Each year in October, Educause holds its annual conference. It’s the perfect time for institutions, solution providers, and consultants to meet and discuss technological needs. Since 2021, we have compiled data on the exhibitor floor plan to see if it could reflect some market trends in edtech. What can we infer from this year’s floor plan?

Research Methodology

We gathered all floor plans and exhibitors’ lists since 2012 (except for 2017 -unavailable- and 2020 -not an in-person conference). Central to our analysis are the most significant booths, which cover six squares (600 sq ft) or more. The smallest possible booth a company can purchase is one square (100 sq ft). Please refer to the table on our website for the most common area size used on the floor plan.

General Findings

Between 2012 and 2023, 86 companies purchased a big booth to promote their products or services. For the 2023 conference, six new companies have decided to buy a big kiosk (Explorance, K16 Solutions, Meta for Education, OneOrigin, Ready Education, and TD Synnex).

The year with the most big booths was 2018, with 34 kiosks. In 2023, the floor layout only showcases 23 booths with six squares or more, the second smallest number of big exhibitors since 2012.

The HigherEd IT sector is very volatile when selecting big booths at the Educause annual conference. Between 2012 and 2022, 24 exhibitors bought a bigger booth (six squares and more) only once. Most of these companies are not the top vendors of their product categories. We also saw some company purchases (VMware acquired AirWatch in 2014, for example) modifying the floor plan.

Between the 2022 edition and this year’s, we saw more prominent exhibitors downsizing their kiosk size; for example, Cisco (including Cisco Secure) went from 20 to 12, and Zoom selected a six-square booth instead of nine.

We also noticed that two companies had increased their footprint, showing optimism in the in-person conference format: Carahsoft Technology Group increased its booth from nine to 12, while T-Mobile bought a nine-square booth (it was six last year).

Compared to last year, the percentage of large exhibitors remains the same at 8.46%.

Regarding the number of companies that purchased a booth for this year’s conference, we counted 272 exhibitors, the same number as last year and similar to 2018. While we noticed that Educause hadn’t lost any exhibitors, we would have hoped to see this number increase to show a return to normalcy.

Since 2012, very few companies have been present as big exhibitors each year. We only count two: Anthology (average size of 11 squares; a slight decrease compared to last year) and Ellucian (average size of 12). Extron Electronics, a large exhibitor since 2012, reduced its booth to 4 squares for this year’s conference.

