On June 14, 2022, at least three HigherEd-oriented websites (Inside HigherEd; Higher Ed Dive; EdScoop) published articles stating that investments in the SIS product group doubled in 2021. The authors referenced a report by the Tambellini Group. In this post, we want to add some data insights on SIS implementations available in our database. For readability reasons, italics indicate quotes from the report.

“The strong growth in 2021 represents a significant turning point. We predict ongoing acceleration in investments as available systems continue to evolve and institutions show renewed interest in resuming selections delayed during the pandemic.“

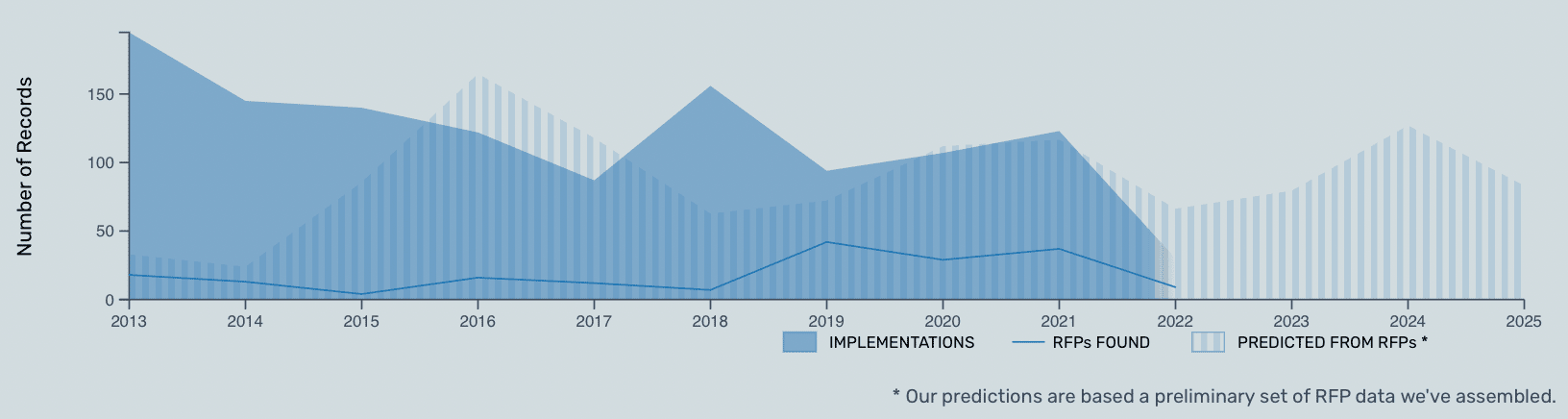

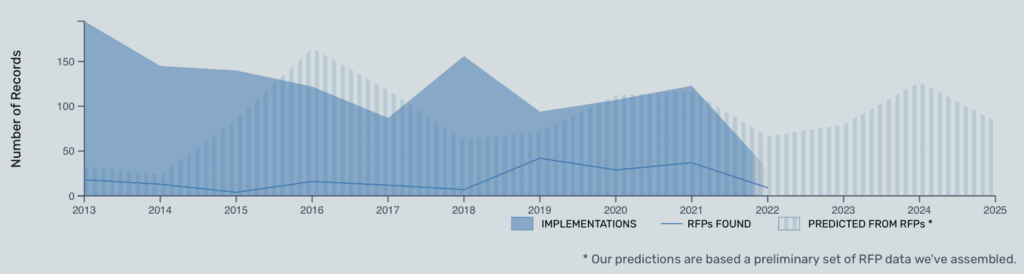

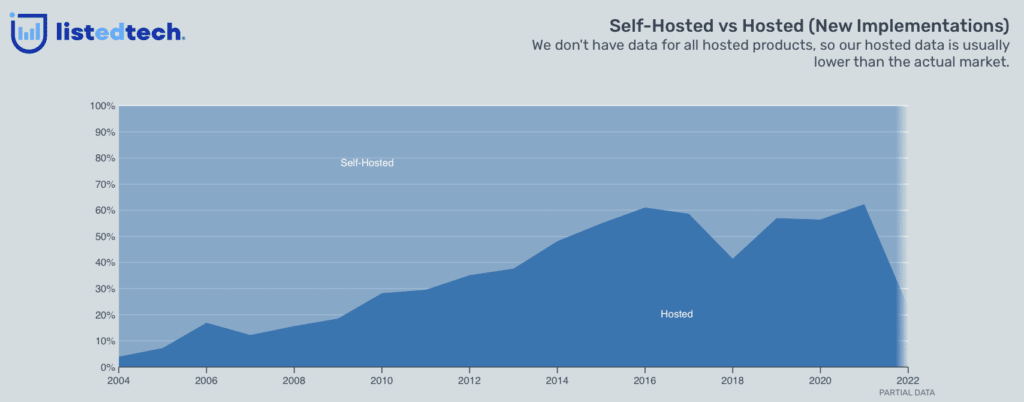

This quote from the Tambellini report spotlight refers to product selection. Our database, based on implementations, shows a decline that may continue for a few more years. For the rest of this post, we keep referring to system implementations.

