Key Takeaways

- Microsoft Market Dominance: Entra holds a decisive lead.

- Declining Legacy Solutions: Shibboleth continues a long-term decline while institutions transition toward modern, hybrid architectures.

- HigherEd-Native Growth: Ellucian Ethos and QuickLaunch are rising by offering deep campus-system integrations.

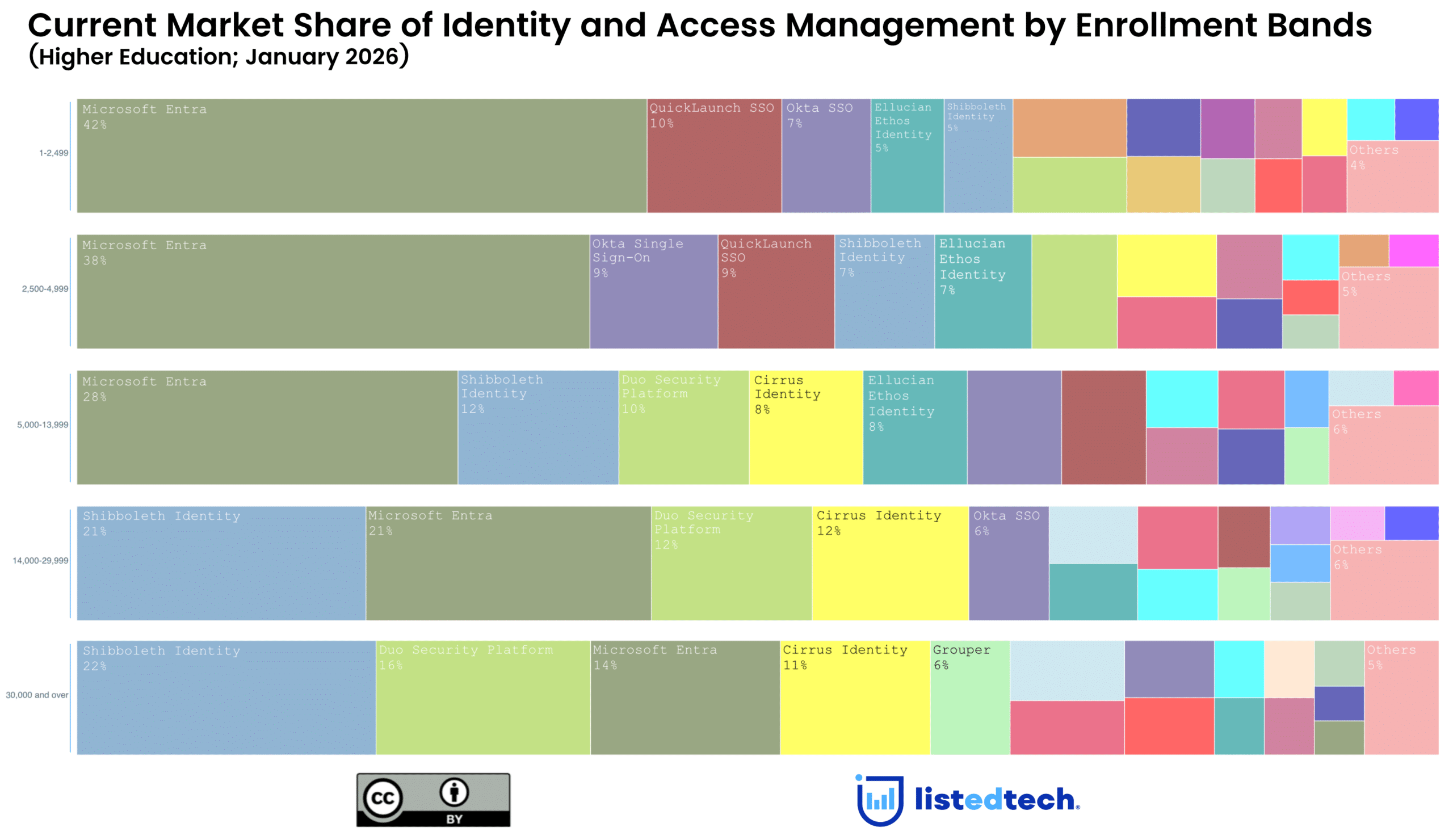

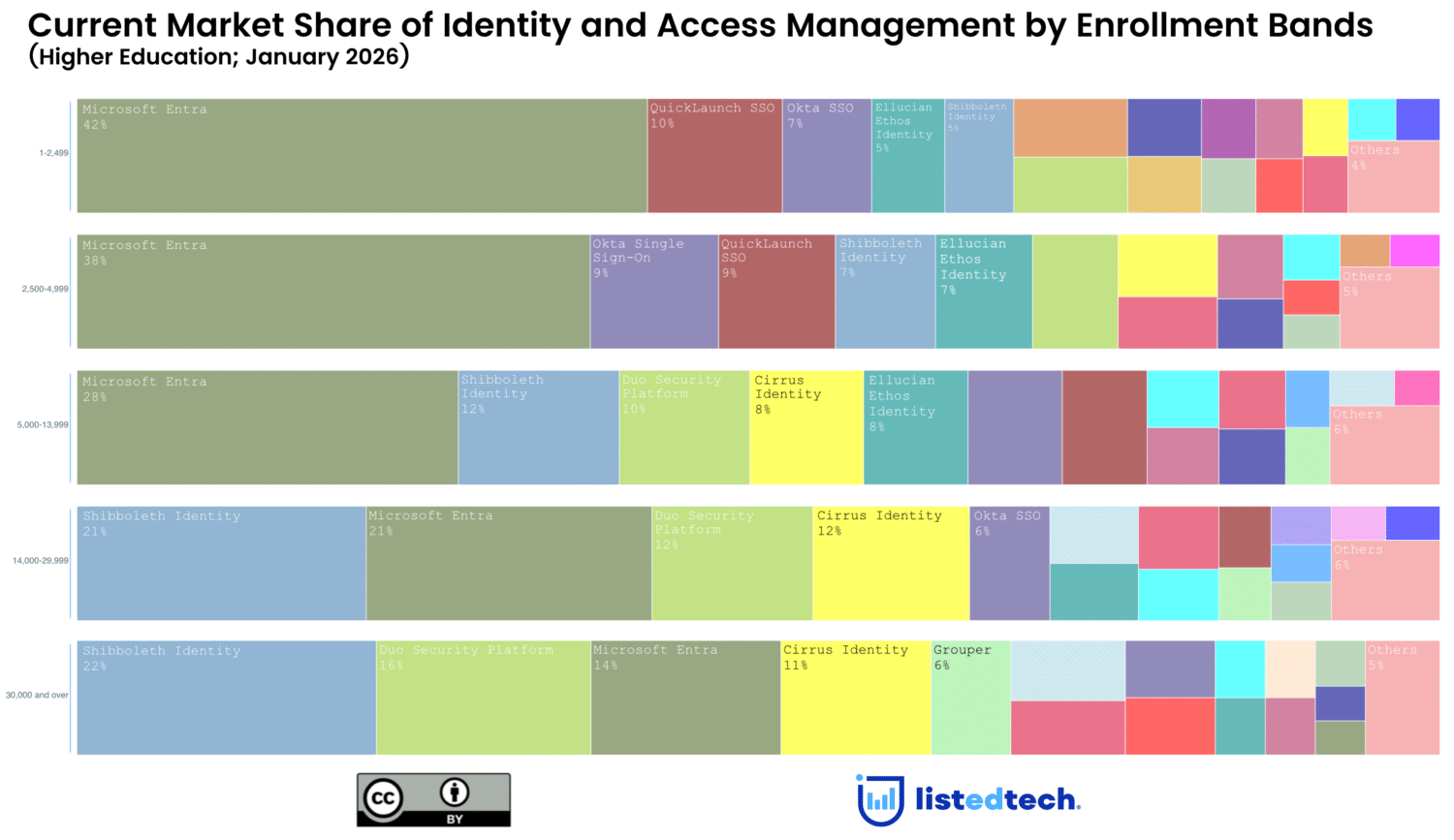

This month, we rolled out Identity and Access Management (IAM) as a new product group in the ListEdTech database, with support from the team at Unicon. As part of that launch, we analyzed nearly 3,000 IAM implementations across higher education institutions in North America, segmented by enrollment band—and the results highlight a market that is consolidating at the top while quietly reorganizing underneath.

Microsoft Entra: Scale and Momentum

Microsoft Entra holds a decisive lead across nearly every enrollment band, and that lead continues to widen. What’s notable isn’t just Entra’s installed base, but how Microsoft is productizing identity as a platform layer—for AI agents, workforce access, external identities, and governance.

With deeper Conditional Access, expanded identity governance, tighter network protections, and Entra’s role as the backbone for Microsoft’s AI roadmap, Microsoft is pulling on both scale and growth levers simultaneously.

A Small Group of Challengers Is Gaining Traction

Beyond Microsoft, momentum is clustering around a limited set of vendors—Okta Single Sign-On and Ellucian Ethos Identity—even as the mid-tier remains tightly packed in the 5–9% share range.

