According to the most recently available IPEDS data, twenty-one percent of undergraduates and eleven percent of postbaccalaureate students reported having a disability across all US institutions from 2019 to 2020. Yet, many of these students do not consider their accessibility needs met by their institutions. For example, a 2019 survey by Educause showed that “only about half of all respondents gave good or excellent ratings for institutional awareness (50%) and support (53%) of their technology needs.” About a quarter of respondents rated these as poor or fair, suggesting a great need for technology to improve how these students access digital content.

Are institutional leaders rising to the challenge of meeting this need? And, if so, which solutions are they considering?

Are Institutional Leaders Rising to the Challenge?

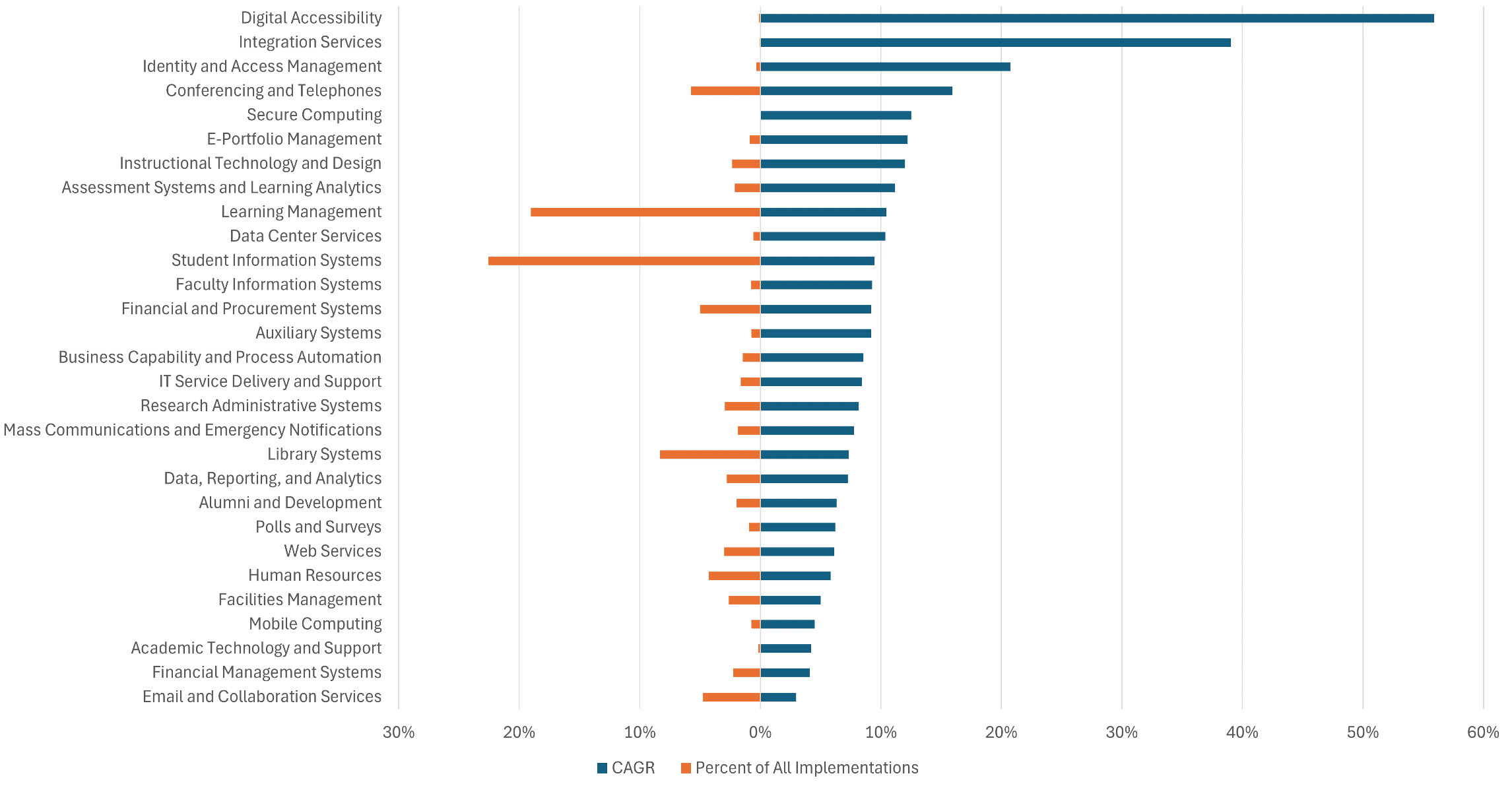

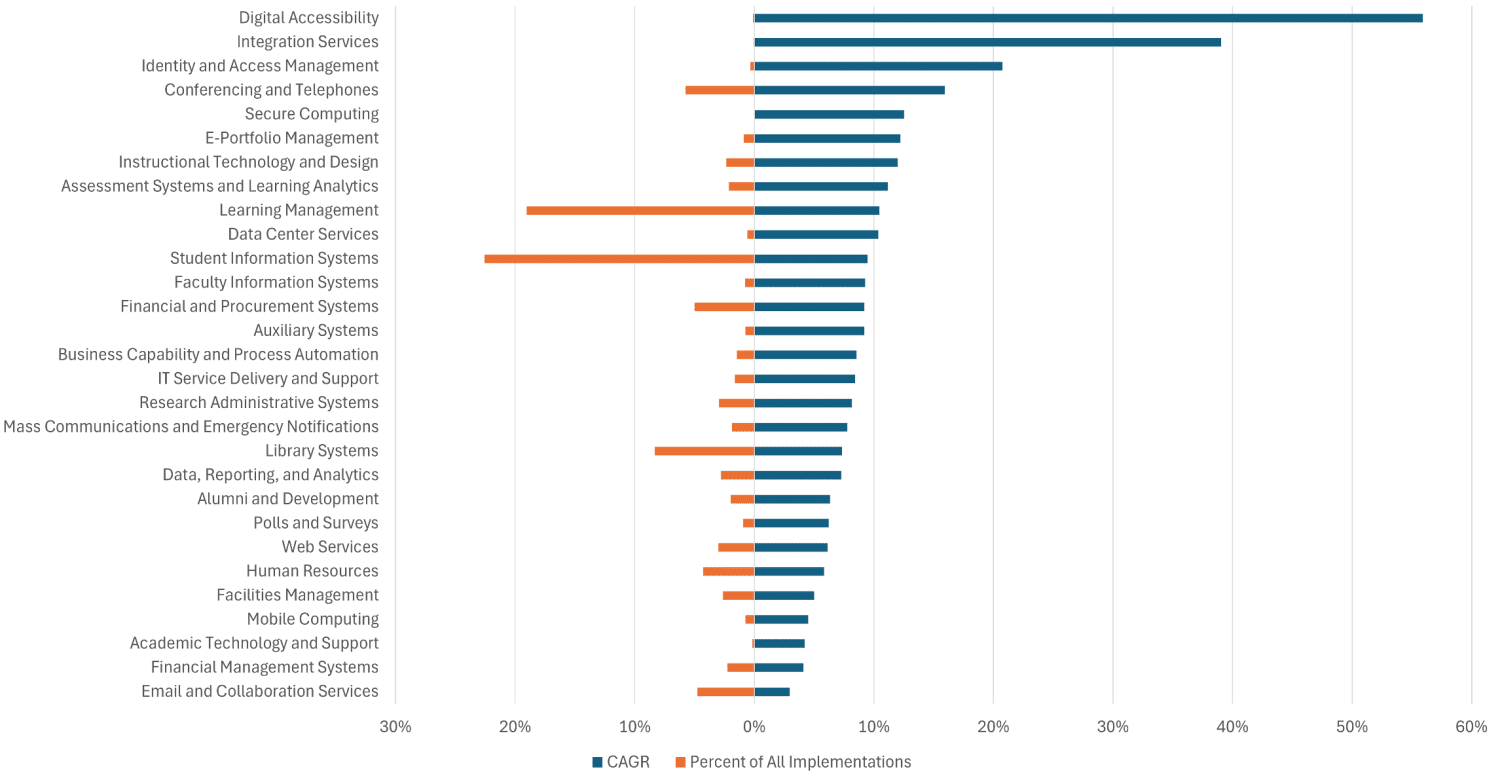

Figure 1 shows the output of our attempt to answer whether institutional leaders are rising to the challenge of improving their support for the journeys of students with disabilities. Covering cumulative implementation rates of 5,481 institutions in the US, in all sectors (public 4-year or above, etc.) and enrollment ranges, this figure reveals that the answer is mixed:

- Rapid growth in implementations: Implementations of digital accessibility solutions over the past ten years have outpaced implementations in all other IT service categories. For example, implementations of these solutions show a combined annual growth rate (CAGR) of 56%, sixteen percent more than technologies in the integration services category (Okta, etc.), and just over six times the CAGR of all technologies (6.56%) overall.

