Market saturation occurs when a product or service has become widely distributed within a given market, leaving little room for further expansion. Businesses face increasing difficulty in attracting new customers, leading to intensified competition and reduced profit margins. In saturated markets, the search for whitespace—unexplored areas where unmet needs still exist—becomes crucial. As we prepare a report on this topic, we wanted to share with you some preliminary information that could be useful.

Evolution of System Implementations in Higher Education

Educational technology began in the 1980s and 1990s with simple tools like computer-based training (CBT) systems and early Student Information Systems (SIS), mainly used for administrative purposes such as course registration and grading. Most institutions relied on homegrown systems rather than commercial solutions. The use of desktop computers in classrooms grew, and educational software began to emerge, though its adoption remained limited. In the early 2000s, Learning Management Systems (LMS) like Blackboard and Moodle became popular, enabling online course delivery and distance education. At the same time, Enterprise Resource Planning (ERP) systems were integrated into higher education to streamline administrative functions such as HR, finance, and student information systems.

The 2010s marked a shift towards cloud-based solutions, enabling greater scalability and accessibility for educational institutions. Mobile learning gained popularity as smartphones and tablets became more common, and Massive Open Online Courses (MOOCs) expanded global access to education. In the 2020s, educational technology is increasingly data-driven, with analytics and artificial intelligence (AI) being used to personalize learning, automate tasks, and improve decision-making. The COVID-19 pandemic accelerated the use of remote learning technologies, emphasizing the importance of digital platforms. The focus now is on creating more personalized, efficient, and accessible learning environments.

