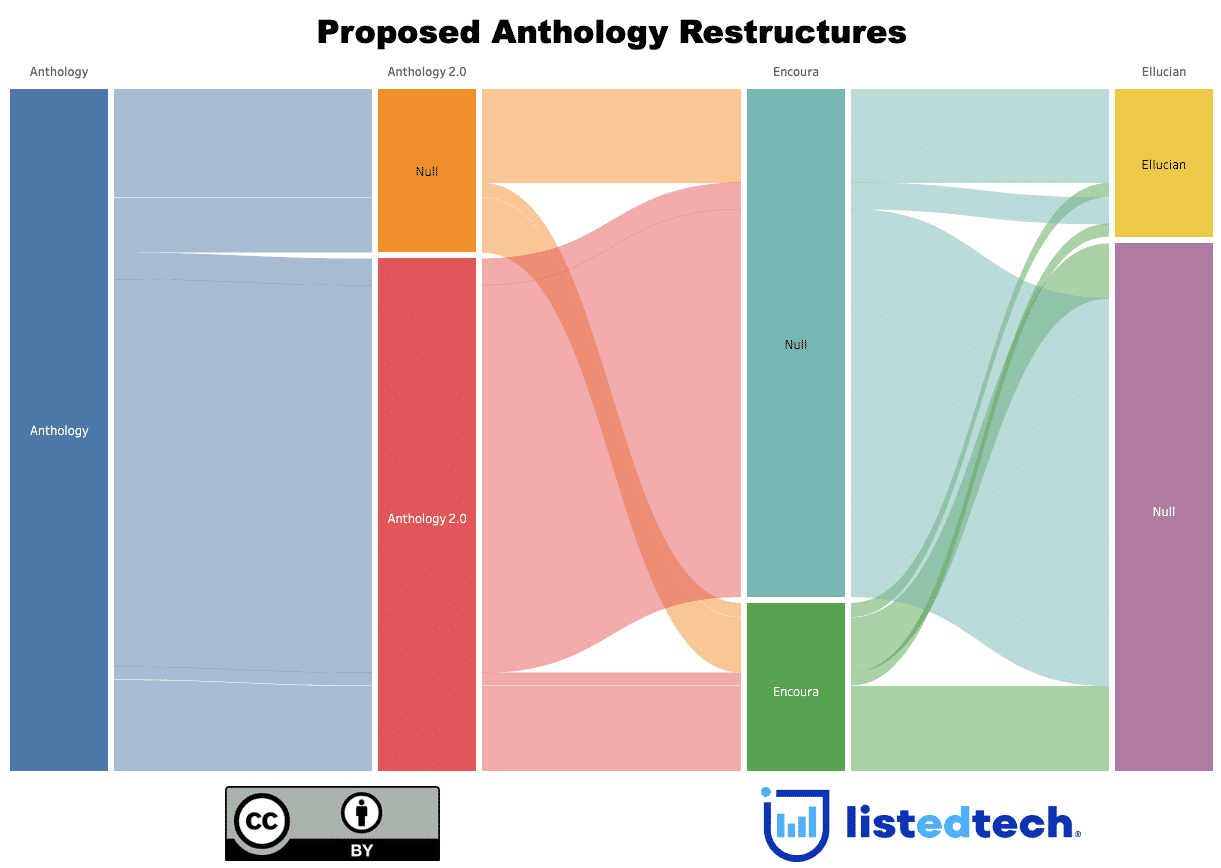

- Targeted Asset Sales: Ellucian and Encoura are set to acquire Anthology’s SIS/ERP and student success units, with little overlap among client bases.

- Debt-Driven Risks: The restructuring underscores the dangers of acquisition-fueled debt and the growing role of private equity in EdTech.

September 2025 marked a major turning point for Anthology, the owner of Blackboard and several other higher education technology platforms. The company filed for Chapter 11 bankruptcy in the U.S. after efforts to sell itself or parts of its business outside of court failed.

The filing is not a liquidation. Instead, it is a structured reorganization designed to reduce debt and sell off business units, leaving a leaner company built around Blackboard and its teaching and learning portfolio.

What’s Happening

- On September 30, Anthology (see our blog posts on the company) filed for Chapter 11 protection in the U.S. Bankruptcy Court for the Southern District of Texas.

- The company reported $1–10 billion in assets and liabilities in its petition.

- As part of the process, Anthology will receive at least $50 million in new financing and emerge with its debt fully written off.

- The plan calls for Anthology to retain Blackboard and its core teaching and learning solutions, while selling other units.

The sales process will unfold over the next several months, with bids due in mid-November and auctions planned shortly after if competing offers are received.

Who the Buyers Are

Two stalking horse bids have already been set, establishing a baseline for the asset sales:

- Ellucian → Buyer of Anthology’s SIS and ERP assets.

- Encoura, LLC (owned by Nexus Capital Management) → Buyer of Anthology’s Lifecycle Engagement and Student Success units, including CRM products.

Meanwhile, Blackboard and related learning solutions will remain with Anthology, recapitalized by its creditors and new investors such as Oaktree Capital Management and Nexus Capital Management (also investors in Encoura).

Based on our data, Anthology currently serves roughly 3,000 educational institutions. When comparing this with the proposed restructuring, the majority of institutions will remain with Anthology 2.0, while smaller segments fall under Encoura and Ellucian. Importantly, there is very little overlap between the three groups: only five institutions appear across all three entities. This lack of overlap highlights a deeper challenge in Anthology’s growth-by-acquisition strategy. With limited cross-selling and upselling across its broad product portfolio, the company struggled to fully leverage its scale. Instead of one institution adopting multiple Anthology solutions, many remained tied to a single product line. This not only reduced revenue potential per customer but also contributed to the financial pressures that ultimately pushed Anthology toward restructuring.

Why This Is Happening

Anthology’s path to this restructuring lies in its history of mergers and acquisitions. Over the past decade, the company rapidly expanded by buying multiple EdTech providers. While this strategy broadened its offerings, it also created a complex and overlapping product portfolio, with multiple solutions serving similar purposes but built on different technologies.

At the same time, the acquisitions left Anthology with substantial debt. Servicing this debt limited flexibility and investment in product growth.

By splitting into three more focused companies, the restructuring aims to:

- Streamline operations.

- Clarify product lines.

- Improve agility by removing heavy debt obligations.

What It Means for Institutions

For universities and colleges currently using Blackboard, the core teaching and learning products are expected to remain stable throughout the restructuring process. Anthology has said it will maintain service levels during bankruptcy and move through the process quickly.

That said, the bankruptcy filing and sale of assets introduce uncertainty into the marketplace. Institutions evaluating renewals or new contracts may weigh stability concerns when considering Blackboard against competitors.

The Bigger Picture

This move highlights broader themes in EdTech:

- The risks of growth by acquisition, especially when fueled by debt.

- The increasing role of creditors and private equity in shaping company outcomes.

- The consolidation of EdTech vendors, as core systems are absorbed into fewer, larger players.

Anthology’s breakup reflects these dynamics. The end result may be a leaner, more focused organization, though the long-term effects on the higher education technology market remain uncertain.