This was originally posted April 2, 2019 by Phil Hill on e-Literate. Since we helped with the images and data, I’m reposting it here.

——

In 2013, Harvard Business professor Clayton Christensen made a bold prediction based on his ubiquitous innovation theory that maybe half of all postsecondary institutions could close within 10-15 years.

(source: https://youtu.be/KYVdf5xyD8I, starting at 6:25)

The scary thing is that 15 years from now, maybe half of the universities will be in bankruptcy, including the state schools. But in the end, I’m excited to see that happen.

Christensen then doubled down on his predictions in 2017, humorously saying it might take nine years instead of ten.

Q. Do you still believe, as you’ve said before, that as many as half of colleges and universities will be bankrupt or closed within a decade?

A. Um, yes. [snip] Whether the providers get disrupted within a decade — I might bet that it takes nine years rather than 10. Maybe I’m too scared about the Harvard Business School to be rational about it. But we should worry.

There have been plenty of articles written about these claims, but it has been frustrating that very few back up their analysis with data. One exception is Derek Newton’s article critiquing the claims in Forbes, titled “No, Half Of All Colleges Will Not Go Bankrupt”.

Look at the numbers. In the 2013-14 year, there were 3,122 four-year colleges according to the Department of Education. In 2017-18, the most recent data, there were 2,902 – a drop of about 7% over four years. That could be disruptive. But numerically, all of school closures since Christensen made his 2013 forecast were four-year, for-profit schools, which fell from 769 in 2013 to 499 in 2017 – a drop of 270. Of all the colleges, at all levels, that have closed since 2013, 95.5% of them were for-profit institutions.

Another exception is Michael Horn’s explanation of the predictions (he co-authored the New York Times op-ed from 2013, titled “Innovation Imperative: Change Everything”, that included the initial prediction). This 2018 post “Will half of all colleges really close in the next decade?” also sought to go back to original, more nuanced claims of 25% closures and mergers at the Christensen Institute.

Translation? Our predictions may be off, but they are directionally correct.

To that I emphasize one more piece of nuance. Ultimately we are really predicting a failure rate, made up of a combination of closures, mergers or acquisitions, and bankruptcies in which a college or university has the opportunity to restructure itself. Not all universities that “fail” will disappear. [snip]

From 2004–2014, “Closures among four-year public and private not-for-profit colleges averaged five per year from 2004-14, while mergers averaged two to three,” according to Moody’s. Moody’s predicted in 2015 that that closure rate—out of 2,300 institutions—would triple by 2017, and the merger rate would double.

Assuming that were true, and say that the rate held steady for 15 years, that would take out roughly 13% of existing higher education institutions right there.

Thanks to our partners with our LMS Market Analysis service, ListEdTech, we can now provide data visualizations to better evaluate the validity or likelihood of these claims. For the first time that I’m aware of, we have visualizations showing combined closures and mergers over time, broken down by sector and degree-type, and showing data 2-3 years in advance of IPEDS publications.

