Key Takeaways:

- Market Consolidation: The K–12 CMS market has consolidated rapidly, with two vendors controlling more than 40% of district websites.

- AI and Compliance: AI and compliance have become the top factors driving platform decisions across the K–12 CMS market.

- All-In-One Platforms: All-in-one communication ecosystems are replacing standalone tools in the K–12 CMS market, especially in budget-constrained environments.

The K–12 CMS market has transformed more in the past two years than in the previous decade. Based on our dataset of more than 17,000 school districts across Canada and the United States, the story is clear: a market once defined by choice is now shaped by consolidation, compliance pressure, and the rapid normalization of AI. Two companies now command more than 40% of all school district websites in North America, while the remaining vendors either specialize or slowly disappear.

A Market Led by Giants With Specialists at the Edges

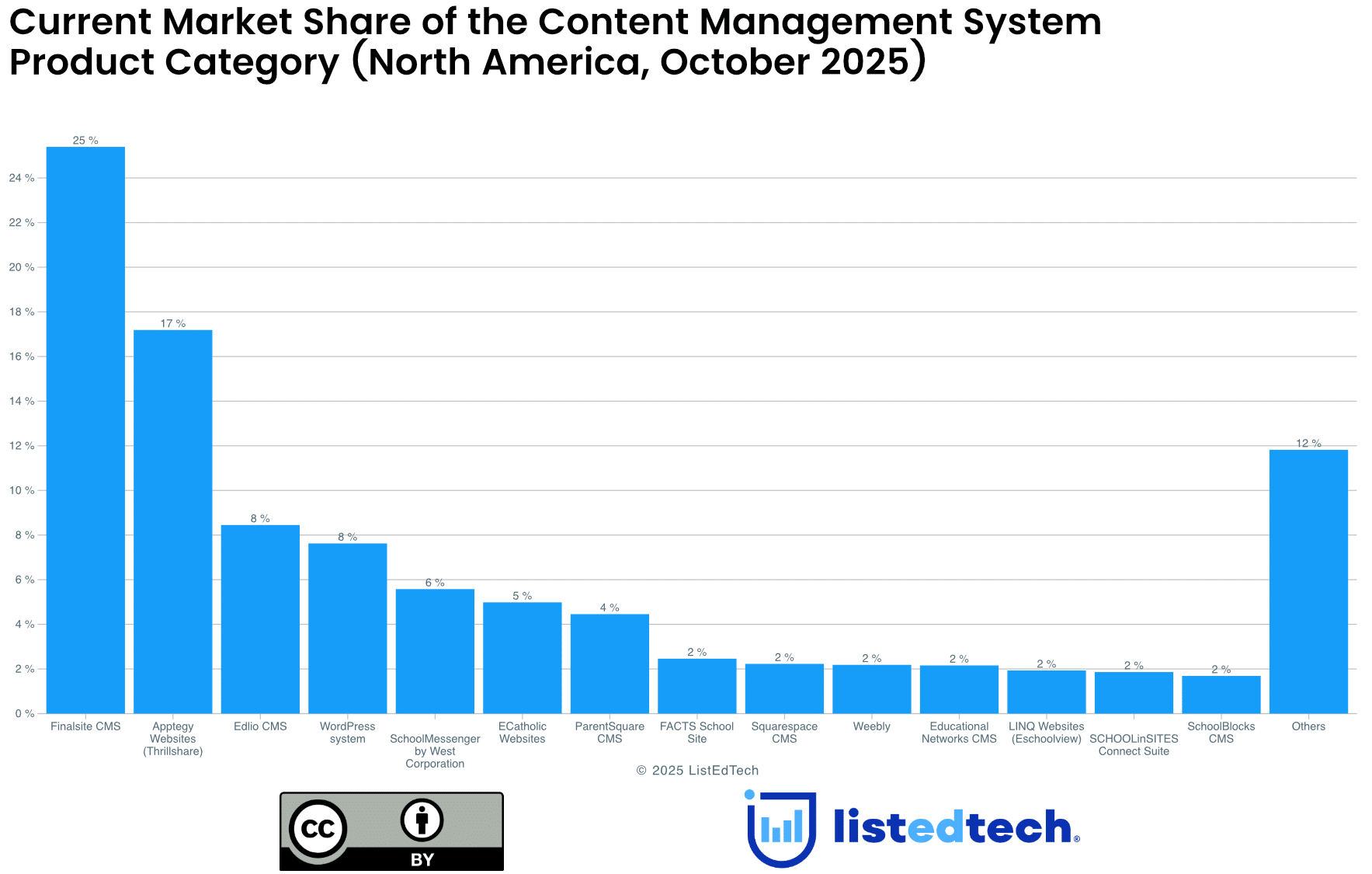

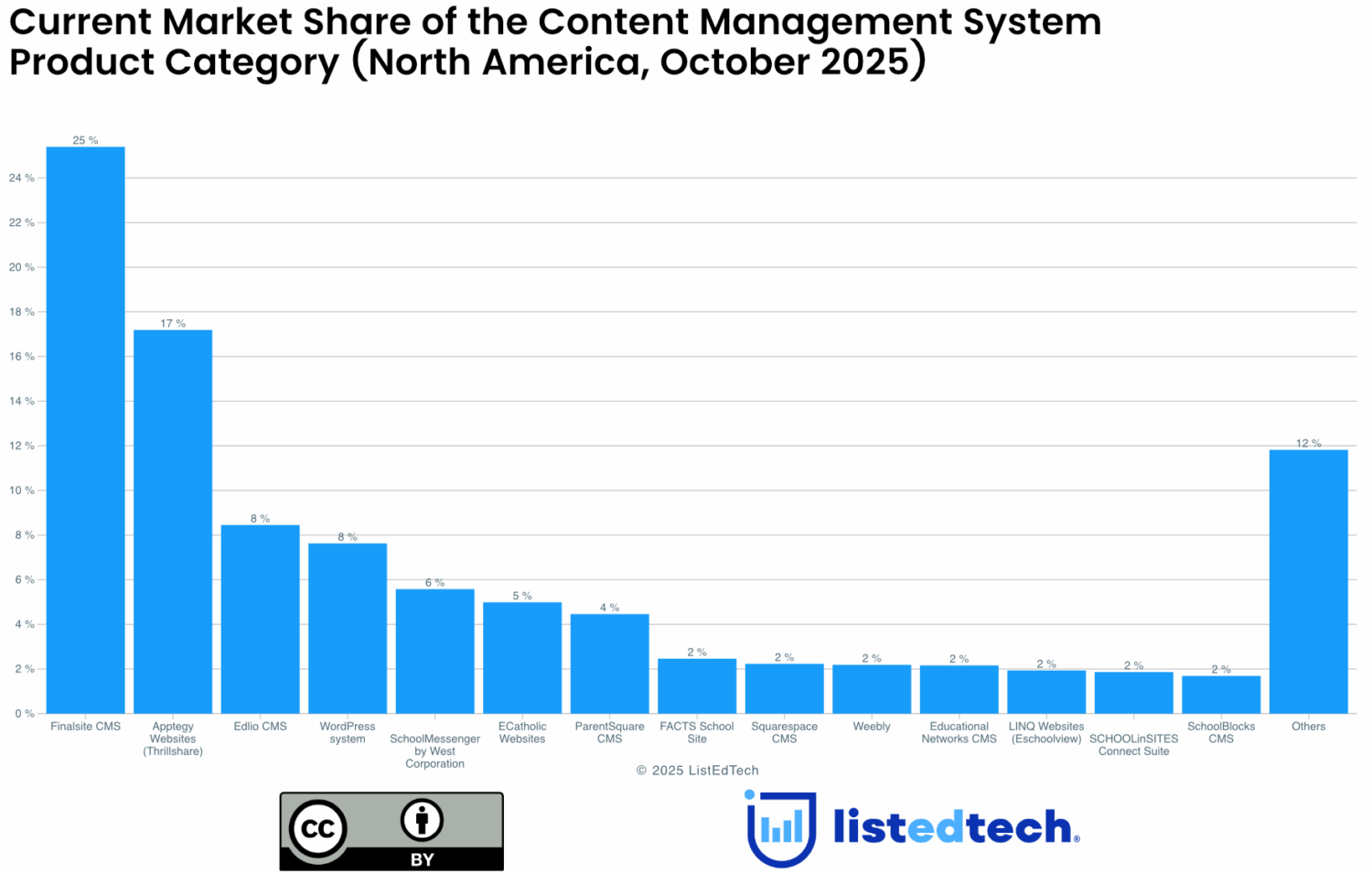

Finalsite dominates with 25% of the K–12 CMS market, followed by Apptegy (Thrillshare) at 17%, an extraordinary climb from a near-invisible presence a decade ago. Behind them, Edlio (8%), WordPress (8%), and SchoolMessenger (6%) form a distant second tier, while ECatholic (5%), ParentSquare (4%), and FACTS (2%) serve more narrowly defined audiences.

These niche players are not merely surviving: they are thriving where audience identity matters. ECatholic continues to gain ground in faith-based education, while FACTS remains a trusted option for small districts that value platform integration over customization.

A Concentrated K–12 CMS Market Becomes the New Normal

Together, Finalsite and Apptegy are implemented in more than four out of every ten school districts. Nearly all remaining vendors hold between 2% and 8%. We consider this to be a rare level of concentration in this market and reflects two long-running trends: aggressive consolidation among vendors, and persistent niche markets that resist one-size-fits-all platforms.

