Key Takeaways

- Upgrades Signal Institutional Commitment – Upgrading within the same vendor’s ecosystem requires investment in training and workflow changes, making it a significant decision.

- Mergers and Decommissioning Drive Upgrades – Institutions often upgrade due to vendor acquisitions or product phase-outs rather than purely voluntary choices.

- Blackboard Ultra Reflects Market Shifts – Despite Blackboard’s declining market share, most remaining users have moved to Blackboard Ultra, showing strategic decision-making within vendor ecosystems.

When analyzing the education technology market, we often focus on two key indicators: market decommissioning (when institutions phase out a product) and new implementations (when institutions adopt a new system). These trends help us gauge customer satisfaction and vendor success. However, there’s another crucial factor that often goes unnoticed: how institutions move within a vendor’s product lineup—a process we call upgrading.

What Is an Upgrade?

An upgrade occurs when an institution transitions to a newer version or a different product from the same vendor within the same product category. Unlike switching vendors, upgrading signifies a continued commitment to a company’s ecosystem while adopting its latest technology.

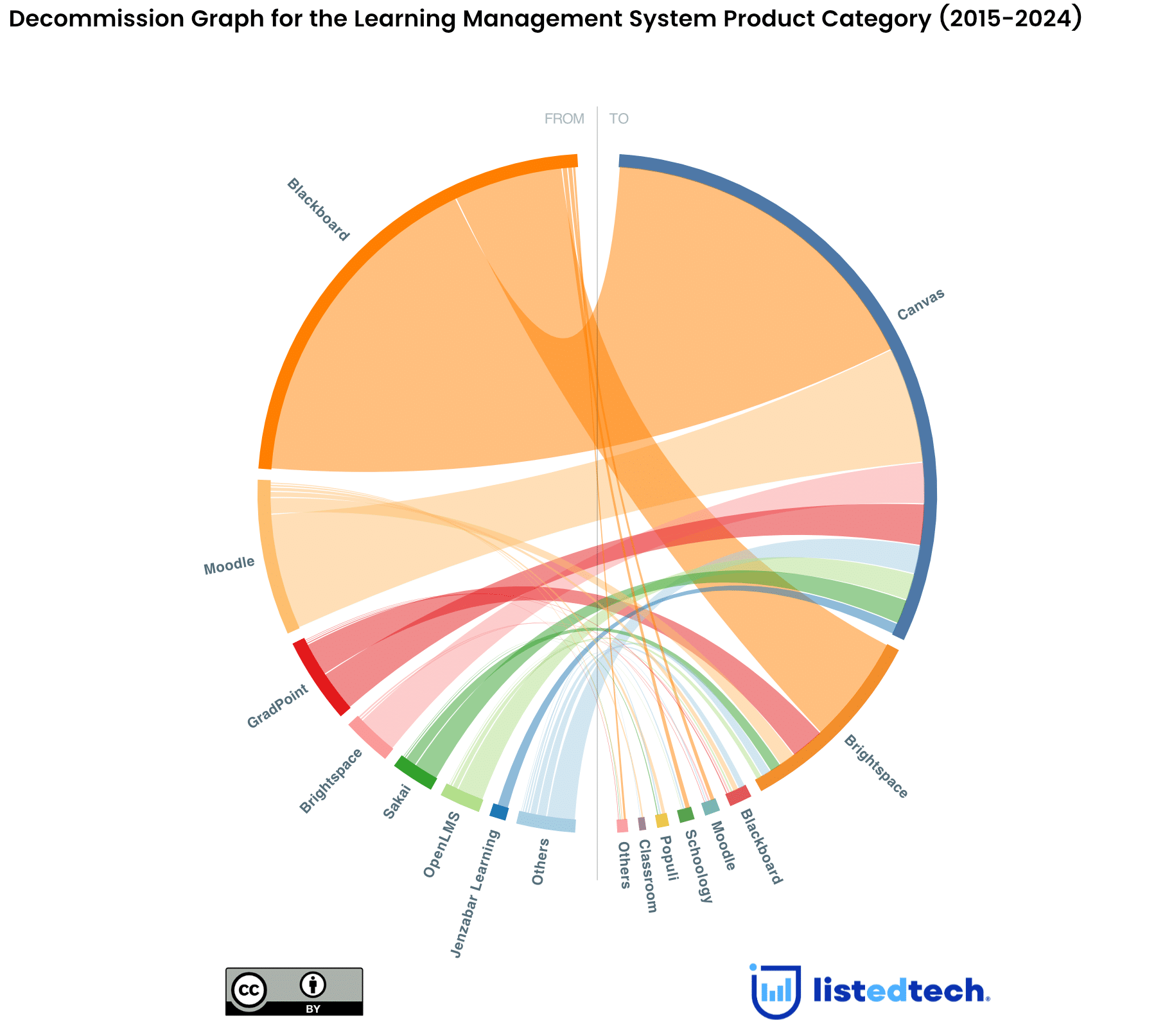

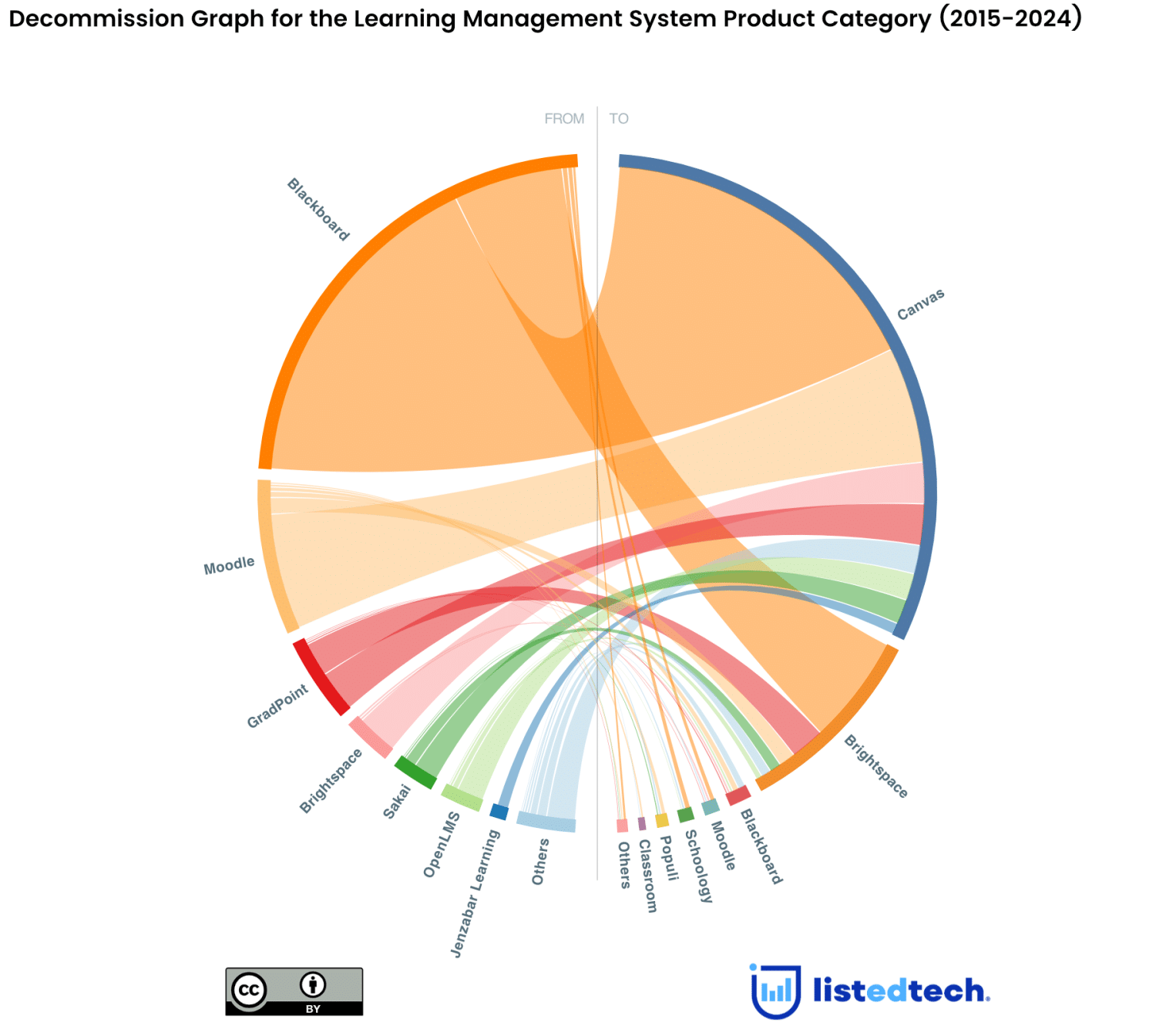

In our Decommission graph on the ListEdTech portal as seen below, we’ve excluded upgrades to highlight broader market trends. If upgrades were included, we would see a significant flow of institutions moving from one product to another product from the same company. Blackboard products are an excellent example in the LMS category. In the future, we would like to add the option of upgrades in this graph.

How Mergers, Acquisitions, and Decommissioning Drive Upgrades

Upgrades don’t always stem from a voluntary choice; they can be the result of market shifts such as mergers, acquisitions, or product decommissioning.

