Fall 2021 has seen another acquisition in the HigherEd IT systems. On November 16, Cayuse has announced its intention to acquire iMedRIS Data Corporation. If it passes all regulatory steps, Cayuse will consolidate its leading place in the grant management product category.

Since Cayuse was bought out by Quad Partners on July 13, 2017, It has been on a shopping spree. At first, it bought rival companies (Process Pathways, the maker of ROMEO and IT Works) in 2018. With Process Pathways’ acquisition, Cayuse took control of the Canadian market. Then, it purchased NTM Consulting Services in 2019, a grant management solution specialized in resource management in the health sector. Later that same year, it was time for ERA Software Systems to join Cayuse. Finally, earlier in 2021, Cayuse bought Haplo Services. Throughout this purchase cycle, Cayuse always wanted to fill the gaps within its product line while offering the most comprehensive platform possible. iMedRIS’ purchase is aligned with this business strategy.

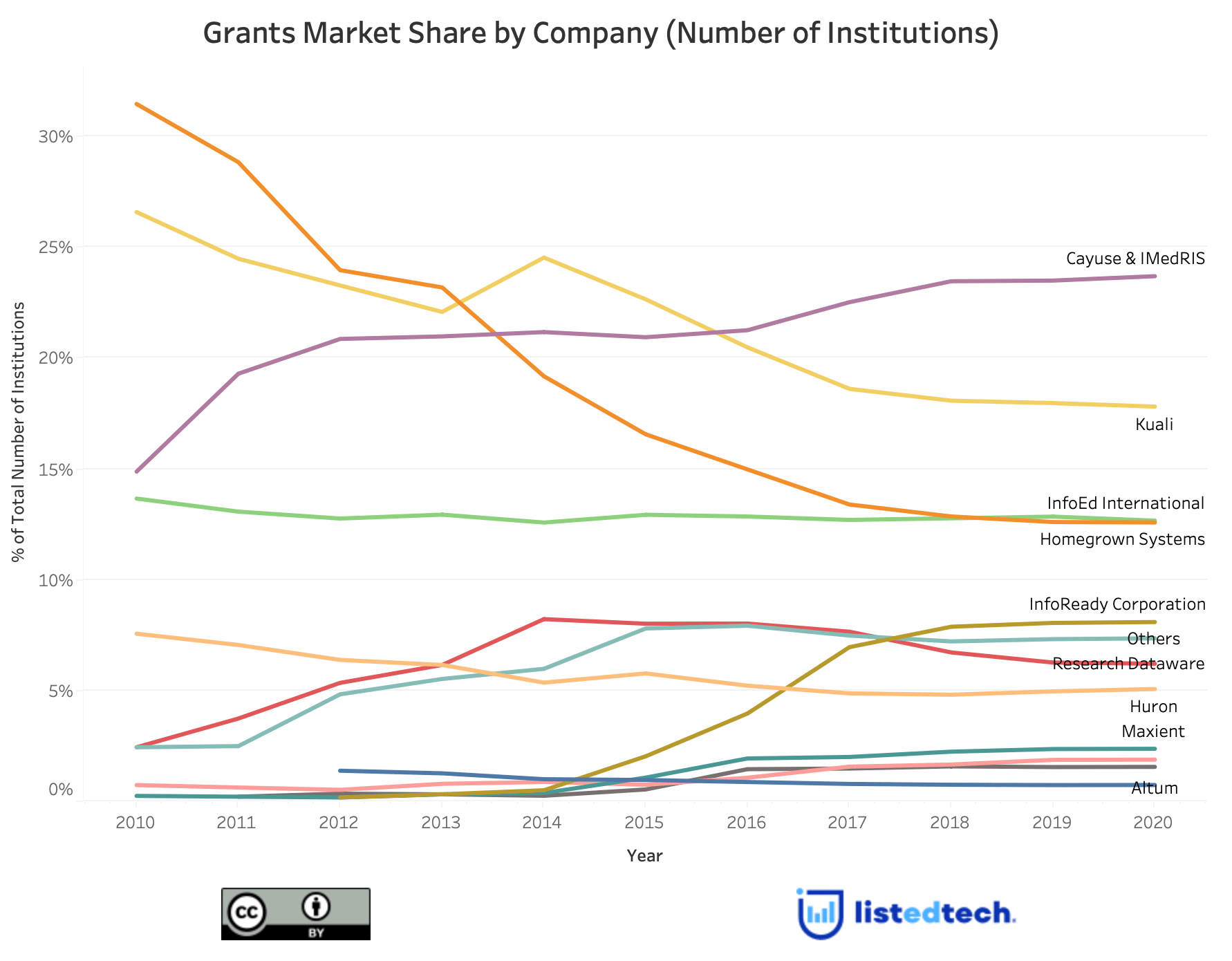