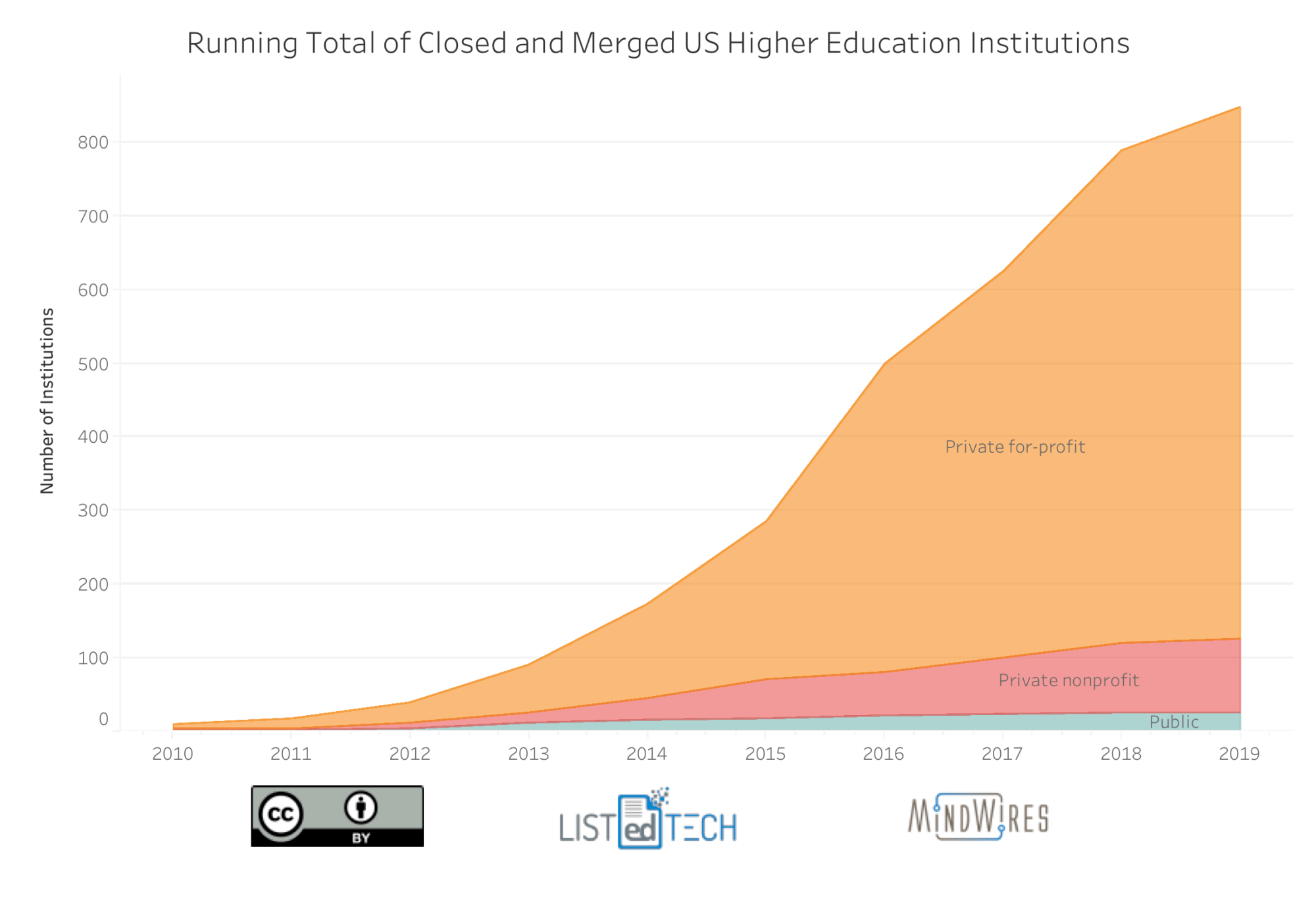

The ListEdTech data shown below tracks known closures and mergers, which have then been checked against both IPEDS and Federal Student Aid data sets. There are translation issues in all three data sets, so the data will not match 100% – probably more at the 80 – 90% confidence level. The first view shows combined closures and mergers per year, broken out by control and whether they are classified as 2-year or 4-year degree-granting institutions.

As Derek Newton and Michael Horn pointed out, the vast majority of closures were from the for-profit sectors. Part of the dynamic at play is that when a large for-profit chain meets its demise (e.g. Corinthian Colleges, ITT, Westwood Colleges) or has a massive downturn (e.g. University of Phoenix) literally dozens of individual institutions close, whereas when a small private nonprofit college in New England closes, it is one school. Add to the that the massive drop in for-profit enrollments since 2012.

The public sector data in 2013 and 2014 is largely driven by reorganizations in the University System of Georgia.

Also note that the 2019 data only includes the first quarter.

