Before the Internet was even a thing, businesses and institutions established terms and procedures to sell, acquire and exchange goods and services. This process was named procurement. Thanks to significant advancements in technology and SaaS, public organizations and educational institutions nowadays use e-procurement solutions to manage their procurement processes.

History of e-Procurement

We have to go back to the early 2000s to see the first signs of the system that will later be called eProcurement. It is documented that the first company to use this process was IBM for its Guadalajara plant, the largest personal computer production plant at the time. The objective with this project was to increase productivity, which it did, bringing the production of the plant from 1.6 billion dollars to 3.6 billion dollars a year.

eProcurement in the public sector is massively used in the European Union since 2004. At the time, a framework was developed to offer transparent and equal opportunities for suppliers in the context of public procurement. Because of regulations, all public organizations and government bodies had to abide by these directives.

What is Electronic Procurement?

In a document titled “Are you ready for eProcurement?“, the European Bank for Reconstruction and Development explains that electronic procurement is “the use of information technology, especially the Internet, by governments in conducting their contracting of works, goods, and services as required by the needs of public sector.”

This definition sheds light on why 90% of educational clients of these solutions are public institutions. Because of regulatory laws, public institutions must report all expenses and justify vendor selection in the most transparent and efficient way.

eProcurement solutions are managed by three main principles:

- Governance: most solutions offer the possibility to consult all processes, decisions and results (selection of the vendors) within the tool. Although not all solutions offer access to the public, these documents and decisions can be easily obtained and can help future suppliers in their preparation of bids.

- Efficiency: when using an e-procurement solution, institutions ensure they streamline their acquisition processes and, therefore, reduce significantly administrative costs and scheduling delays. Ultimately, it guarantees that public funds are well managed.

- Balanced Development: these e-procurement solutions must not hinder healthy competition between suppliers while promoting local and regional economies (settings can be modified based on the local regulations).

What Should be Included in the eProcurement Process?

If we simplify the process to the maximum, an eProcurement process should include three key components: e-tendering, e-purchasing and e-contract management. While e-tendering is mostly used in situations where there is high value but low volume, e-purchasing facilitate the procurement of the opposite: low value in high volume. The latter may require a complex system to support procurement activities, but will always include a catalogue where all items are listed, can be ordered, processed and delivered to the client.

The last component is the management of receivables, payments, contract settlements and variations, performance securities, audit and control activities.

eProcurement Market Leaders

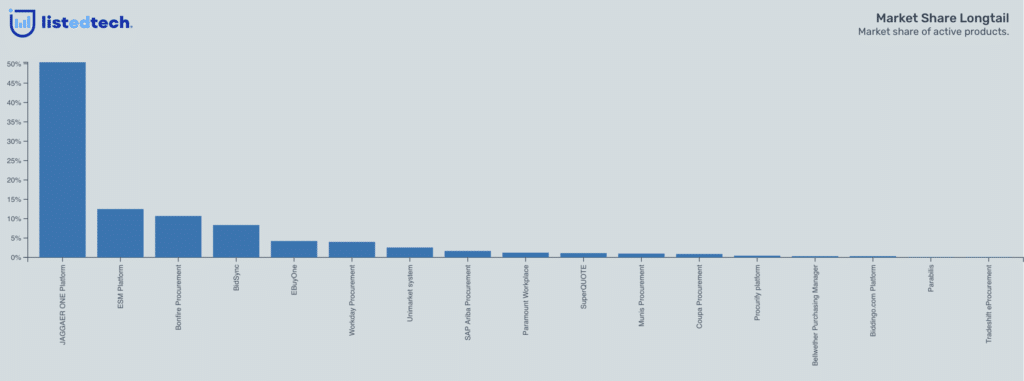

The e-procurement product category is dominated by Jaggaer One platform. Based on our database, it is not clear why this solution is way ahead of other products. Two main factors could explain their domination: the company has been in business for more than 25 years and their median age implementation is over 10 years. However, over the past decade, some institutions have changed their product, dropping Jaggaer to the benefit of ESM platform. In the next few years, we may see a closer gap between the leader and the first contender.