- Scarce implementations overall: Despite the rapid growth of implementations of digital accessibility solutions, relatively few institutions have them as part of their technology ecosystems. For example, fewer than one percent of institutions have implemented these solutions over the same period, well below technologies in other IT service categories, such as student information management (24%), learning management (18%), and library systems (9%).

These findings suggest that institutional leaders are intensifying their focus on acquiring technology to support the journeys of students with disabilities, but there is a long way to go.

Which Accessibility Solutions Are They Considering?

Diving deeper into the data reveals most institutional leaders are implementing two main digital accessibility products:

- Ally (Anthology): With seventy-three percent of the market share of digital accessibility solutions, Ally has been the clear choice of institutional leaders over the past ten years. Acquired by Blackboard in 2016 and incorporated in the merger with Anthology in 2021, Ally empowers institutions to place design for accessibility at the heart of content development by enabling them to build content aligned with Universal Design for Learning (UDL) principles. Likewise, Ally also integrates with any Learning Management Solution (LMS), which enables institutions to build accessible content for students regardless of which LMS it has. Lastly, institutions with the Blackboard Learn Ultra have access to a digital content reviewing tool (Accessibility Checker) that helps instructors identify and correct accessibility issues with course content.

- Panorama (Yuja): Although Panorama has a much smaller market share than Ally (17%), it has had a much more significant growth rate over the past few years, with a 48% CAGR versus just over two percent for Ally. Founded in 2013, Yuja offers several products across different categories, such as lecture capture, proctoring systems, and video communications. Its Panorama product allows institutions to create accessible content, review existing content for accessibility issues, and provide accessibility reports to instructors and administrators. As with Ally, Panorama is LMS-agnostic, integrating all four major learning management systems. Lastly, learners can customize their accessibility preferences by installing Panorama’s Website Accessibility Tool, which allows them to select custom profiles, adjust content, and access alternative formats on pages.

Summary

Institutions face risks and challenges when supporting students with disabilities, including legal and governmental challenges, institutional culture, and staff and leadership participation in accessibility training. Technologies such as digital accessibility solutions will not serve as a singular way to overcome these risks and challenges.

However, these solutions help identify areas in digital content that may cause their students to struggle with their learning, although in different ways. For example, institutions that want to build accessibility into the core course design practices might find Ally an excellent choice for their students. On the other hand, leaders who wish their stakeholders to have a wide range of functionality they can control might prefer Panorama.

We hope that the rapid growth in implementations of digital accessibility solutions continues, as without it, millions of students will be prevented from having access to the entire learning experience offered by institutions and be at a disadvantage compared to other students.