Even if we have been tracking Customer Relationship Management systems data for several years, we have yet to discover a standardized definition of a CRM. In a book published earlier this year, Marco Bardicchia defines the term as one of many different approaches that allow a company to manage and analyse its own interactions with its past, current and potential customers. For HigherEd institutions, we can say that these customers would be their students who become eventually alumni and even donors.

In terms of internal use, CRM systems can have several applications: support general communications with current students, assist with recruitment of prospects, help to analyze retention data, and ensure sustainability of the institution through donors. They could also support event bookings, offer weekly admission dashboards, or even become the central alumni database. One of the key attributes of a CRM is that it cuts across traditional functional areas.

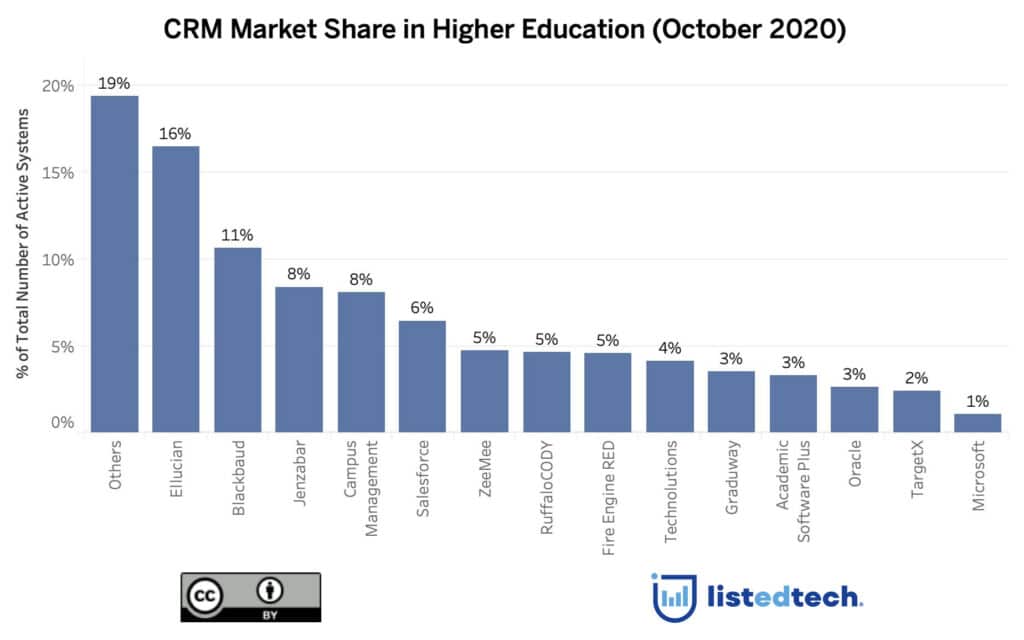

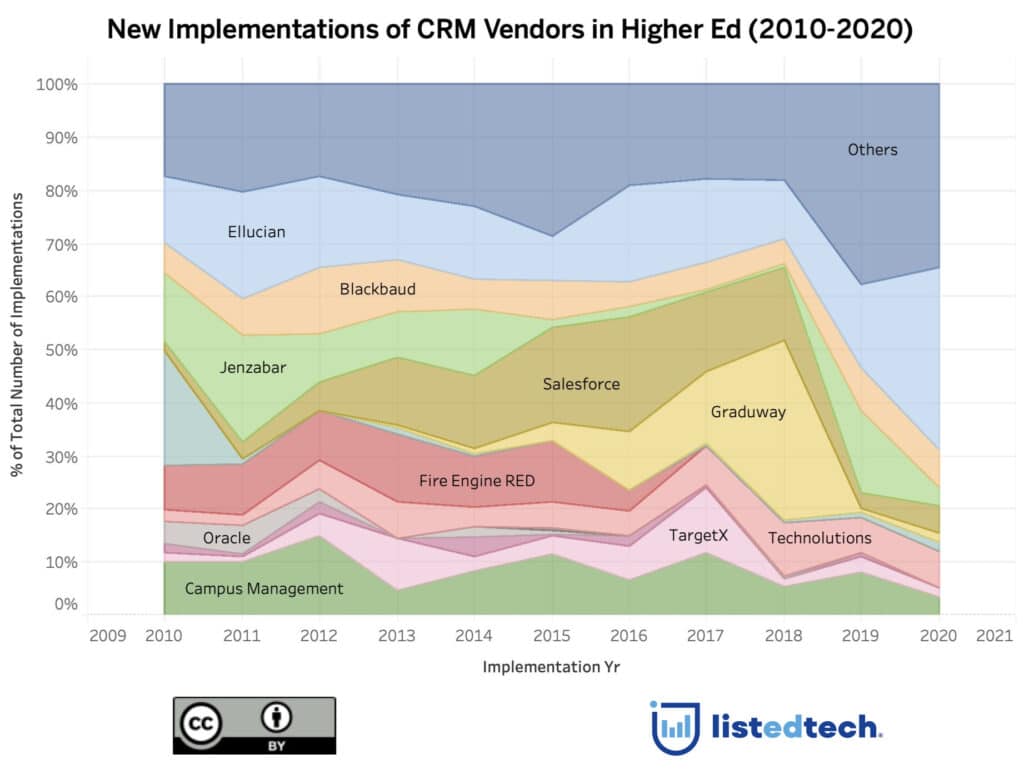

As you can see, the CRM market share is one of smaller players. Even if we can see CRM vendors like Ellucian, Blackbaud, Jenzabar and Campus Management + Hobsons in the top 5, the first position goes to these small players. This long-tail type of graph shows the others in the leader position with a strong advance of 19% in the number of records.

