When a business segment reaches a point where several competitors offer the same products (in terms of cost, quality, and functionalities) to the same clients, this is when the real fight begins: prices go down (as well as profit margins) and businesses have a hard time finding new ways to innovate or even survive. One solution to this problem is market consolidation: a few stronger and bigger enterprises acquire smaller players. These acquisitions diminish competition while increasing the price of products. This situation does not favor customers but allows the industry to continue its natural cyclical development.

In the past several years, we have seen a consolidation of the HigherEd market when it comes to Learning Management Systems – LMS and Student Information Systems – SIS. In the LMS product category, Blackboard purchased several companies (Prometheus, WebCT, and Angel) to become, at the time, the largest LMS company. On the SIS side, Unit4, Ellucian, Tribal Group, and Jenzabar acquired some of their competitors. We talked about these mergers in a past post.

In an effort to remain competitive, a company will decide to merge with a competitor, acquire another company or be bought by a rival. This market consolidation allows businesses to cut on expenditures while still offering their previous products or jointly develop a new line of products. This situation often reassures investors who decide to support such consolidation. In terms of business development, businesses can decide to combine into one through a merger or an acquisition or again, to establish a holding company to simplify the finance and legal aspects of the business.

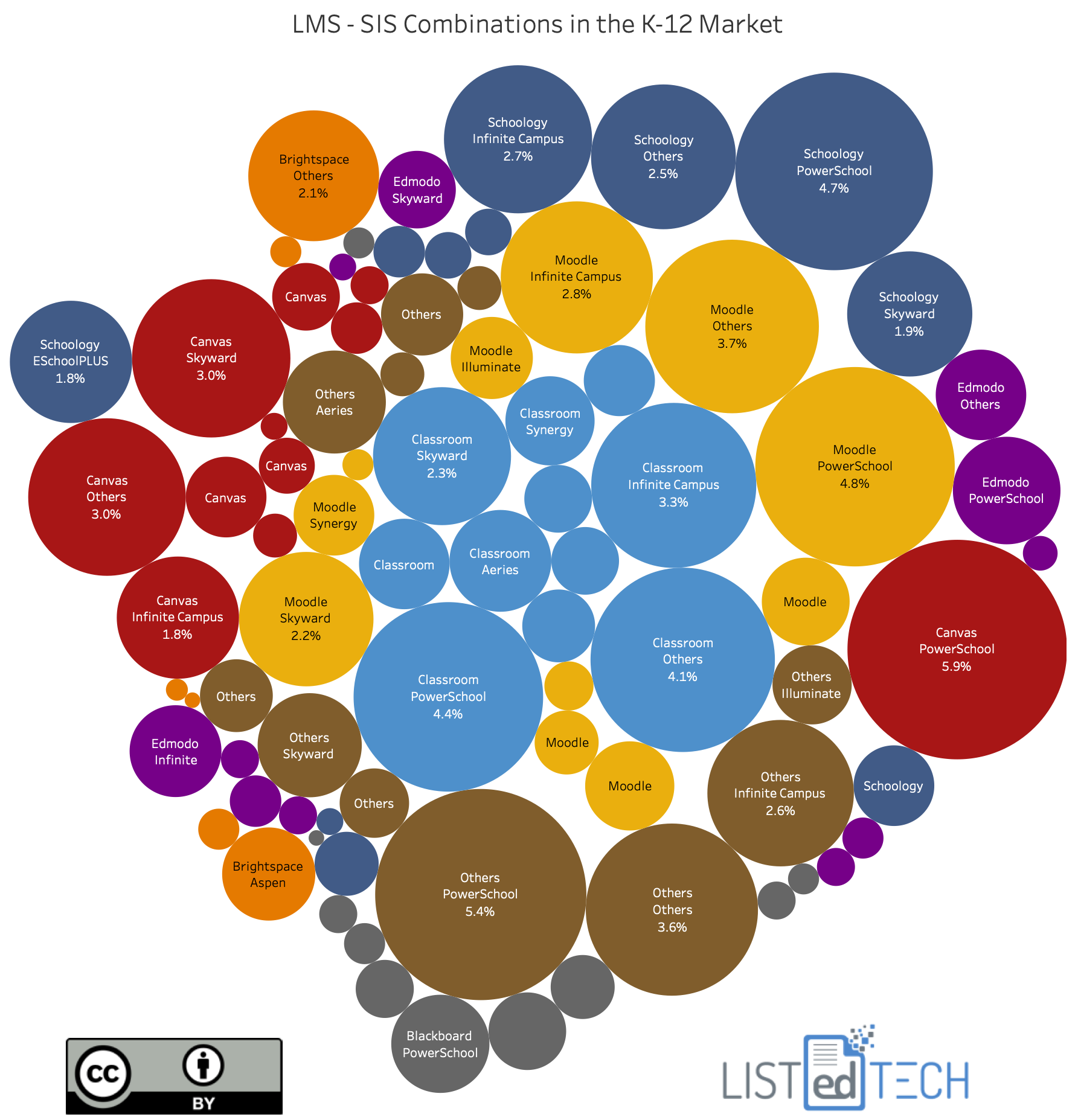

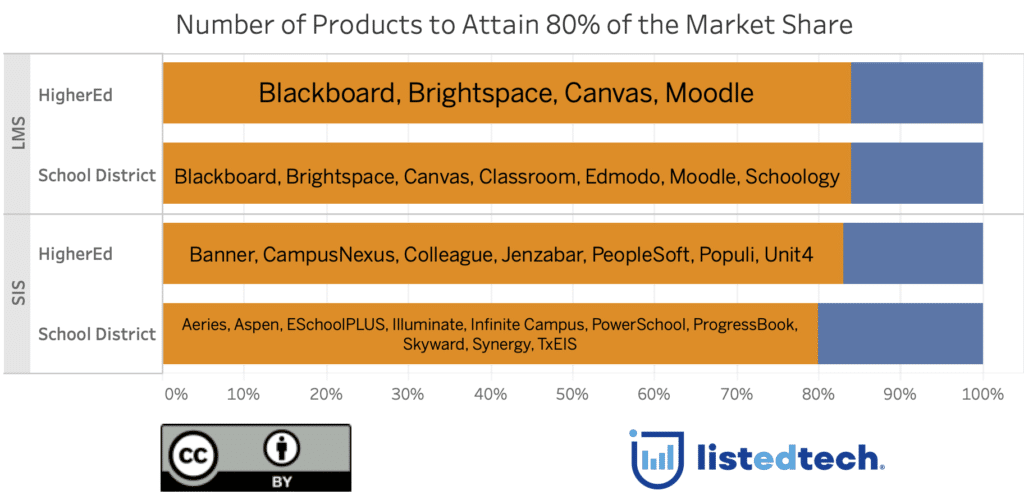

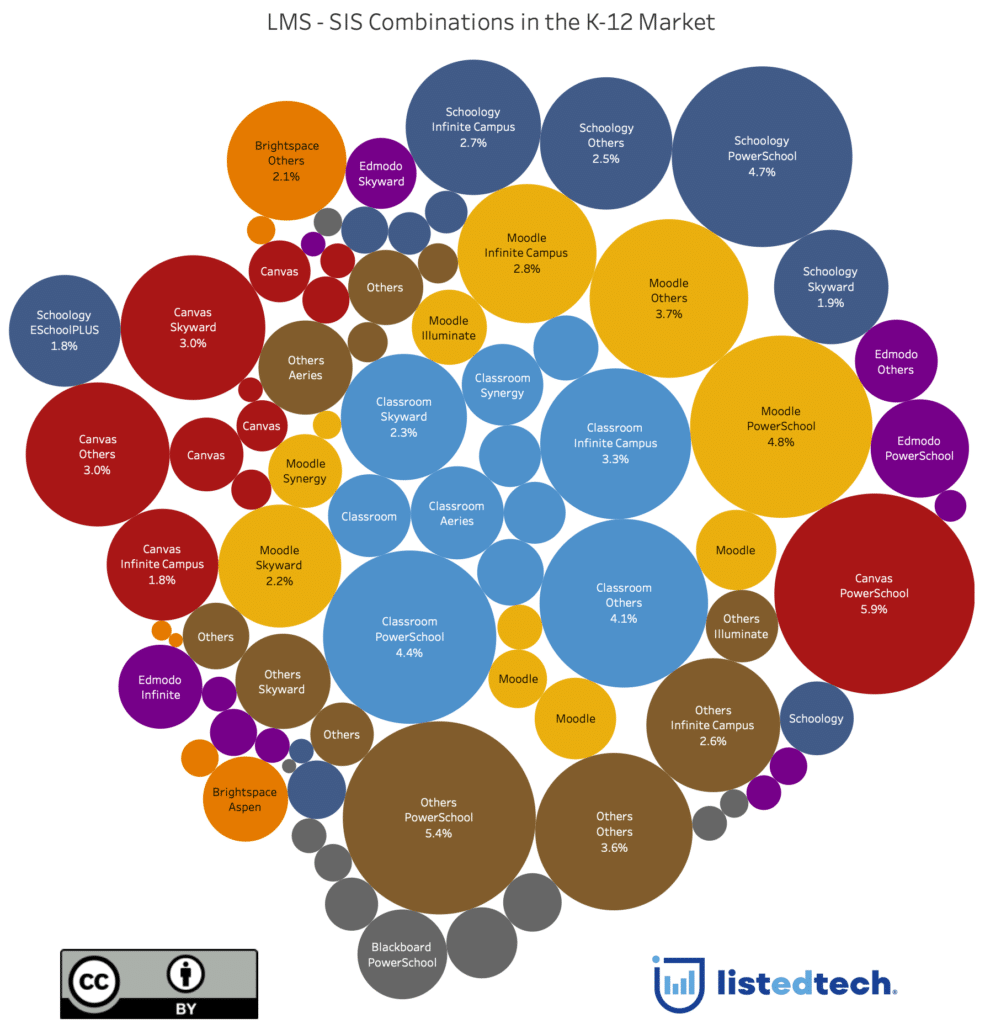

In the K-12 market, we can see the first signs of consolidation but the market still has several important players. The first graph below shows the number of companies it takes to hit the 80% mark of each product category for HigherEd and K-12 markets.

In HigherEd, only four LMS systems are needed to get to 80% (Blackboard, Brightspace, Canvas, Moodle).

For the K-12 market, we need seven LMS systems to reach the same mark (Blackboard, Brightspace, Canvas, Classroom, Edmodo, Moodle, Schoology).

The SIS category requires more players than the LMS product category to attain 80%.

In the HigherEd market, we count seven products (Banner, CampusNexus, Colleague, Jenzabar, PeopleSoft, Populi, Unit4) to hit the mark.

In the K-12 market, we need ten (Aeries, Aspen, ESchoolPLUS, Illuminate, Infinite Campus, PowerSchool, ProgressBook, Skyward, Synergy, TxEIS).

Even with so many players, the K-12 market does not show any dominating LMS-SIS combination. The bubble graph below shows several bubbles of similar size; the biggest being between 4 and 6% with the majority being in the range of 2-3.9%. We don’t see the supremacy of one product combination over another one. Here are some of the combinations:

However, with the recent acquisitions made by PowerSchool (Schoology and Haiku Learning to name two) and the decision of Illuminate to soon cease the support for its student information system, we could see an accelerated consolidation of the K-12 market.

Data Note: For the two graphs, we have selected only North American implementations.