Key Takeaways:

- Market Fragmentation: The “Others” category still accounts for 25% of SIS implementations, highlighting vendor diversity.

- AI Integration: Major SIS vendors are embedding predictive analytics and automation to stay competitive.

- Regional Shifts: Statewide migrations like North Carolina’s are reshaping the vendor landscape in 2025.

The North American 2025 K-12 SIS market continues to show the hallmarks of a mature industry: steady leadership among top vendors, slower implementation cycles, and a growing emphasis on product differentiation through AI and integrated analytics. Yet beneath this stability lies meaningful change. Mergers and acquisitions, new state-level migrations, and evolving expectations around data intelligence are reshaping the competitive balance.

Market Overview

As of 2025, ListEdTech tracks over 23,000 school districts across the U.S. and Canada—an increase of more than 6,000 districts since our last update. This expanded coverage provides one of the most comprehensive and accurate views of the K-12 SIS market available today.

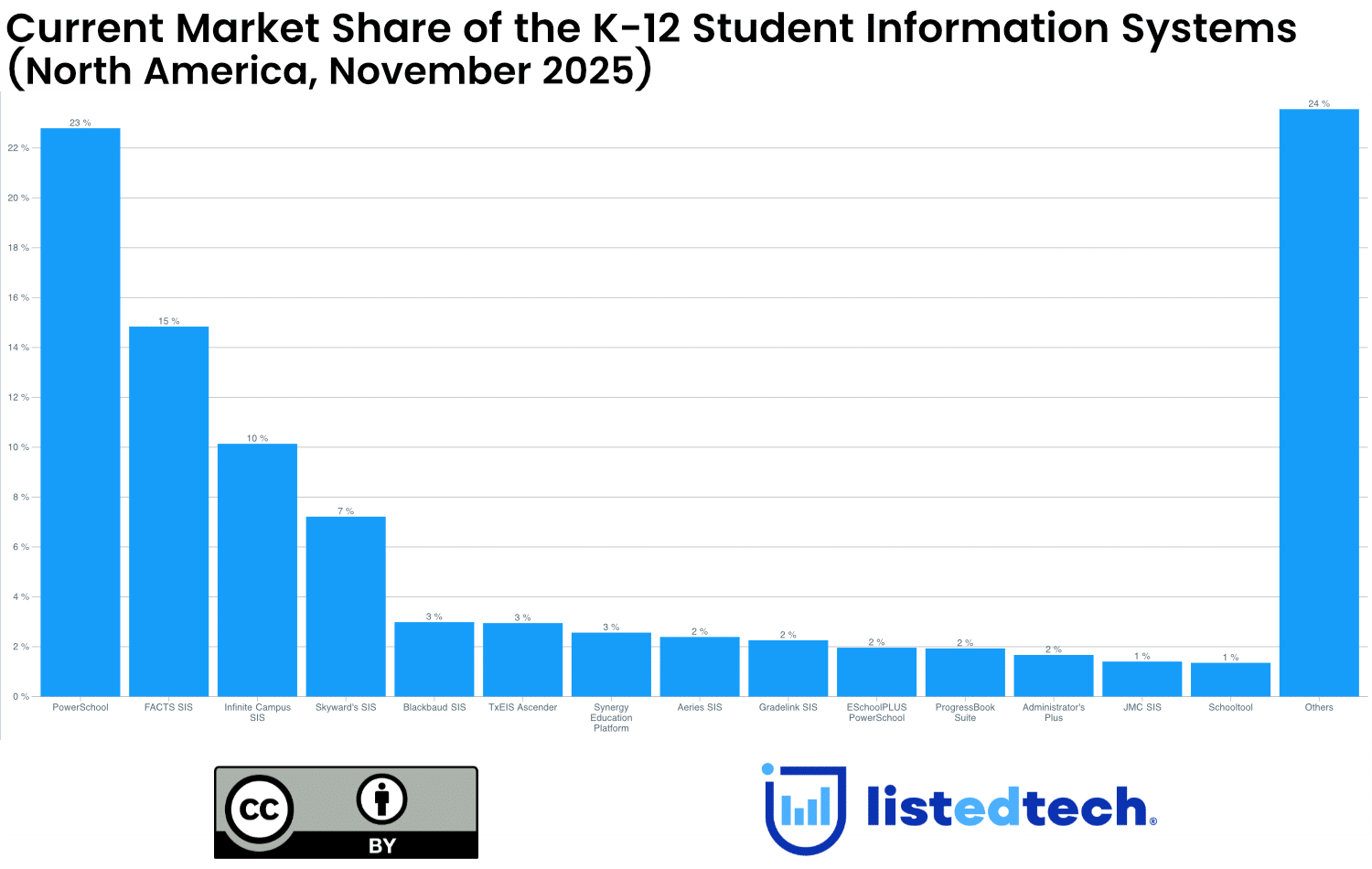

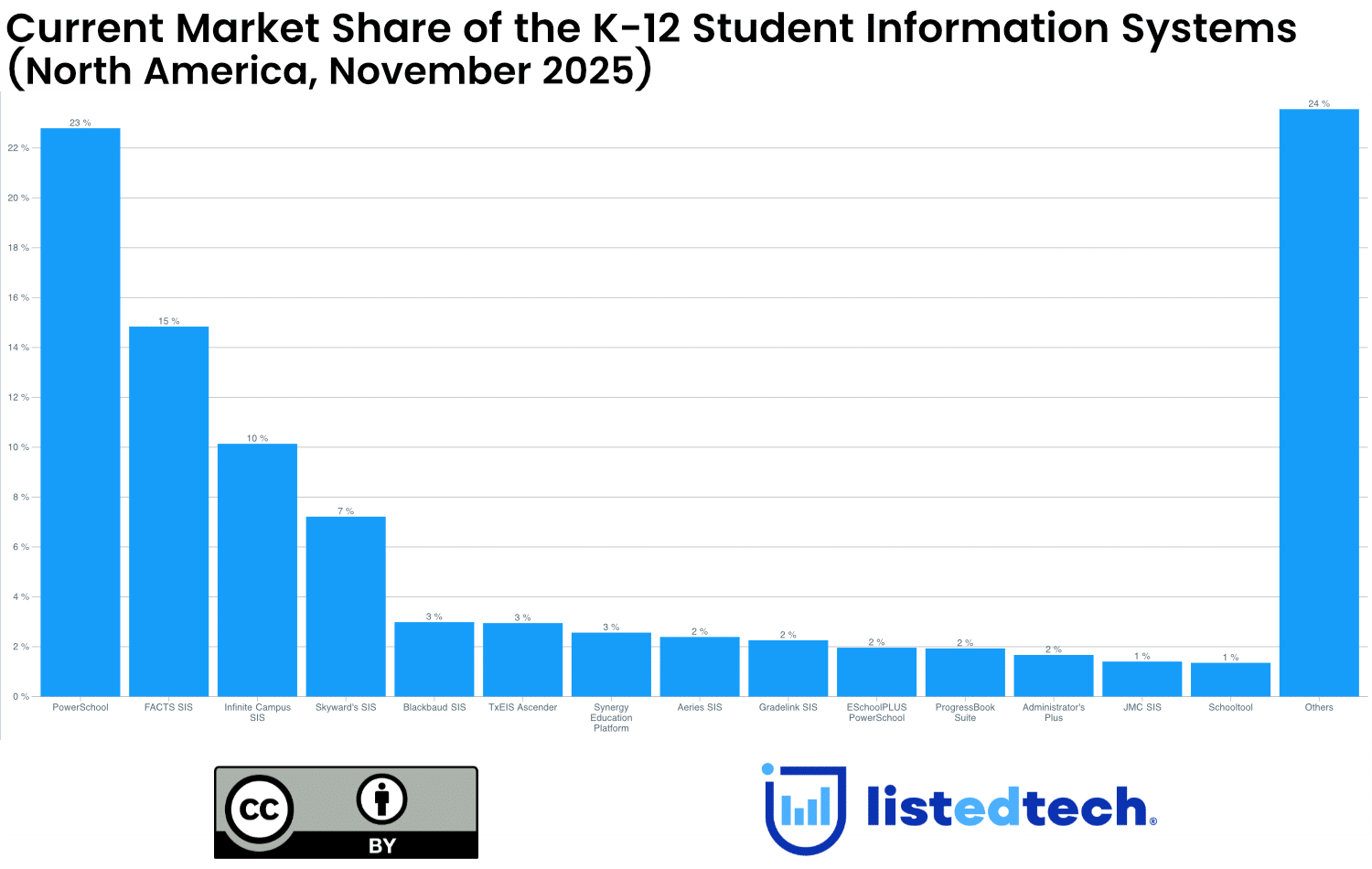

Within this broader dataset, PowerSchool remains the dominant provider, holding 23 percent of identified implementations. FACTS SIS follows at 15 percent, while Infinite Campus captures 10 percent. Other significant players include Skyward (7 percent), Blackbaud (3 percent), TxEIS Ascender (3 percent), Synergy Education Platform (3 percent), and several vendors clustered between 1 and 2 percent market share.

Collectively, the “Others” category (representing roughly one-quarter of all known implementations) remains the single largest segment of the market. This long-tail distribution highlights the fragmentation that continues to define the K-12 SIS landscape.