Mergers and acquisitions have redefined the K–12 CMS market. Finalsite absorbed SchoolAdmin, ParentSquare acquired Remind, and Apptegy added AlwaysOn to its portfolio to expand its AI communication capabilities. The result is a shrinking vendor field with broader product suites, stronger integration, and more resources behind each platform.

AI and Compliance as New Baselines

AI has shifted from an optional enhancement to a core expectation in the K–12 CMS market. Districts increasingly evaluate platforms based on how AI can support accessibility, content creation, communication workflows, and day-to-day efficiency. Vendors such as Apptegy, Finalsite, and Edlio have moved quickly, deploying tools like AI chatbots, intelligent search features, and automated accessibility checkers. Even general web builders like Wix and Squarespace are relying on AI to remain competitive with education-focused platforms.

At the same time, compliance has become a determining factor in procurement. New ADA and WCAG requirements, along with state-level regulations on communication governance, have placed accessibility and oversight at the center of platform selection. School districts now refuse to consider vendors that cannot demonstrate continuous compliance support, monitoring, and clear reporting capabilities. Compliance is no longer a one-time certification. It is now an ongoing service obligation.

The Shift Toward Unified Communication Platforms

School districts are moving away from standalone website tools toward unified communication ecosystems. Leading platforms in the K–12 CMS market now bundle websites, notifications, parent messaging, accessibility tools, and policy controls into a single system. This shift is driven by three operational goals: efficiency, accountability, and fewer vendor relationships to manage. The appeal is clear: one contract, one support channel, and one governance framework.