For instance, some upgrades occur because a vendor acquires another company:

- PowerSchool’s acquisition of Chalkable in 2016

- Transact’s acquisition of CASHNet still in 2016

Other upgrades happen when older products are phased out, pushing institutions toward a newer solution. A notable example is:

- Ex Libris’ transition from ALEPH and Voyager to Alma

In these cases, institutions must decide whether to stay within the vendor’s ecosystem or explore alternative solutions.

The Case of Blackboard Ultra

One of the most notable upgrade trends in recent years has been the shift from Blackboard Learn to Blackboard Ultra. Although institutions remain with Blackboard, this upgrade involves more than just a routine software update—it requires staff retraining, workflow adjustments, and in some cases, a reassessment of the institution’s long-term edtech strategy.

For many institutions, this transition presents an opportunity to reevaluate their learning management system (LMS) needs and explore what other products exist in the market.

Market Share and Upgrade Trends

Over the past decade, Blackboard’s market share in North America has declined from 9% to 5%. Despite this, our data reveals that about 60% of K-12 and higher education institutions still using Blackboard have moved to Blackboard Ultra, a trend that remains consistent worldwide.

Why Do Upgrades Matter?

While upgrading within the same vendor’s ecosystem may seem like a straightforward decision, it actually signals a major institutional commitment to a new product version. Even without switching vendors, institutions must learn new features and interfaces, adapt some operational processes and ensure their staff can use the new software.

Tracking these upgrades helps us understand vendor-client relationships, product evolution, and how institutions make decisions in an ever-changing edtech landscape.

As we continue monitoring these trends, we’ll share more insights on how upgrades shape the future of education technology. Stay tuned!