Implementation Trends

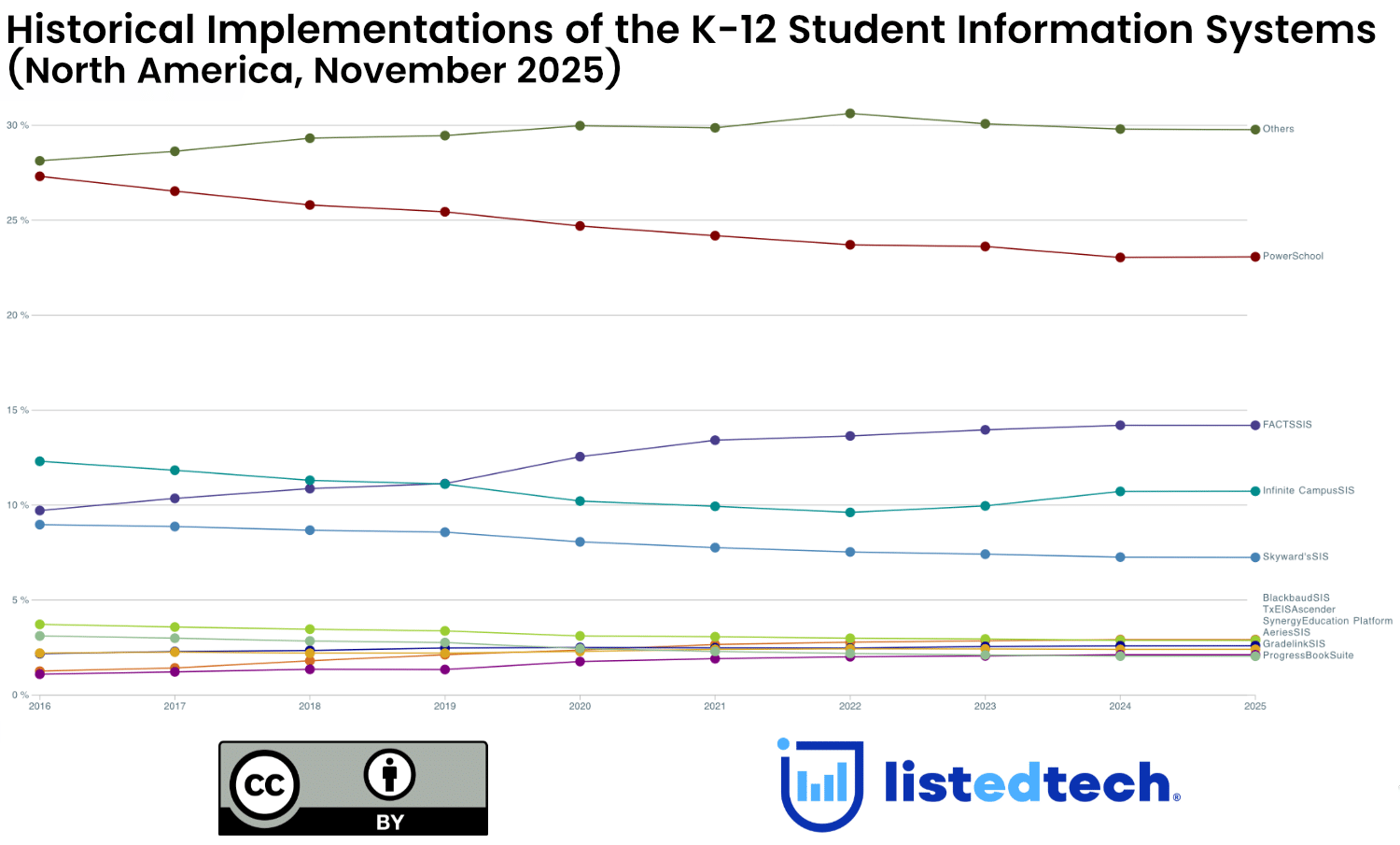

New implementations across the region have slowed compared to the pandemic-era spike. From 2020 to 2022, many districts made first-time SIS adoptions or major upgrades driven by emergency funding and digital-learning mandates. Since 2023, however, the number of new projects has declined and stabilized at pre-pandemic levels.

PowerSchool’s dominance has gradually eroded as districts pursue alternatives offering stronger analytics, integration, and configurability. FACTS SIS continues to climb steadily—its growth driven primarily by the private-school segment—while Infinite Campus holds steady overall, with notable gains in specific regions. The overall trend suggests that the market has reached a mature, replacement-driven phase rather than one of rapid expansion.

Key Themes Shaping the 2025 K–12 SIS Landscape

Mergers, Acquisitions, and Market Consolidation

M&A activity is shaping the SIS sector more visibly than at any point in the past decade. PowerSchool’s acquisition by Bain Capital underscores sustained investor confidence and sets the tone for potential large-scale consolidations. Sycamore’s purchase of TuitionEP strengthens its financial-management capabilities and differentiates its offering among mid-sized districts. Meanwhile, the SchoolData Solutions–Munetrix merger reflects how regional vendors are seeking to consolidate expertise and product breadth to compete nationally.

With the “Others” category representing nearly one-quarter of the market, further consolidation is both likely and necessary. Smaller systems face mounting pressure to scale, modernize architectures, and meet rising interoperability standards. Over the next two years, we expect additional mergers or exits as vendors align with partners to maintain relevance.

The Rise of AI-Enhanced SIS Platforms

A major new storyline for 2025 is the integration of AI-driven features directly within SIS products. PowerSchool highlights predictive analytics and personalized-learning modules powered by its new AI framework. Skyward, through its partnership with Panorama Education, has introduced best-in-class MTSS-focused AI tools, while Infinite Campus, Blackbaud, and others have launched AI-assisted reporting and automation capabilities.

