We all love making predictions. They help us deal with uncertainty, which has undoubtedly come into sharp focus over the past year. The issue with forecasting, however, is that they are often wrong—some spectacularly so. And those involving higher education technology are no exception: just remember those projections about the supposed disruptive power of massive online open courses (MOOCs).

So, should we avoid making predictions about higher education technology? We think not. Forecasting should be less about hype and consider how other trends might positively or negatively influence forecasts. This week’s post will focus on this question through the lens of the major student information systems.

Methodology

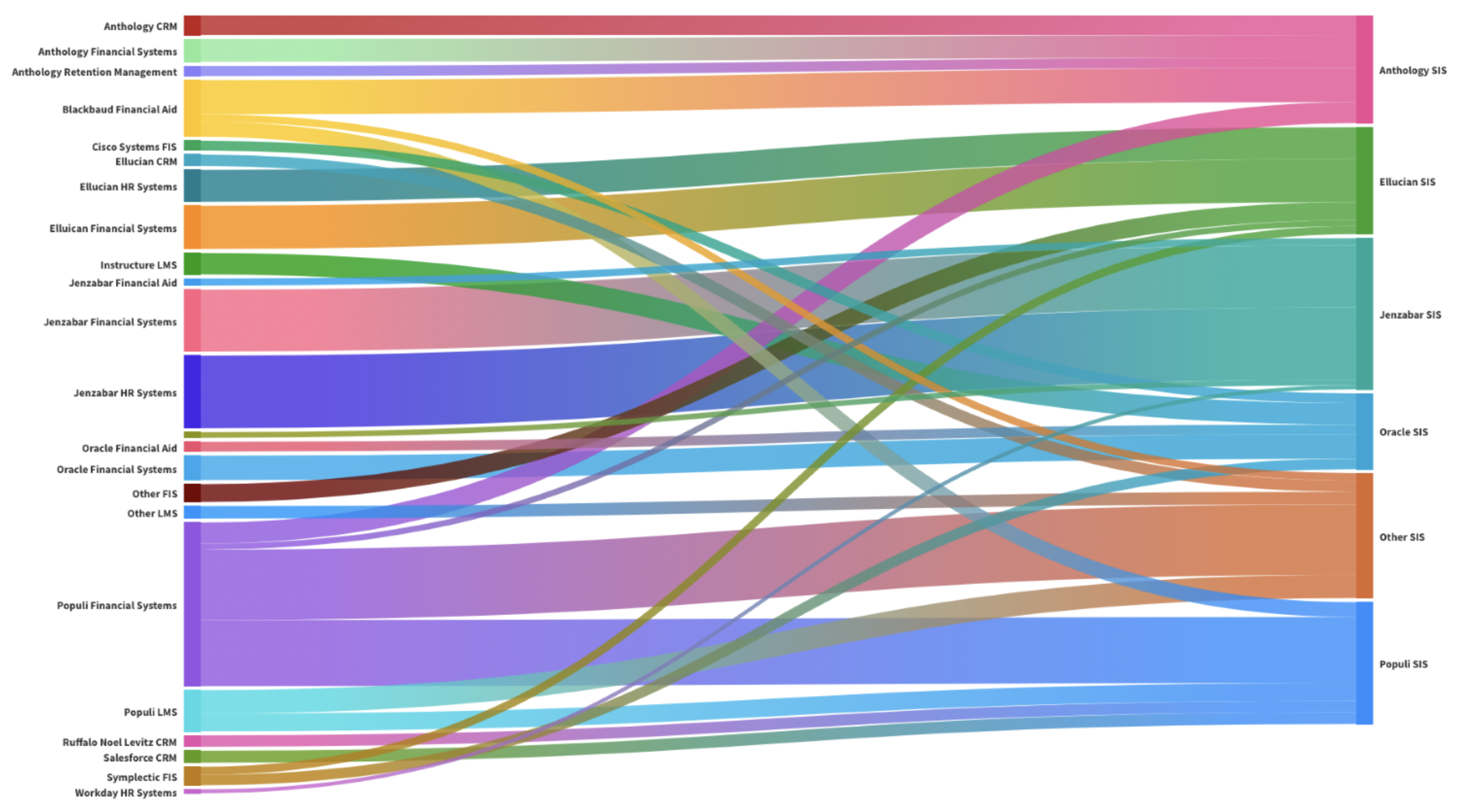

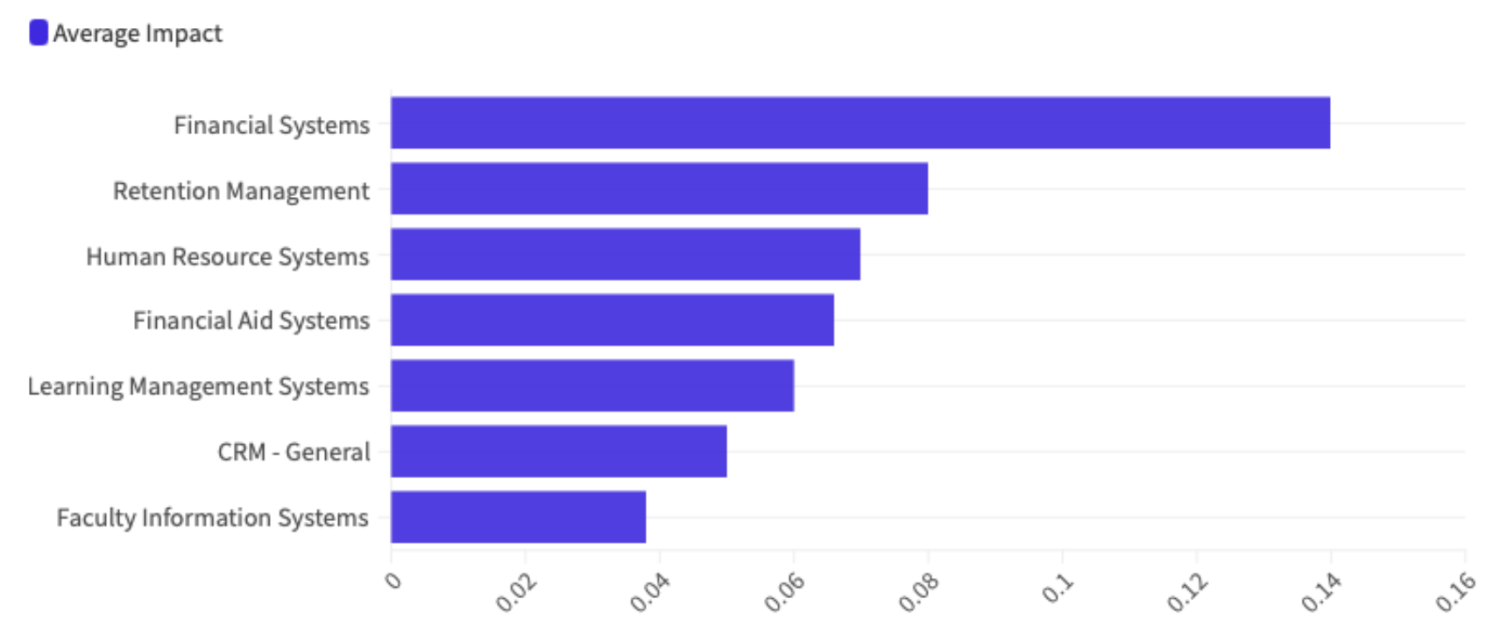

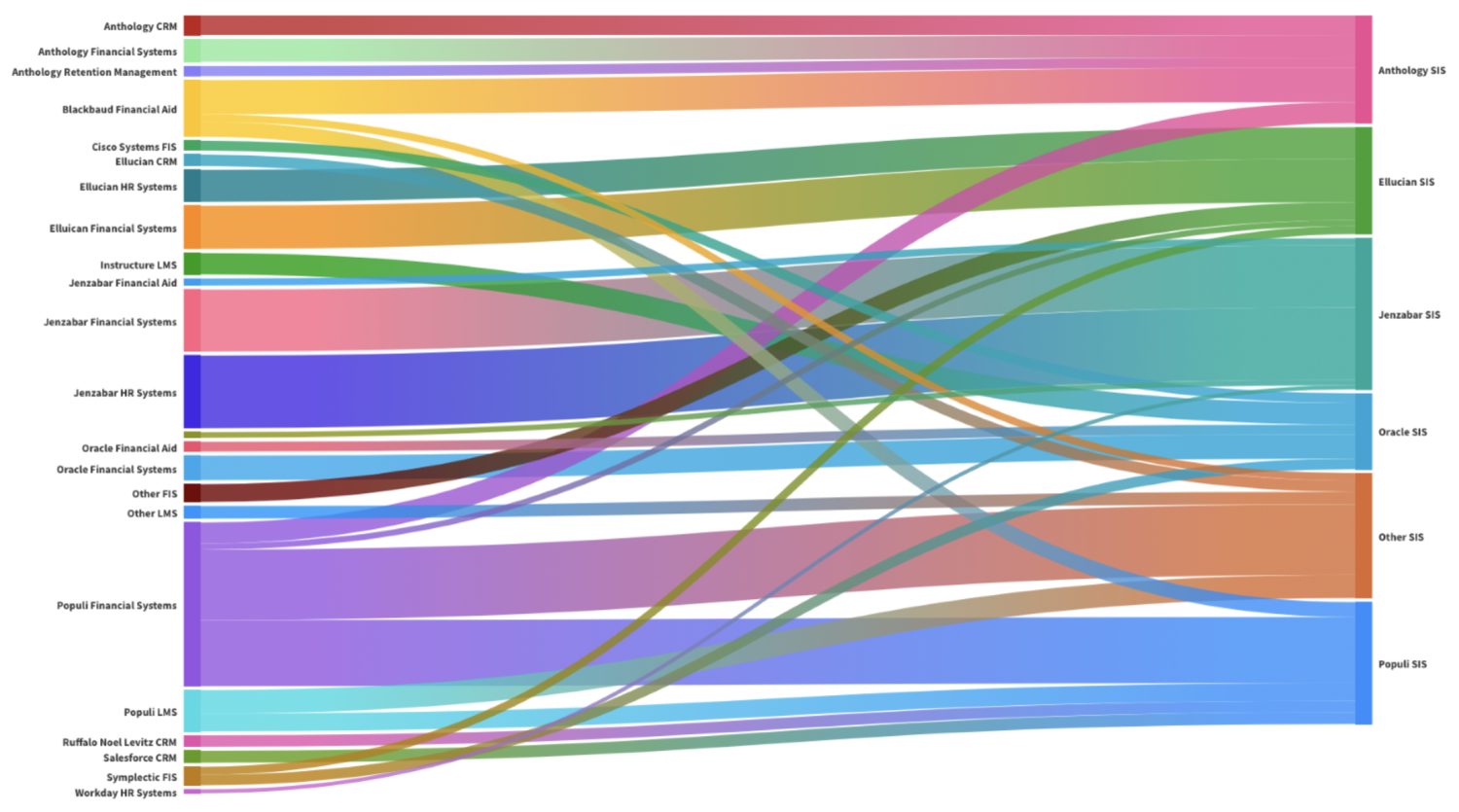

