Key Takeaways:

- A select few lead: Twenty institutions consistently rank among the first adopters across 30 tech categories.

- Shared traits: Mostly small- to mid-sized schools, with a mix of public/private and strong Northeast presence.

- Innovation testbeds: Their early adoption helps refine new products and set benchmarks for the sector.

This year, I’ve been revisiting some of the classic business books: Blue Ocean Shift, Free, The Innovator’s Dilemma, Zero to One, and of course, Crossing the Chasm.

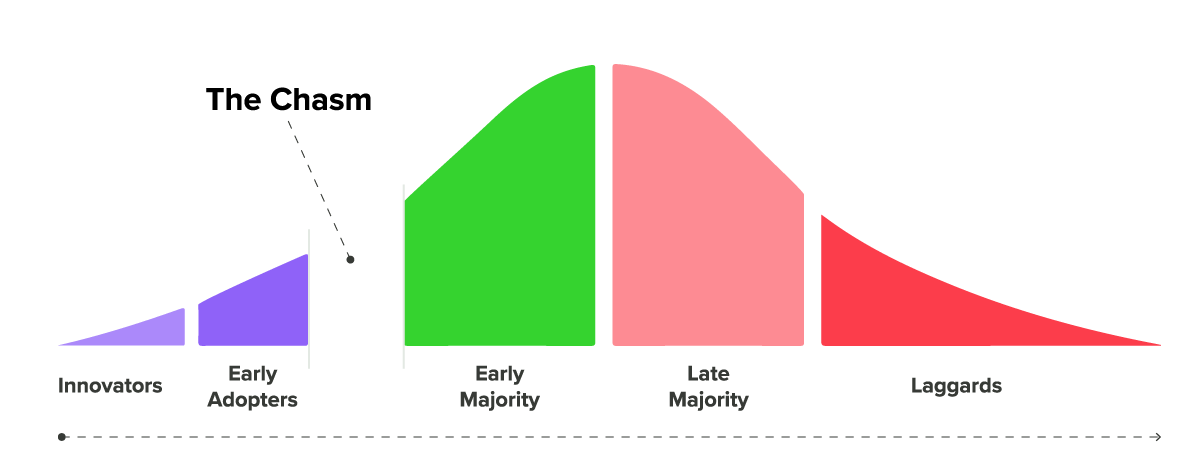

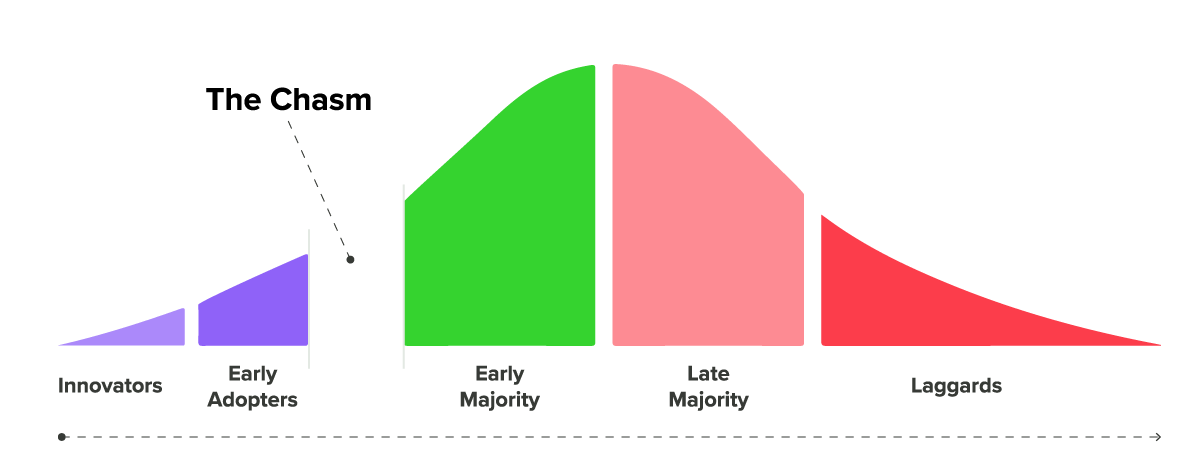

That last one really got me thinking about early adopters. In tech markets, they’re the people (or in HigherEd, the institutions) who are comfortable taking risks, trying something new, and shaping the market before the majority jumps in.

On the Product Adoption Curve, these are the Innovators and early adopters — the visionaries who are comfortable with a little risk if it means being ahead of the curve.

So we asked ourselves a simple but fun question:

If we look at 30 different product categories and track the first 25 institutions (in North America) to adopt in each, will we see the same names pop up again and again?

The data says: yes.

Institutions Ahead of the Adoption Curve

In fact, we found a group of 20 institutions that often appear at the very start of adoption curves. They’re the scouts of HigherEd tech — blazing the trail while others wait to see if the path is safe.

Here’s the roll call (alphabetical order):

- Agnes Scott College

- California State University – Monterey Bay

- Carnegie Mellon University

- CUNY – College of Staten Island

- CUNY School of Law

- Fort Lewis College

- Goshen College

- Grove City College

- Loyola University Maryland

- McGill University

- Mount St. Joseph University

- Northern Illinois University

- University of Maryland, Baltimore County

- University of the Incarnate Word

- University of Toronto

- Virginia Commonwealth University

- Washington College

- Willamette University

- Wilmington College

- Yale University

When we dug deeper into the numbers, we saw that these institutions didn’t just appear once or twice. Each one showed up between 4 and 7 times among the first 25 adopters across the 30 product categories we studied. To put that into perspective:

- If an institution had shown up just once, that would be about 3% of the time.

- But these 20 “tech leaders” appeared in the 13%–23% range — far higher than chance.

In other words, it’s not random. These institutions consistently land at the very front of the adoption curve, regardless of the product category.

Common Characteristics of the 20 Early Adopters

When we step back from the individual names and look at the group as a whole, a few patterns emerge:

- Private vs. Public: Just over half of the institutions (11 out of 20) are private not-for-profit, with the rest public. This mix suggests that both mission-driven independent and larger public universities are willing to take risks early.

- Enrollment Size: They’re not all giants. In fact, the majority fall into the small to mid-sized range (under 5,000 students). Only three (McGill, Toronto, Yale) have enrollments over 14,000. This hints that smaller institutions may have the agility to test and adopt faster.

- Geography: While the list spans North America, there’s a strong U.S. Northeast and Mid-Atlantic presence (New York, Pennsylvania, Maryland, Connecticut). Together with the Southeast, these regions make up more than half of the group. Only two Canadian universities made the list: McGill and Toronto.

- Age of Institutions: There’s a mix of very old and fairly new. The oldest is Yale (1701), while the youngest is CSU-Monterey Bay (1994). On average, these institutions were founded in the mid-19th century (~1870s), giving them long histories but also a demonstrated willingness to evolve.

- Type: All are 4-year or above degree-granting institutions, with a surprising number of liberal arts colleges alongside major research universities.

Setting the Pace for What Comes Next

The tech leaders aren’t only the biggest or the most famous universities. They’re often smaller, private colleges with the flexibility to move fast, plus a few large research powerhouses that set the tone for the sector.

Of course, not every early experiment turns into a long-term win. But that’s what makes these institutions so important: their willingness to adopt early helps shape products, set benchmarks, and give the rest of the sector a signal about what might be worth following.

Think of them as the HigherEd’s Tech Leaders.

So, the next time you see a new system, app, or platform making the rounds, don’t be surprised if one of these names is already on the adopter list. Because when it comes to trying something new, they’re not just on the curve… they’re at the very front of it.