Key Takeaways

- Divergent SIS Trends: K–12 remains resilient with modernization cycles, while HigherEd activity has halved since 2022 as institutions postpone major system migrations.

- LMS Stabilization: HigherEd surged to 102 RFPs in 2025 (doubling 2024 levels) as institutions finally move toward second-generation, long-term platform replacements.

- Infrastructure Focus: Institutions are prioritizing security, CRM, and core systems over experimental or discretionary technology investments.

What five years of RFP activity tells us about shifting institutional needs in HigherEd and K–12

As this will be our last post of the year, we wanted to take a moment to look back at RFP activity across Higher Education and K–12. Each year, RFP patterns give us an early indication of where institutions are investing and where the market is heading. By reviewing the trends from the past five years, we can better understand not only what shaped 2025, but also what these signals tell us about the priorities and projects coming in 2026.

Why RFPs Matter

To understand where institutions are truly committing resources, we analyze thousands of RFPs collected annually through the ListEdTech database. Unlike product launches or marketing announcements, RFPs reflect concrete institutional intent, particularly in categories with long procurement cycles such as ERP, SIS, and LMS. As a result, they remain one of the clearest early indicators of where investment decisions are heading.

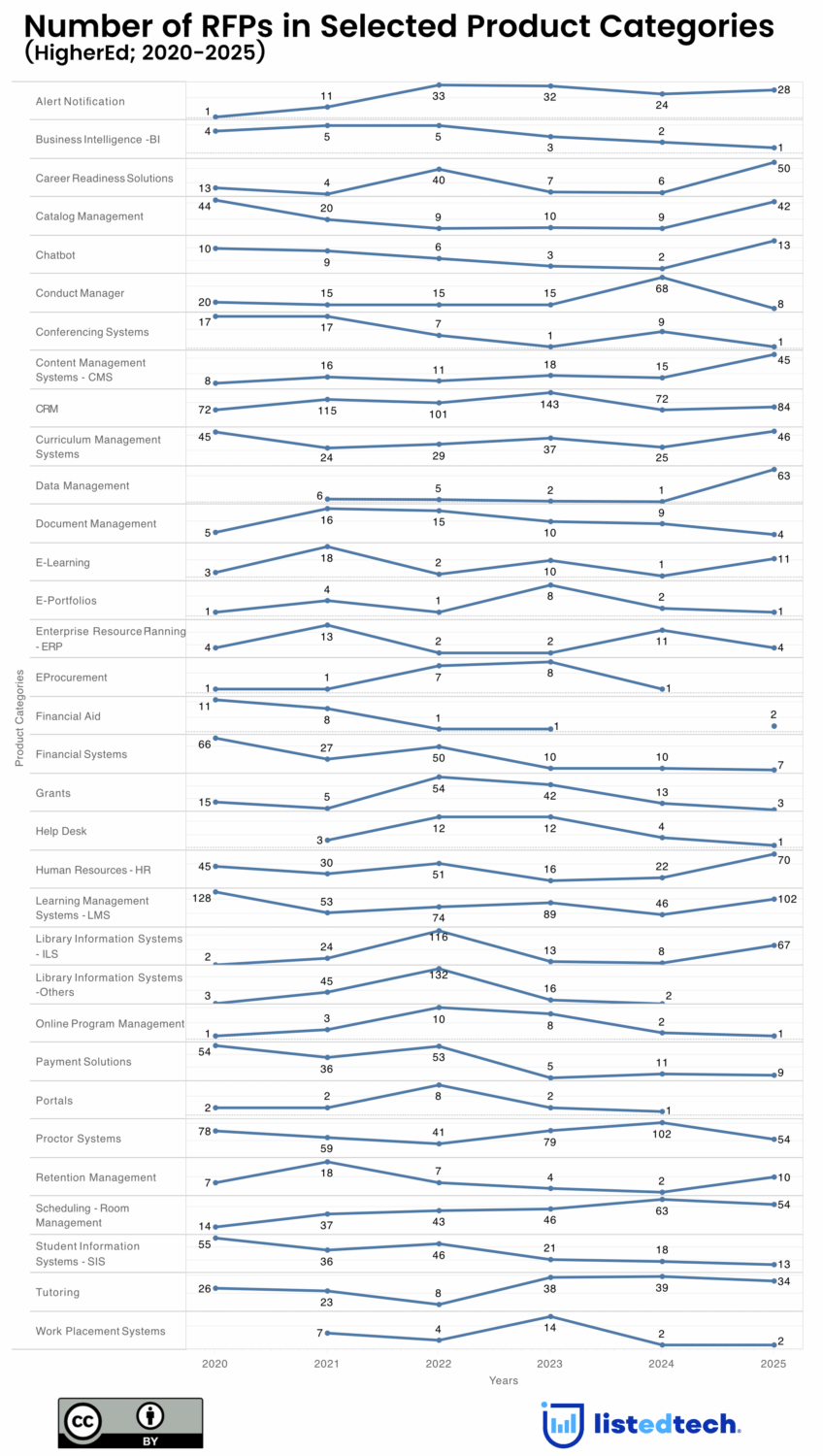

This year’s analysis spans RFP activity from 2020 through 2025 and includes both HigherEd institutions and K–12 school districts across 40+ product categories. What follows are the most meaningful patterns to emerge from this five-year view.