The Presence of Specific Product Categories

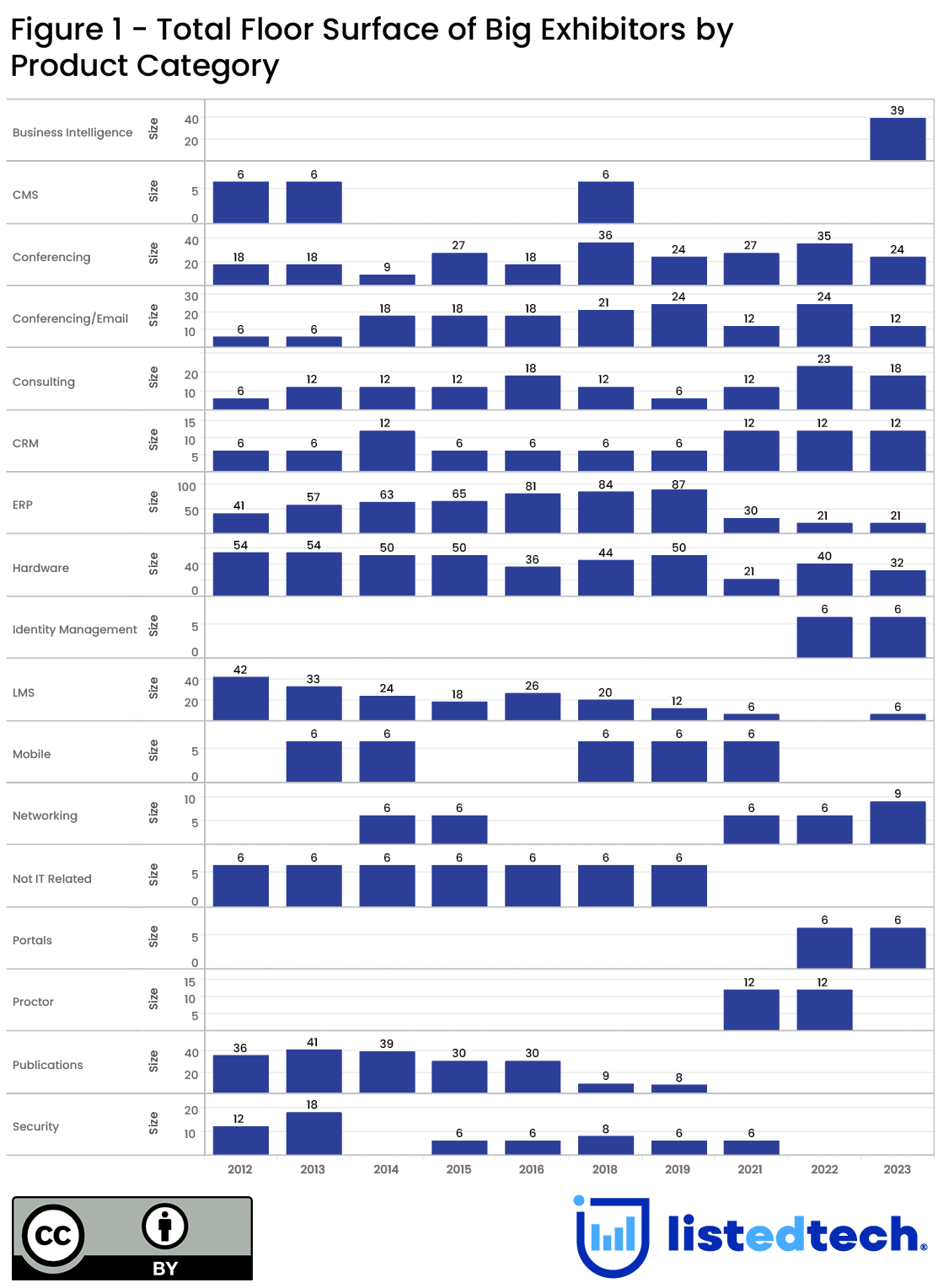

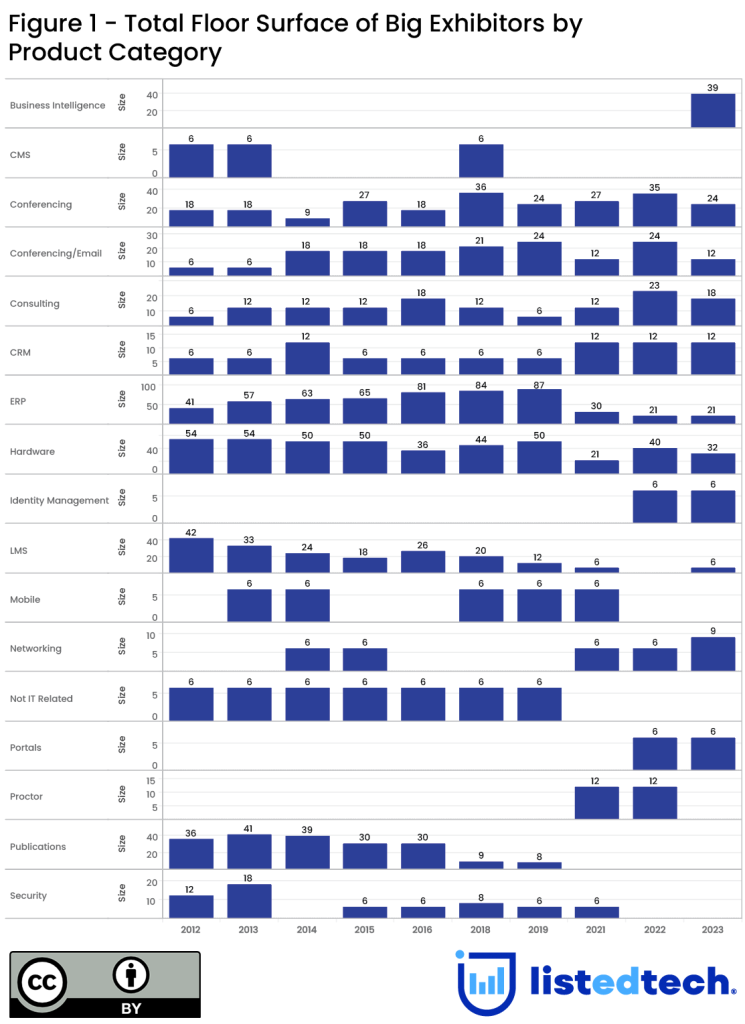

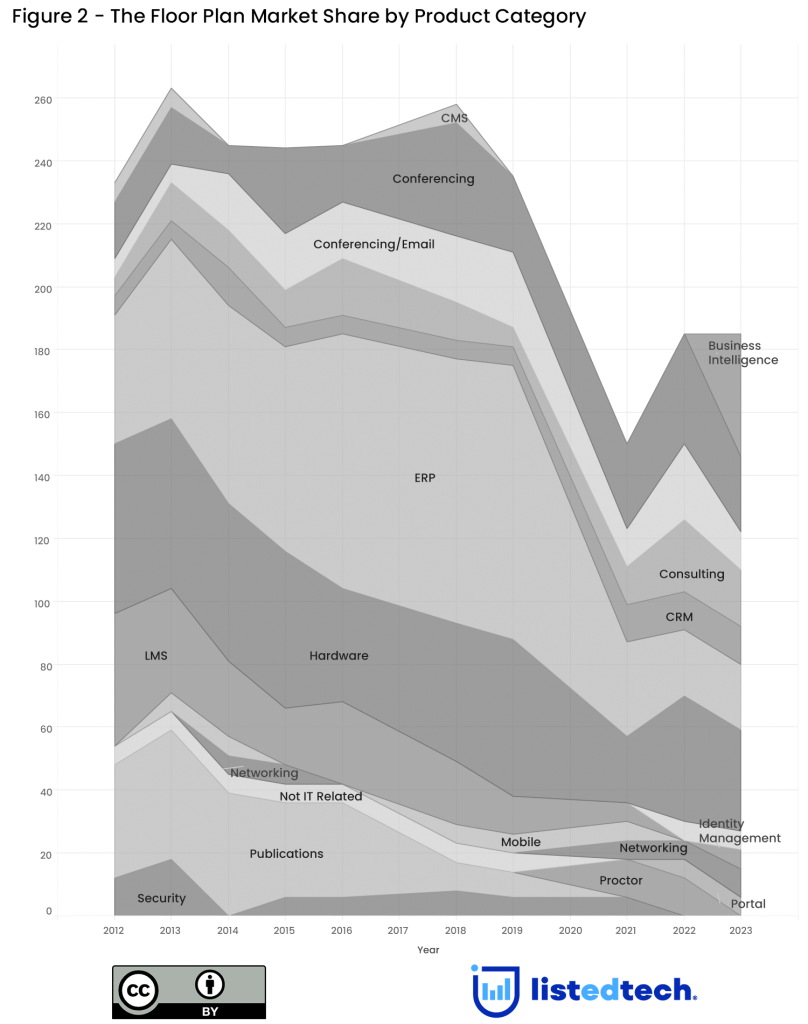

Figure 1 shows that some product categories disappeared over the years while others arrived in the big booth group. Please note that a product category must have more than one company selecting a big kiosk during the analysis period to be included in this graph. For this reason, some categories do not appear.

Once vital to higher education, the Publishing industry no longer appears to select big booths. McGraw-Hill Higher Education, Pearson, and Cengage Learning were all 12-square booths or nine-square booths in 2012, 2013, and 2014. In comparison, in 2023, these three companies are no longer on the floor plan. Cengage Learning was the last company to have a kiosk: a one-square booth in 2022.

The Hardware industry is another example of the transformation of the higher education IT sector. When comparing campuses from 2012 to 2021, we know that computer labs take up less and less space on higher education campuses as students bring their laptops. Universities and colleges no longer need to invest massive chunks of their budget in server rooms as cloud solutions evolve into the preferred implementation choice. In 2012 and 2013, five hardware companies were among the big booths. Their numbers dropped to four in 2014 and 2015. In 2023, four hardware companies are still part of the prominent exhibitors: Dell (12), HP (eight), Intel (six), and Viewsonic (six). Lenovo, a significant exhibitor since 2012, opted for a two-square booth in 2022 and a four-square kiosk this year.

The Conferencing category did benefit from distance learning during the pandemic. This rapid growth in the product group resulted in new companies on the floor plan. A case in point is Zoom, which saw record sales during the pandemic and bought a nine-square kiosk last year to reduce it to six squares this year.