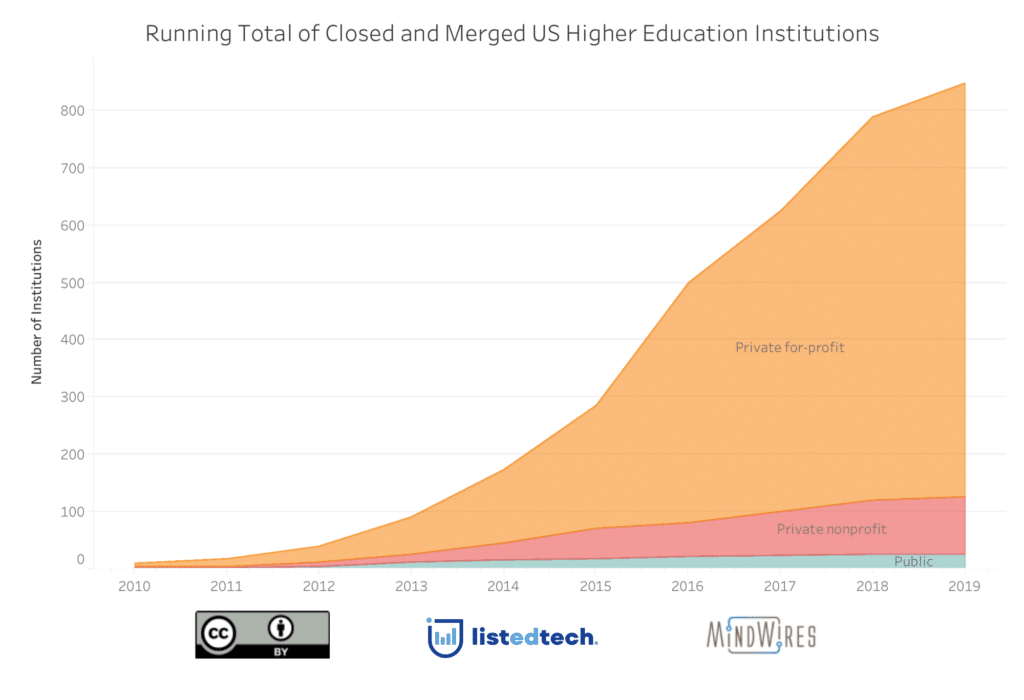

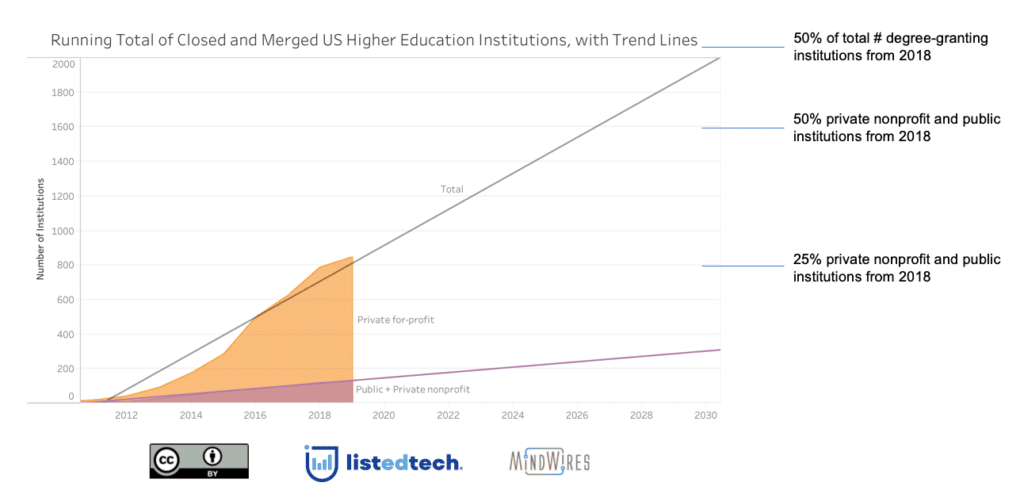

If we want to track the Christensen (and Horn) predictions, however, we need to view this data as a running total.

Let’s zoom out to capture the timeline of the most recent predictions of a decade from 2017, and let’s add the rough levels indicated (using bold row from this IPEDS table to define number of institutions).

If you include all degree-granting institutions (i.e. for-profits as well as private nonprofits and publics), then the current trends lines show that the 50% closure prediction by 2027 certainly seems feasible. Note, however, is that there are less than 1,000 for-profit institutions remaining as of Fall 2017 IPEDS data, and the rate of for-profit closures cannot continue more than another 8-10 years (best case / worst case, take your pick).

There are quite a few stories recently about private nonprofit small-school closures, but the data thus far don’t show a rapid acceleration of closures. Some perspective is useful here.

If you ignore the for-profit sectors, then the trend line for private nonprofit and public institution closures + mergers remains far below that needed to hit the 25% level described by Horn or the 50% level described by Christensen. None of this is to say that the trends moving forward will be linear, however. The rate of private nonprofit and public closures and mergers would need to at least triple to hit the more conservative level of 25% within a decade, a possibility that I would not reject out of hand. And it turns out that Moody’s was wrong – the rate of closures and mergers in this group did not triple from 2015 – 2017. Nevertheless, the data could get worse.

We’ll share more information on this new data, but hopefully these visualizations provide a better sense of the trends on college closures and mergers.