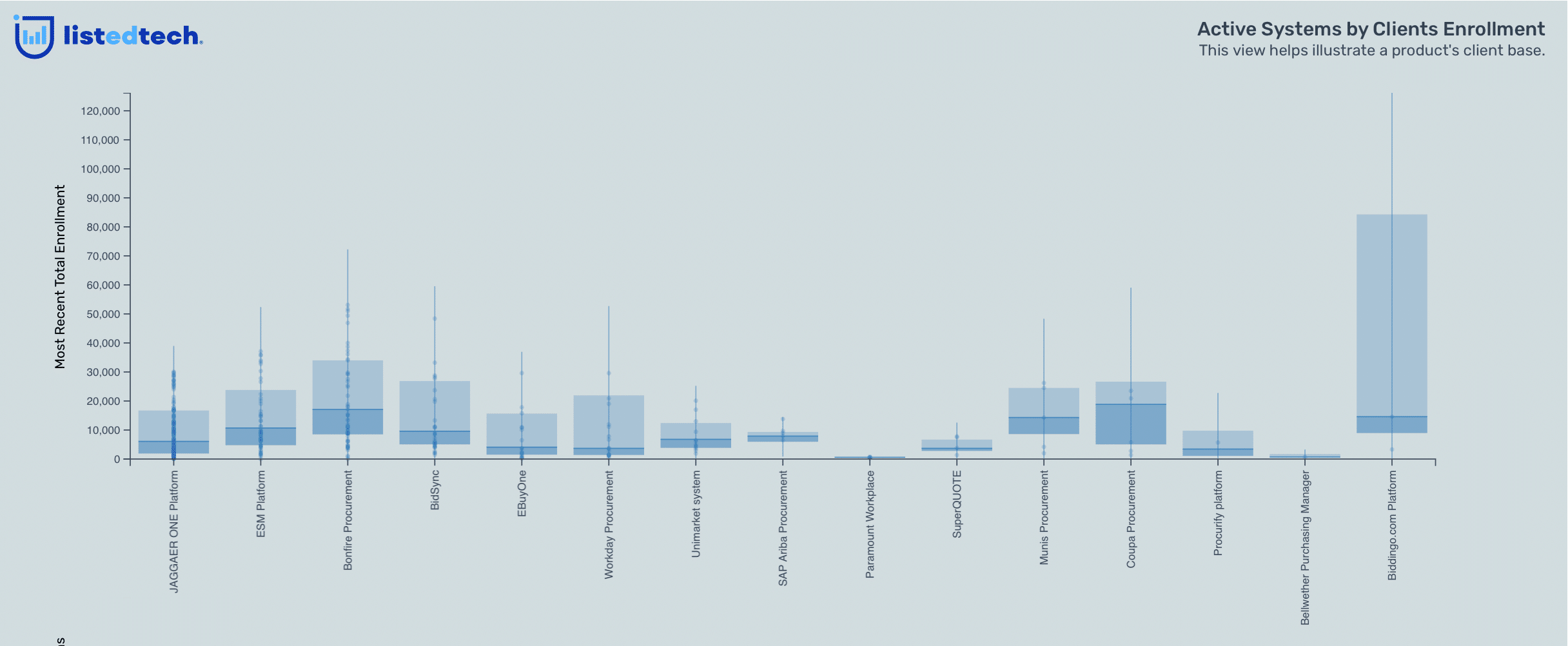

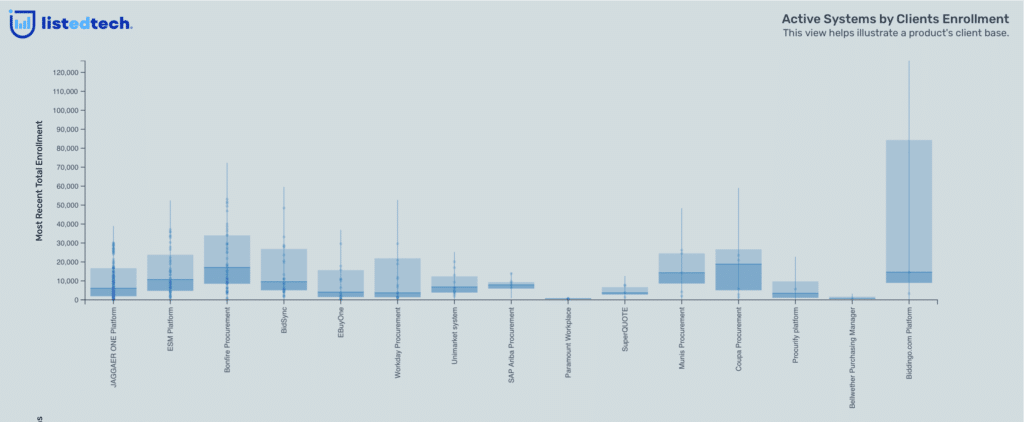

As we can see in the Active Systems by Client Enrollment graph, the distribution of the client enrollment varies for each product. The only solution that has a large client enrollment distribution is Biddingo.com, but the total enrollment for this product is only 172,000 students, compared to 5.5 million for Jaggaer.

What is the Future for eProcurement?

Each day, the e-procurement product group is getting bigger as more institutions are implemented one of the available solutions. Between 2013 and 2022, the total number of institution enrollment using an eProcurement solution has risen from 5 million to 12.5 million. In addition, many countries have implemented these solutions as part of their business practices, with many of these countries being in the populous Asia continent. This product group will only getting bigger.