Pre-pandemic, the ERP product category was the most stable. Anthology (previously advertised as Campus Management and Blackboard at Educause) and Ellucian have had two oversized booths since 2012. Jenzabar, which used to have a 12-square booth until 2019, has a 4-square booth this year after being absent from last year’s floor plan. The same goes for Unit4, which bought a 6-square booth in 2013 and 2014, an eight-square in 2015, and a 12-square in 2016, 2018, and 2019 but has been absent since 2021.

How Acquisitions and Financial Struggles Impact the Floor Plan

The more we examine the Educause floor plan data, the more we notice that the economic cycles impact the annual conference. Some companies appear or disappear following a merger or an acquisition.

The decrease in Cengage’s booth size from 2012 to its disappearance in 2023 can be explained by two events. In 2013, the company filed for Chapter 11 bankruptcy. Following its restructuring in 2014 and 2015, the company has focused more on online learning.

With the purchase of some of Hobsons’ products, EAB entered the big exhibitors’ group with a six-square booth in 2021. In 2019 and 2018, it occupied a two-square kiosk and was absent in 2016. However, it has been in the smaller exhibitor group with a 2-square kiosk since 2022.

Except for 2021, Hobsons has been on the exhibitors’ floor of Educause since 2012. Between 2012 and 2016, it bought a six-square kiosk. In 2018, it decided to downsize to a four-square, then to a one-square in 2019. With its purchase by PowerSchool and EAB in 2021, the company is no longer active.

With its many products targeting the higher education sector, Microsoft has been at Educause since 2013. While it offered its Office suite, including Outlook, it was rather timid with a six-square kiosk. More recently, it has grown its booth to reach 12 squares in 2019 and has remained at that size.

Based on these ten years of data, the Educause floor plan is unsurprisingly linked with market trends. When misfortune hits a company, its size and presence are impacted in the following Educause annual conference. On the other hand, when a company does well, it wants to invest in a larger booth to increase its visibility. As such, the Educause floor plan is a reflection of the leading edtech companies of that year.

Note: For this article, Business Intelligence includes Artificial intelligence (AI), Chatbot, Learning Analytics, Student Success Platforms.