Since implementations are always a few years after RFP (the average is five to six years between the RFP and the implementation), we can see the 2019 increase in RFPs being reflected in the 2024 and 2025 increases in implementations.

Under Notable Trends and Findings

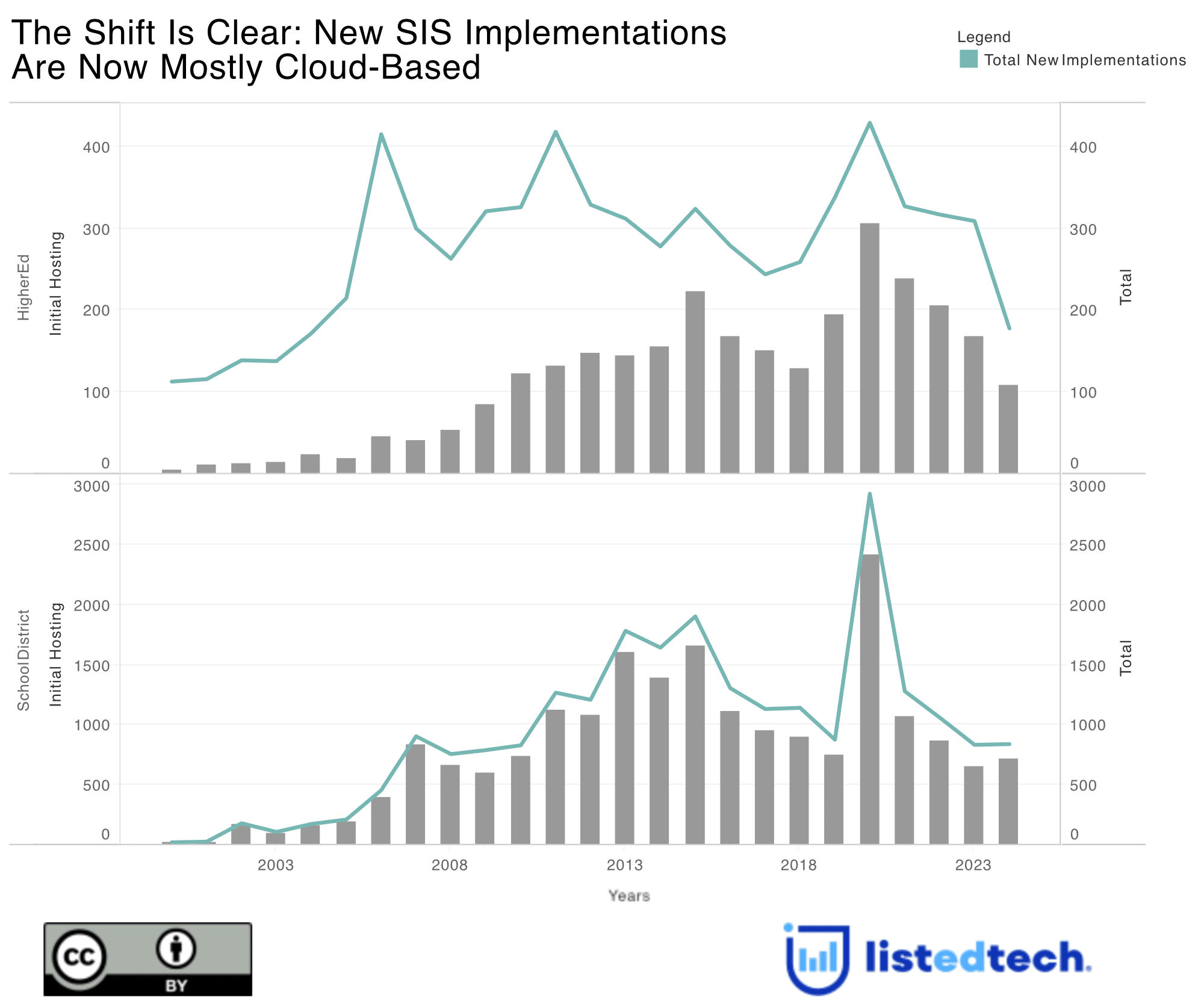

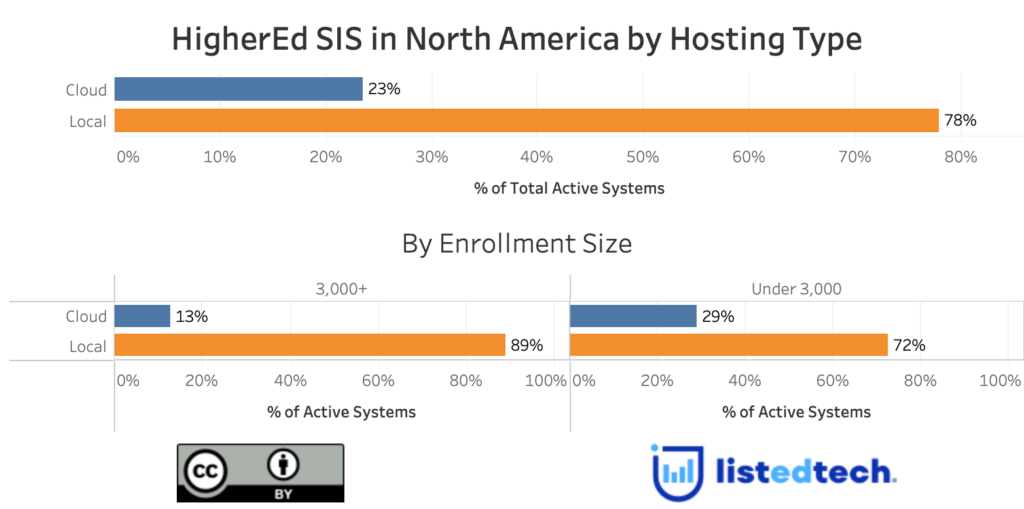

“Market-Wide Adoption: Approximately 5 percent of the higher education student market has selected a modern cloud student system since 2015, when vendors first began to offer these systems.“

Our database shows more than 50% of the SIS implementations are hosted in the cloud since 2015. The year 2018 has a lower proportion of cloud implementations but these implementations still represent 40%. Also, our database shows that vendors offered various hosted solutions since 1999.

In the graph below, we notice that implementations in the cloud are much more popular in smaller institutions. This graph presents all active implementations in our database.

“Vendor Landscape: Workday and Jenzabar led 2021 student system selections, and 29 percent of institutions that selected a student system chose cloud-native ones from Oracle or Workday.“

We need to underline that selections do not represent implementations. Our data indicate that Workday contracts are often options to purchase. Also, for 2020-22, more than 70% of Jenzabar implementations were actually product upgrades from previous Jenzabar SIS.

