In the next two to three months, we plan to launch our subscription service of the K-12 LMS market. Over the last year, we have been gathering substantially more LMS data for the U.S. and Canadian K-12 markets. The initial focus was on the top 1,500 districts, which are each comprised of more than 6,550 students. From there, we focused our efforts on the second tier of districts (with 2,500-5,549 students) and finally, our focus shifted to smaller districts, with fewer than 2,500 students. We are now at a point where the data is robust enough to provide a meaningful and insightful view into the market share breakdown in the K-12 market. The year 2019 will serve as a benchmark year and future market movements will be tracked against this base year.

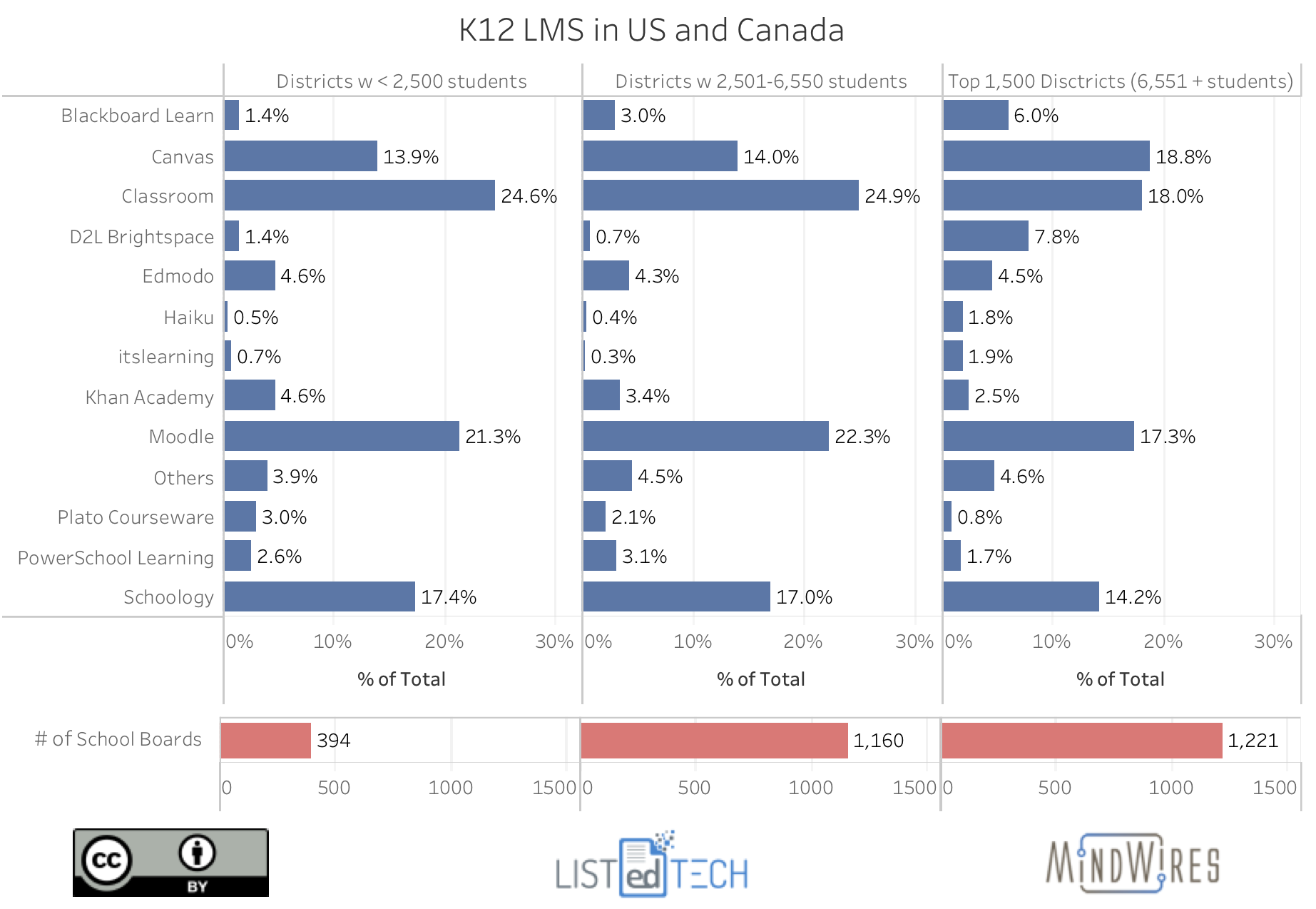

As a preview and a bit of a teaser, we’re including a high-level graphic that shows market share breakdown in the three different tiers mentioned above.

As you can see, the K-12 market is more fragmented than the higher ed market. Many of the same players are present, but there are several K-12-focused vendors as well, most notably Google Classroom, Edmodo, and Khan Academy (not really an LMS, but some schools use it this way). Schoology, a company with a small share of the higher ed market, is one of the leaders in the K-12 environment.

For more analysis and commentary, we plan to release a dashboard-based market analysis service for K-12 in the summer of 2019. The current subscribers to the higher ed service will have access to the K-12 analysis at a discounted price.