This concentration of momentum suggests a coming reshuffle. Institutions appear to be favoring scalable, AI-ready platforms and ERP-adjacent identity solutions, rather than stand-alone tools with narrower roadmaps.

Shibboleth: Declining, but Not Disappearing

Shibboleth’s long-term decline continues, and growth remains muted. Yet it remains firmly embedded in higher education, largely because multilateral federation still matters.

Rather than full replacement, many institutions are bridging Microsoft Entra with InCommon using proxy or federation bridge services. This hybrid model allows campuses to modernize identity architectures without losing federation access—an increasingly common pattern in complex HigherEd environments.

Duo: Defending an Upper-Tier Niche

Duo’s market share has drifted down from its 2018 peak, positioning it as an upper-tier niche player rather than a market leader. In response, Duo is leaning into phishing-resistant authentication—passwordless Windows logon, Verified Push, risk-based controls, and a native Entra External Authentication Method.

These moves reflect a broader shift: phishing resistance and MFA are no longer differentiators—they are baseline expectations. The competitive question is how these capabilities integrate into broader identity platforms.

Identity Is Becoming a Security Fabric

With one dominant leader and a fragmented lower tier, vendors are converging on an identity security fabric model—merging access management, governance, CIEM, PAM, and threat detection.

Microsoft has folded standalone CIEM into Defender for Cloud, while Okta’s acquisition of Axiom strengthens its PAM capabilities and standardizes agent-to-application access. Identity is increasingly the control plane for security, automation, and AI-enabled access.

HigherEd-Native Identity Is Quietly Rising

One of the more interesting signals in the data is Ellucian Ethos Identity, now the fastest riser off a moderate base. Alongside it, HigherEd-focused platforms like QuickLaunch are investing in deeper SIS and ERP integrations, lifecycle automation, and ecosystem partnerships.

The data suggests institutions are rewarding identity solutions that are tightly coupled to campus systems, not just enterprise IAM patterns. In higher education, context and lifecycle still matter.

Why This Matters

Based on nearly 3,000 North American HigherEd IAM implementations, the data shows a market moving decisively toward consolidation at the top, while institutions simultaneously demand flexibility, federation, and campus-specific integration.

As IAM becomes foundational to security, AI adoption, governance, and digital experience, identity decisions are shaping what institutions can do across the rest of the IT stack.

With the addition of IAM to the ListEdTech database, institutions, vendors, and consultants can now track this market with the same rigor applied to LMS, ERP, and CRM—bringing clearer visibility to where consolidation, disruption, and opportunity are emerging.