In an earlier post, we leveraged network analysis to explore Anthology’s product ecosystem to understand whether its ” togetherness ” message was reflected in its products’ implementations. Our study revealed that while Anthology has made great strides in delivering this message, it could do more, such as creating a narrative highlighting the potential benefits of the synergies between its products. Establishing a product ecosystem that delivers the message that the entire ecosystem is greater than the sum of its parts is not unique to Anthology. Our data shows that forty-five percent of edtech vendors offer product ecosystems, and we can assume that many, if not all, have the same goal as Anthology. So, how are they doing? To answer this question, this week’s post examines the product ecosystem of one such vendor (Ellucian).

Our Approach

Before diving into our findings, we should first explain network analysis. Essentially, network analysis explores the relationships between entities. For example, network analysis identifies the relationships between entities and the strength of those connections, such as the relationships between stress, peer pressure, fitness, and nutrition, to help healthcare professionals understand their impact on individuals’ health.

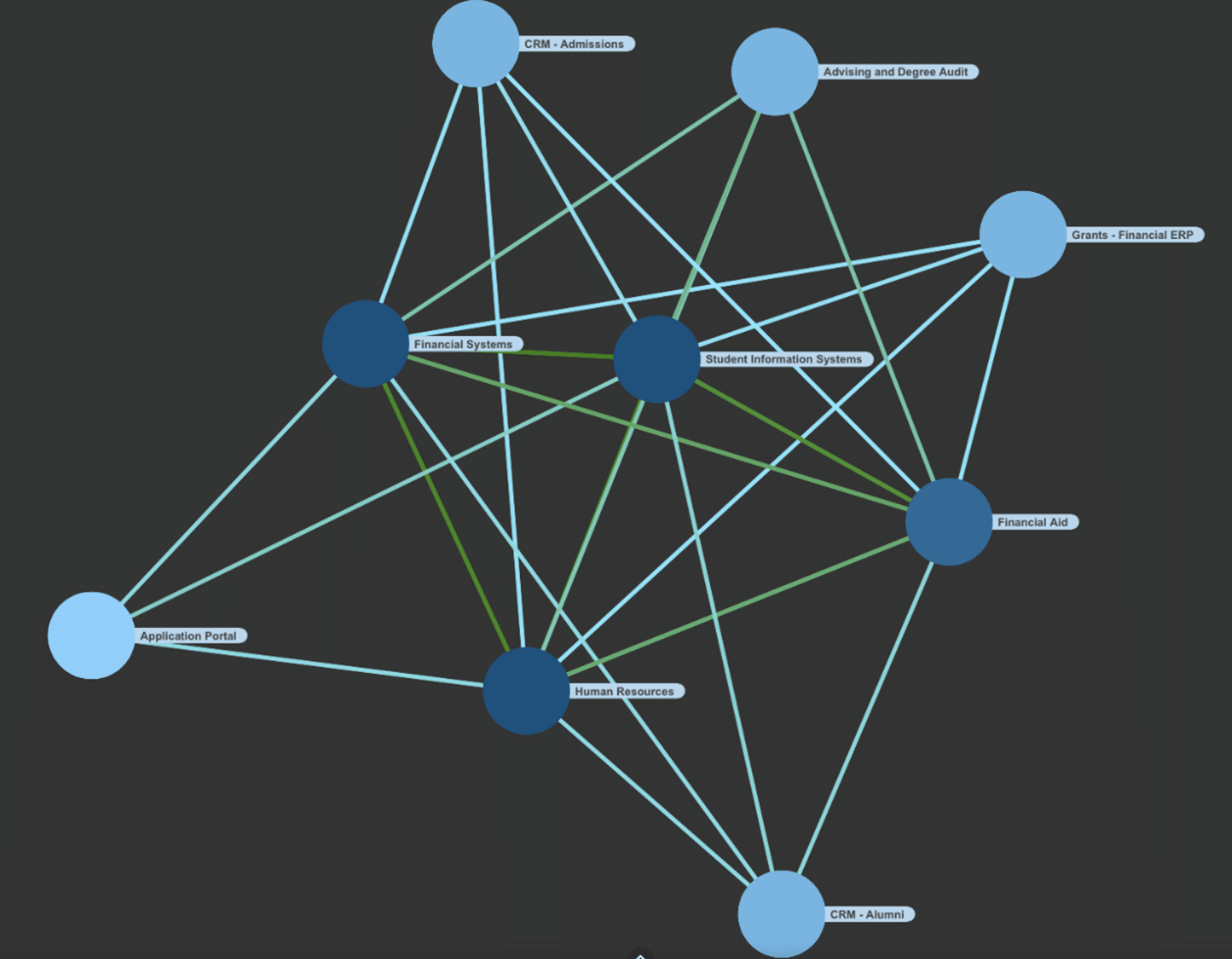

As input to our analysis, we used data from just under 1,300 four-year US institutions, all of which had at least one Ellucian product in the nine product categories where Ellucian’s product appears the most in our data (Student Information Systems, Financial Systems, Financial Aid, Human Resources, Advising and Degree Audit, Application Portal, CRM – Alumni, CRM – Admissions, and Grants – Financial ERP). For clarity, we combined multiple products in a product category (Banner and Colleague, for example) and limited our analysis to the pairs of products implemented in more than 10% of institutions.

Our Findings

Figure 1 below shows our findings. This figure shows the number of relationships by product group (bubble color) and frequency of pairs (line color). There are three main takeaways from this figure:

- An ecosystem within an ecosystem: As shown by the darker green lines, products in three Ellucian product groups (Human Resources, Financial Systems, Student Information Systems add Financial Aid?) have been implemented together more often than products in any other product group. For example, within our dataset, fifty-seven percent of institutions have products in all three of these product groups, followed by 42% of institutions with products in the Student Information Systems, Financial Aid, and Financial Systems product groups.

- Four ecosystem hubs: As the dark blue bubbles indicate, products in four Ellucian product groups (Human Resources, Financial Systems, Student Information Systems, and Financial Aid) serve as the hub for their ecosystem. For example, products in the first three product groups are related to products in all other groups. In contrast, products in the Financial Aid product group have been implemented alongside those in all other product groups except those in the Application Portal group.

- CRMs are on the fringe: Products within the two CRM product groups are less frequently paired with products in other groups, as shown by the absence of dark green lines between them and any other product groups. For example, only 19% of institutions within our dataset have implemented Ellucian’s CRM for Alumni and its SIS, followed by 13% of institutions that have implemented products within the CRM for Admissions product group and its Student Information System.

What does this analysis tell us about Ellucian’s product ecosystem? First, it reveals some good news: rather than product groups being disconnected, there is instead a close set of interrelationships between three product groups (Human Resources, Financial Systems, and Student Information Systems), as well as those groups serve alongside products in the Financial Aid product group to serve as the anchor for their ecosystem. There is, however, some less-than-good news, as the CRMs are not as intertwined in Ellucian’s ecosystem, suggesting that users of other Ellucian products are not as enamored enough of those solutions to implement them alongside their existing Ellucian solutions.

Summary

As with Anthology, Ellucian wants the market to see how its products fit together and provide a combined value that is more significant than if they were implemented alongside a product from another vendor. To that end, Ellucian works to show how its solutions work together, for example, to empower student success and help institutions embark on their digital transformation journeys.

However, as our analysis shows, more is needed. Institutions appear to see the value of the connections between certain product groups (Human Resources and Financial Systems, for example) but need help to see why joining their Banner or Colleague student information systems with an Ellucian CRM is helpful. Until Ellucian figures out how to help institutional leaders connect the dots, its product ecosystem will remain a “good news/bad news” story.