Skip directly to the interpretation

1. SIS Activity Spikes Again, Driven Mostly by K–12

Student Information Systems continue to function as a bellwether for long-term institutional investment, and in 2025, the story diverges sharply between HigherEd and K–12.

HigherEd SIS

SIS RFP activity in HigherEd continued its post-2022 decline, falling to less than half of its 2022 peak of roughly 130 RFPs. This sustained drop suggests that many institutions are postponing major SIS migrations amid financial pressures and competing priorities.

K–12 SIS

By contrast, SIS remains the most active RFP category in K–12. Although volumes dipped slightly in 2025 following a rebound in 2024, activity remains well above pre-pandemic levels. Contracts initiated during the 2017–2019 window are now coming up for renewal, reinforcing SIS as a consistently active procurement category for districts.

What This Signals

Taken together, the data point to a K–12 sector still actively cycling through modernization and consolidation, while HigherEd remains more cautious, likely delaying large-scale replacements until financial and operational conditions stabilize.

2. LMS RFPs Remain Volatile Across Both Sectors

LMS procurement is no longer dominated by urgency. Instead, RFP activity now reflects second-generation decision-making across both sectors.

HigherEd LMS

After a modest uptick in 2024, HigherEd LMS RFPs declined again in 2025, remaining far below the elevated volumes seen during the 2020–2021 period. This suggests that most institutions have already completed the pandemic-driven phase of LMS adoption and are now operating within longer replacement cycles.

K–12 LMS

K–12 LMS activity also declined from its 2022 peak. However, the persistent use of Google Classroom alongside “full” LMS platforms continues to generate a consistent baseline of RFP activity.

What This Indicates

The data suggest the LMS market has transitioned from crisis-driven adoption to stabilization. Today’s RFPs increasingly focus on replacing interim solutions with platforms designed for long-term instructional models.

3. Career Readiness and CRM: Rising Priorities in HigherEd

While front-end experience tools show softer demand, several infrastructure-oriented categories continue to gain momentum in HigherEd:

- Career Readiness Solutions rebounded strongly in 2025 after steady demand from 2020–2024.

- CRM systems climbed back upward in 2025 after a dip in 2024, continuing a multi-year trend toward recruitment and lifecycle engagement tools.

Why This Matters

Enrollment pressures and demographic change are pushing institutions to invest in systems that directly impact retention, compliance, and student outcomes, even as discretionary spending tightens.

4. Back-Office Modernization Continues

Modernization may be slow, but it remains persistent, especially in core administrative systems.

HigherEd

Financial systems saw lower overall volumes in 2025, likely reflecting long replacement cycles rather than declining interest. HR systems remained relatively stable, with 2025 tying for the highest activity level across five years. ERP RFPs, after dipping early in the pandemic, continued their rebound through 2024 and 2025.

K–12

ERP activity increased steadily, reaching its highest volume in the five-year period. Financial systems also remained one of the most consistently active procurement categories.

What This Signals

Institutions appear to be waiting for contractual and budgetary alignment rather than abandoning modernization altogether, particularly as cloud-first architectures become the default expectation.

5. Renewed Activity in Compliance-Related Categories

As emergency remote-learning tools fade, compliance and security-focused systems are re-entering procurement conversations:

- Proctoring Systems rebounded in 2024 but dipped again in 2025.

- Security and Compliance Solutions show fluctuations but remain higher than pre-2021 volumes.

What This Indicates

Institutions are increasingly prioritizing sustainable security frameworks over short-term solutions put in place during the pandemic.

6. Small but steady growth in E-Learning, BI, and Analytics

While categories such as BI, analytics, assessment tools, and e-learning platforms outside LMS do not exhibit dramatic spikes, they show consistent, incremental growth. This pattern suggests institutions are investing more deliberately in data-informed decision-making and targeted learning environments rather than wholesale system replacements.

What This Means for 2026

Viewed together, the last five years reveal a clear progression:

- Pandemic-driven modernization from 2020–2022,

- Followed by stabilization and contract renewals in 2023–2024, and

- And a 2025 shift toward security, infrastructure, and career-oriented systems.

Based on current momentum, we expect:

HigherEd 2026 Predictions

We expect continued growth in CRM RFPs, ongoing SIS consolidation with fewer large-scale migrations, and increased interest in BI and analytics as AI-driven initiatives scale.

K–12 2026 Predictions

LMS activity is likely to remain relatively stable, SIS volume should persist as districts complete modernization cycles, and demand for payment and financial systems is expected to continue rising.

Conclusion

RFP activity remains one of the clearest indicators of market momentum. The data collected in 2025 suggest both HigherEd and K–12 are entering a more strategic, stability-focused investment phase. Rather than rapid digital transformation, institutions are now optimizing the systems adopted over the past five years — with increased focus on security, student success, and back-office modernization.

For access to the full dataset or deeper analysis by product category, explore the ListEdTech portal or reach out to our team.