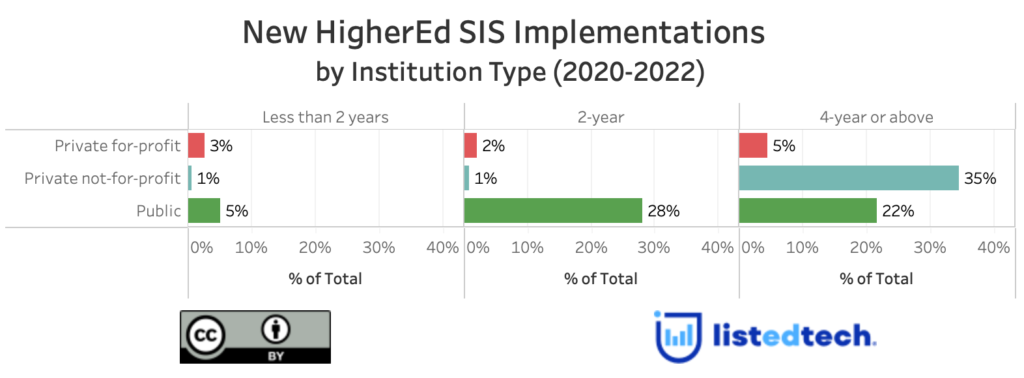

“Public vs. Private Institutions: Private, not-for-profit institutions made the most selections, at 49 percent, followed by 24 percent at public, two-year institutions, and 18 percent at public, four-year institutions, and 9 percent at private, for-profit institutions.“

As shown in the graph above, although the numbers are different than what is mentioned in the report spotlight, we see a similar proportion between the different institution types. Again, the report spotlight refers to product selection when our database includes system implementations.

Market Leaders in the SIS Category

“Six vendors serve at least 1 percent of the higher education student systems market: Anthology, Ellucian, Jenzabar, Oracle, Thesis, and Workday.“

In our database, we have twelve products (ten companies) that have more than 1% of the market shares:

- Banner Student

- Colleague Student

- Jenzabar Student

- Oracle Peoplesoft

- Anthology Student

- Populi

- Unit4 (Thesis)

- PowerCAMPUS

- Workday Student

- EMPOWER

- Diamond SIS

- Lumens

Our data include more than 98 SIS products implemented in 4,673 HigherEd institutions between 1971 and 2022. As always, we only include information available in public sources.