AI adoption is no longer a marketing add-on; it has become a competitive differentiator. Districts increasingly expect actionable insights on attendance, performance, and intervention timing, and vendors unable to deliver embedded intelligence risk being left behind.

Regional Dynamics and Vendor Shifts

One of the most striking developments this year has been the state-wide migration in North Carolina, where multiple districts—and ultimately the state—are transitioning from PowerSchool to Infinite Campus. These moves, influenced by both feature advancement and security concerns following high-profile data breaches, signal a broader willingness among states to re-evaluate long-standing SIS partnerships.

While most of Canada remains steady in its product mix, the U.S. market is showing subtle regional realignment. Infinite Campus’s expansion in southern and midwestern states contrasts with FACTS SIS’s continuing dominance in private and faith-based institutions.

What the Data Suggests

Taken together, the 2025 data reinforces several key themes:

- Maturity and stability among the top vendors, with PowerSchool still far ahead in installed base.

- Fragmentation in the long tail, setting the stage for further consolidation.

- Strategic acquisitions reshaping competitive positioning, particularly in mid-market and regional segments.

- AI integration as the newest performance battleground for SIS vendors.

- Regional shifts showing that even established contracts are no longer untouchable.

Looking Ahead

The 2025 K-12 SIS market in North America is evolving from a technology procurement space into a data-driven ecosystem where integration, analytics, and automation determine long-term viability. Vendors that combine core compliance with advanced intelligence will define the next generation of SIS adoption.

Although large-scale implementation growth may have plateaued, competitive repositioning remains intense. For institutions and vendors alike, understanding where these shifts are happening—and why—will be essential to planning ahead.

Data source (November 2025): ListEdTech database of 23,000+ school districts (an increase of 6,000 since our previous update).