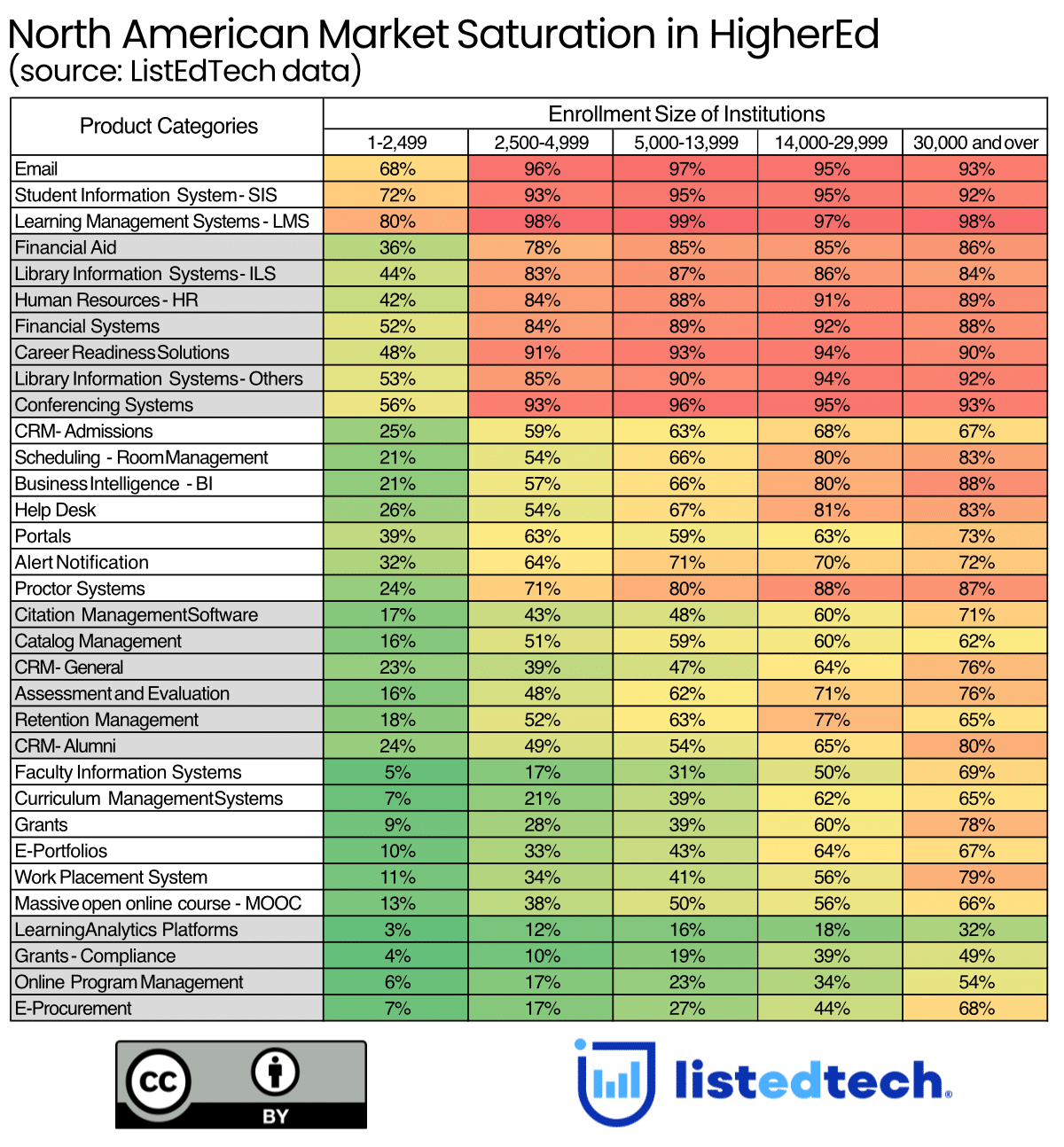

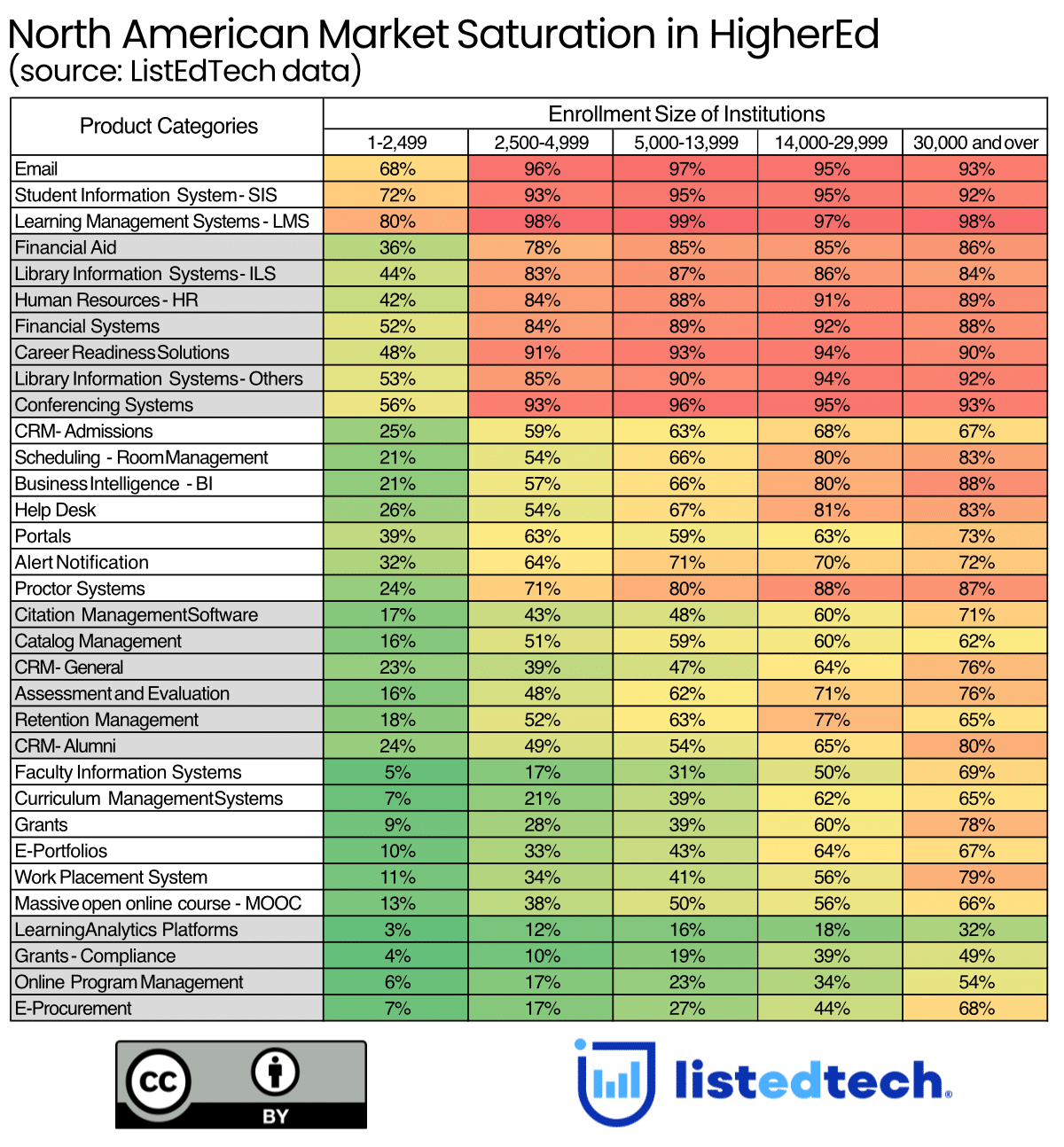

What the image shows is that small institutions will first start by implementing Email Systems, Learning Management Systems and Student Information System before moving into other operational systems. Large institutions usually have more specialized systems implemented. This sequence indicates that the core systems and the basic operational systems have a higher market saturation rate compared to specialized systems. However, not all specialized product categories will be implemented in all institutions due to consumption levels.

A general rule regarding market saturation is that the bigger the institution is, the smaller the whitespace. One explanation for this reality is that many vendors target institutions with larger enrollment since most of the billing is done on an enrollment basis. Therefore, signing a contract with a 50,000-student university is almost the equivalent of signing contracts with ten 5,000-student universities, but it would not be the same amount of time to obtain them. These institutions also have a larger budget to implement technology.

Report Details

Our report will propose an analysis of the current market saturation in higher education across North America for 33 product categories, including all those available on the ListEdTech portal. Our market saturation is calculated using the ListEdTech database, which covers up to 80% of the market share. Recent verifications suggest that coverage now reaches 90% for North American data.

One of the report sections is a comparison between 2-year colleges and 4-year universities. Most product categories see similar market saturation rates between the two institution types in higher education. However, due to specific market realities, a few product categories have different saturation rates: citation management systems, customer relationship management systems, faculty information systems, grants and grants-compliance, online program management and work placement solutions. In addition to the difference in both markets, the report shows specific rates, by enrollment sizes and by institution types.

Summary

Despite the maturity of core systems, many other product categories continue to offer room for expansion. Solutions related to Catalog and Curriculum Management, CRMs, E-Portfolio, E-Procurement, Work Placement Systems, for example, have not yet reached full market saturation. This highlights the fact that there is still substantial potential for growth and innovation in many product categories.