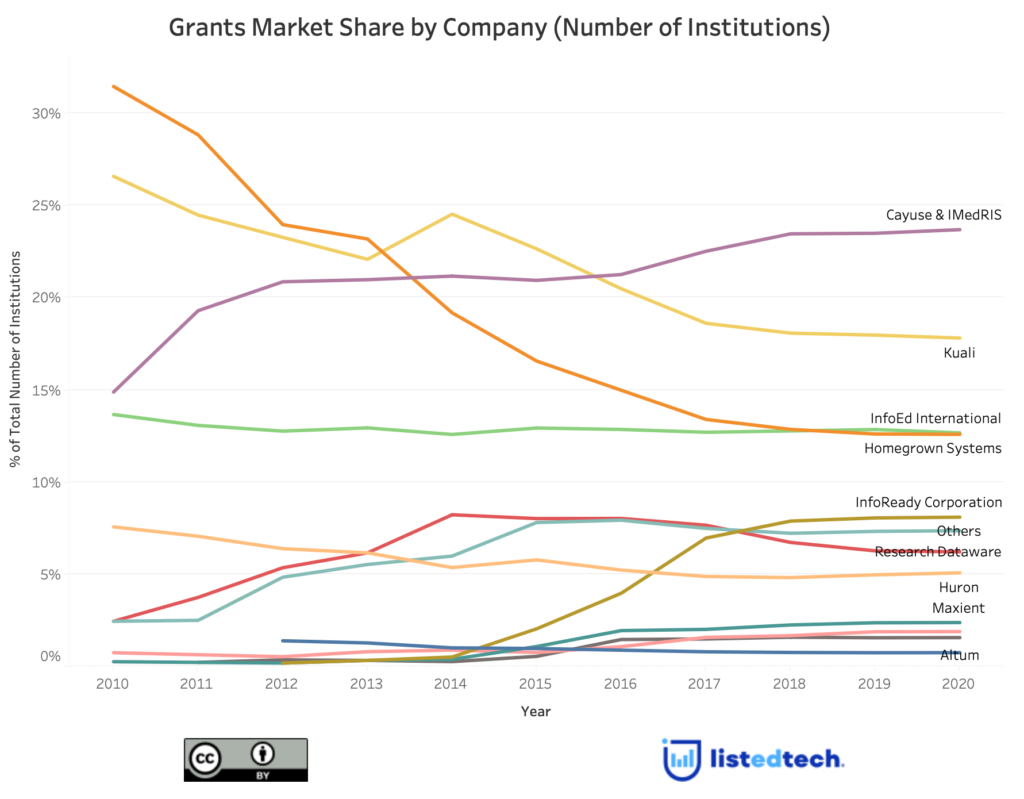

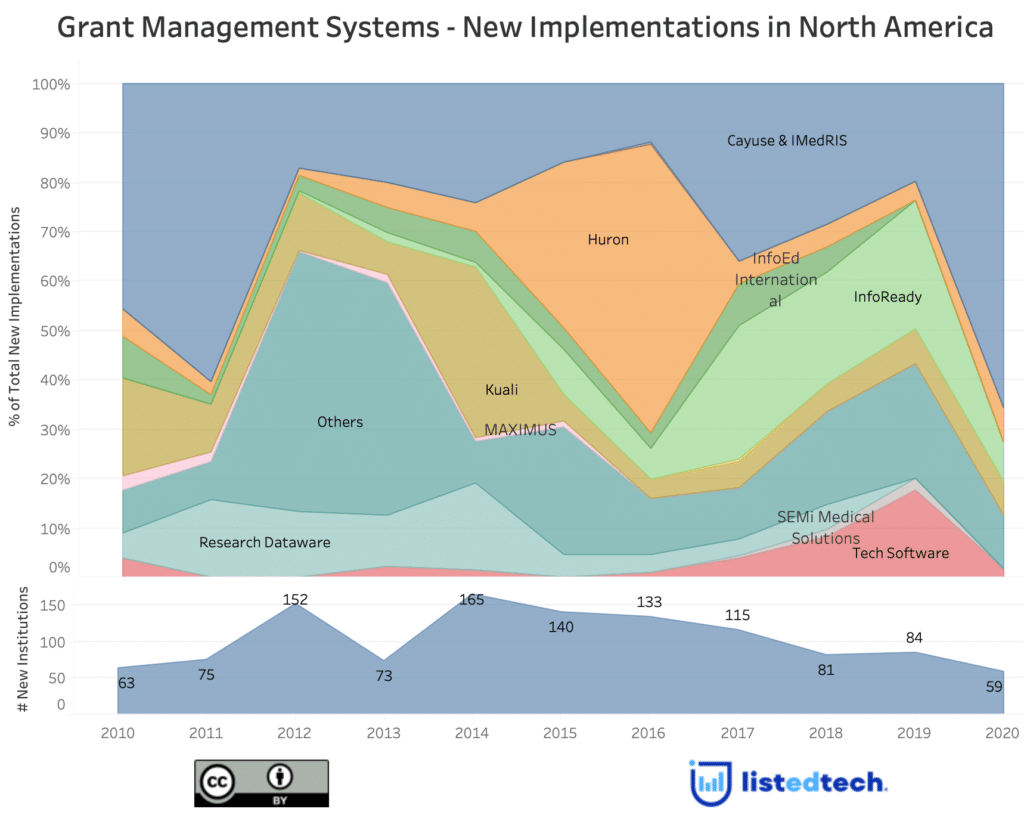

As published in our annual grant management report, Cayuse leads the Canadian and American market for both research-intensive universities and other universities. By buying iMedRIS, it will increase its position in the American market, where Kuali and InfoReady are just behind Cayuse on the podium.

The grant management market has still a lot of homegrown systems in place in many universities. In our most recent report, we mention that they represent about 10% of active implementations and they are the oldest systems implemented. This means that, most likely, these systems are about to be switched to another solution. Since few universities want to keep their homegrown systems, the grant management solutions are looking at prospecting these institutions.

Two Full-Spectrum Solutions to Support Universities

Unlike most of their competitiors in the grant management category, Cayuse and iMedRIS are offering a complete set of features and compliance functionalities within their specific solution. “In consolidating the strengths of the iMedRIS solutions and Cayuse’s research platform, Cayuse is now perfectly positioned to serve the unique needs of hospitals and health systems and government agencies”, mentions Cayuse’s press release.

When looking at the historical implementations of this product category, we see that iMedRIS has never been a big player in the educational space where Cayuse is the dominating company. On a yearly basis, Cayuse implemented between 10% and 60% of all new solutions in the past decade. Its closest competitor in that regard is InfoReady who implemented between 10 and 33% since 2015, except for 2020 (about 7%).

If we compare the higher education market to the health and research organizations, it’s a subset of the grant management category. However, this acquisition of iMedRIS by Cayuse still represents a consolidation of solutions like the ones from the past few years. It also opens up new opportunities to develop new markets.

Want to purchase a copy of our 2021 Grant Management System Report for North America? Send us an email.