This movement is also accelerating the decline of legacy systems such as WordPress and Weebly, which once dominated district websites. With compliance, communication, and support needs becoming more complex, districts are steadily migrating away from generic web builders that require plugins or internal technical expertise. As integration becomes the preferred model, standalone CMS products with no built-in communication features are losing strategic relevance in the K–12 CMS market.

Value, Competition, and Buyer Expectations

Pressure is also coming from fast-growing vendors such as Apptegy and ParentSquare, whose rapid delivery cycles and strong customer communication practices are reshaping expectations in the K–12 CMS market. Districts now expect visible product evolution, transparent roadmaps, and faster implementation timelines.

Budget constraints are increasing these expectations. As funding tightens, districts are evaluating total cost of ownership rather than focusing on subscription fees alone. Integration, compliance requirements, staffing realities, and support needs all factor into purchasing decisions. In this environment, value is more important than feature quantity. Vendors must demonstrate how their platform reduces workload, risk, and fragmentation for district staff.

Looking Ahead: What Comes Next for the K–12 CMS Market

The K–12 CMS market is now top-heavy, compliance-first, and AI-accelerated. The winners will be platforms that deliver three things at once: integration, regulatory readiness, and time savings. Smaller vendors can still succeed, but only through sharper specialization and clear value differentiation.

Check our Product Categories and Reports page as we will soon release our full K-12 CMS Market Report, including deeper competitive breakdowns, trends, and district-level insights across North America.