To better understand these trends, we analyzed implementation data of student information systems for 2,445 US public and private four-year institutions from 2013 to 2023. We then used a variety of approaches (Shapley Additive Explanations, etc.) to determine the categories that most impact overall trends in implementations of student information systems (Figure 1).

Source: ListEdTech

Next, for brevity, we combined the products of the five vendors with the most significant market share in each category and combined the rest into a single group. Finally, we determined each product’s impact on the different student information systems using the same analyses as above.

Findings

Figure 2 shows the output of our analyses. At first glance, there are three main takeaways:

- Most impacts are within the same portfolio: Most products offering the most significant impact on implementation trends of its student information system are within the same vendor portfolio. For example, Ellucian’s financial systems (Banner Finance, Colleague Financial Management, etc.) significantly affect Banner Student or Colleague Student implementations.

- Some cross-portfolio impacts exist: On the other hand, for some vendors, the most significant impact on implementation trends of its student information system comes from different vendors’ products. For example, Blackbaud’s Award Management solution provides the most crucial influence on implementation trends of Anthology’s student information systems (Anthology Student, for example).

- One-to-many impacts occur: Certain products significantly impact more than one student information system. Populi Finance, for example, impacts its student information system and those offered by Anthology and Ellucian. Likewise, Symplectic’s faculty information solution influences the implementation trends of the student information systems of both Oracle and Ellucian.

Source: ListEdTech

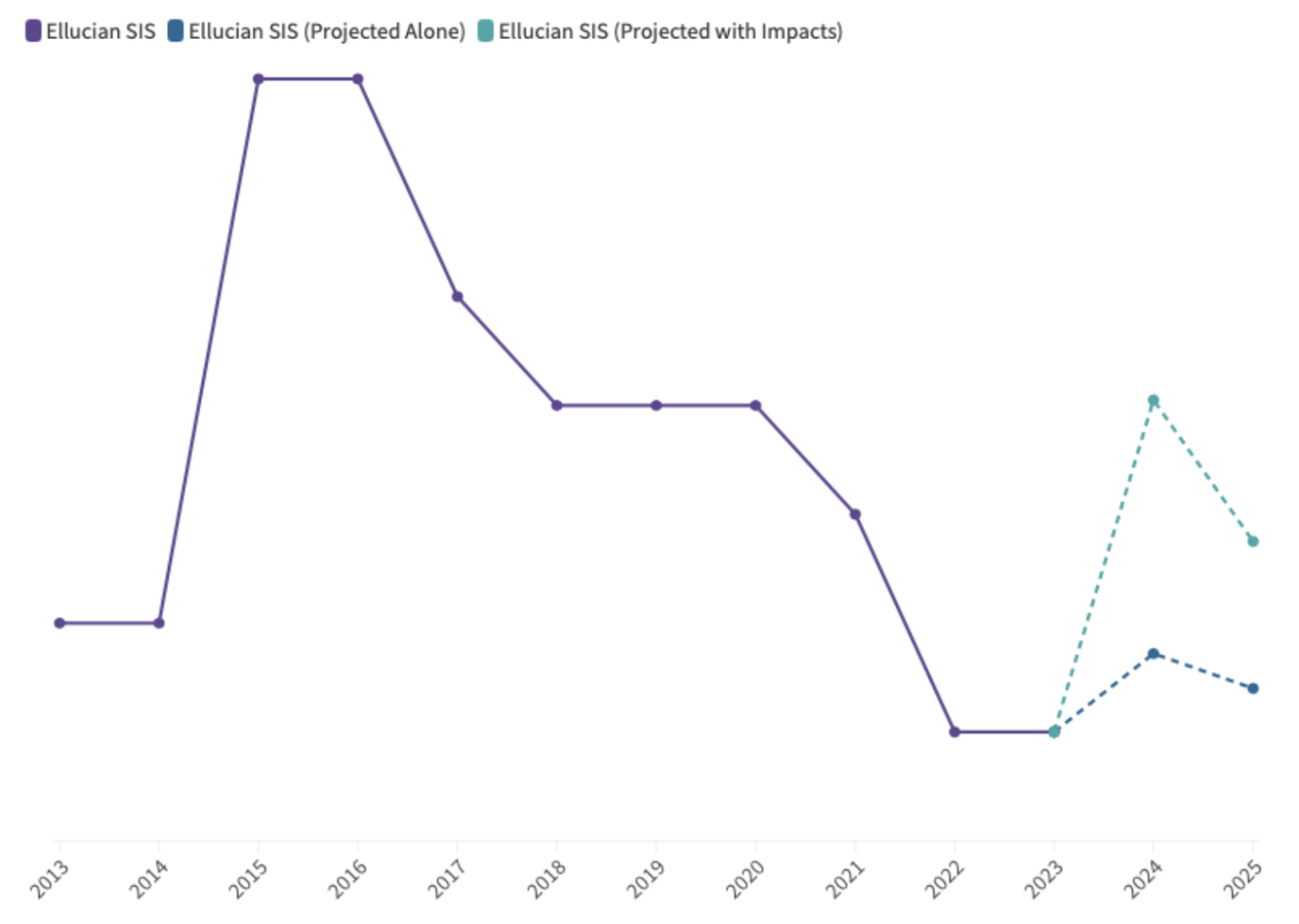

Figure 3 shows why our analyses matter. The implementation of Ellucian’s student information system demonstrated a downward trend since 2013, with a slight projected increase (based on classical time-series forecasting) from 2023 to 2025. We may, therefore, be tempted to forecast Ellucian’s dominant market share in the student information system category as being in danger and subject to products from other vendors gaining dominance.

Source: ListEdTech

However, that may not be quite right. Factoring the trends that have the most significant impact on Ellucian’s student information systems (such as its financial systems), we see a different forecast, one where there is a sharp increase in implementations over the next two years, followed by a subsequent decrease. This increase would undoubtedly change our read of the immediate future of Ellucian’s dominant share of the student information system market and give us pause when announcing its demise.

Summary

This analysis shows we ignore the interrelationships of technology trends at our peril. Forecasting and analyzing the market would obfuscate potential shifts in the implementation of technology. For example, this view reveals ways vendors might improve their market shares, i.e., by bundling their student information systems with other products that have the most significant impact on student information system implementations. Likewise, this analysis indicates that vendors whose student information systems respond to products outside their portfolios may want to factor whether institutions have these other systems into their sales and marketing approaches.

In our conversations with institutional leaders, they increasingly look to decide whether they should implement technology at their institutions based in part on whether similar institutions have the same technology. Our analysis lends itself to this decision-making input, as it helps leaders see not only the combinations of products but also whether implementing one product makes the implementation of another more likely.

Lastly, we must acknowledge that there may be other factors at play. We may find, for example, that trends in retention rates or institutional spending are more significant drivers of implementation trends over time. In future posts, we will explore these other factors alongside technology trends to determine a better method of predicting the future of technology implementations.