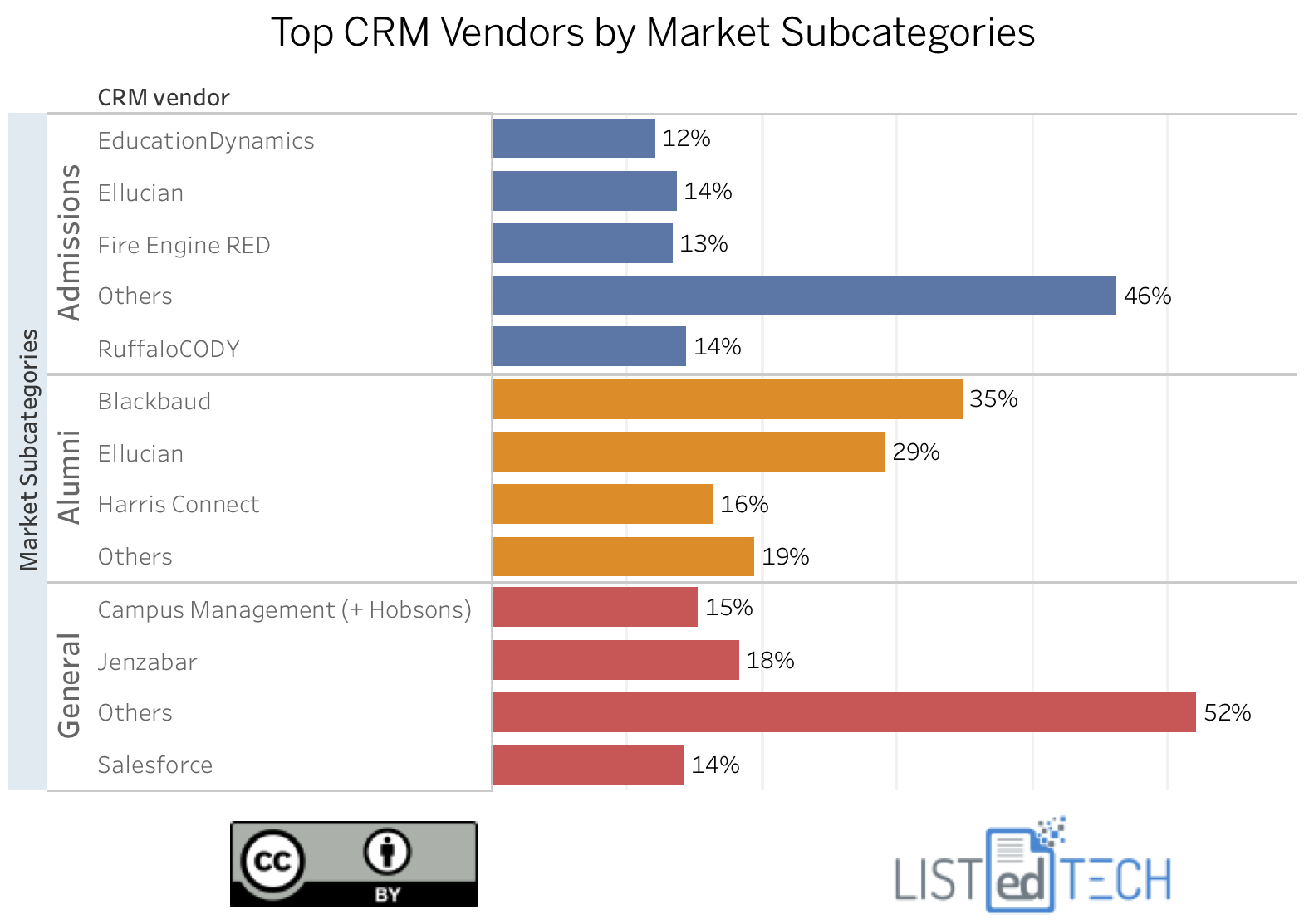

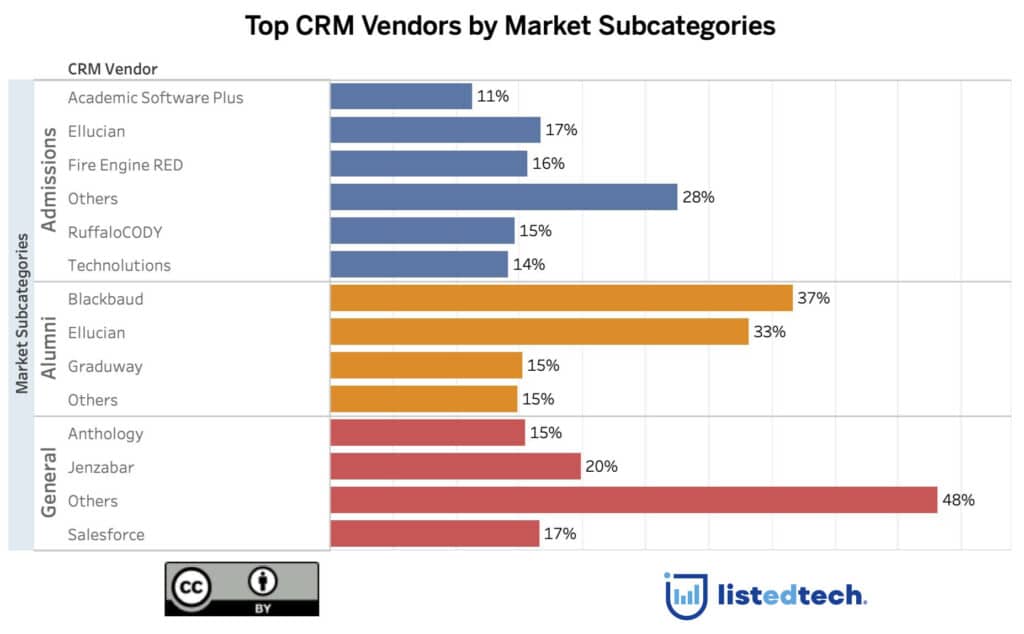

In April 2019, when Salesforce announced the acquisition of Salesforces.org and then the creation of a new education vertical, the education market was no longer an after-thought for one of the biggest CRM vendors. The education world being a complex one, we need to segment this CRM market share into three major groups:

Admission/Recruitment

Advancement/Fundraising

General

For simplicity’s sake, we only show market adoption for North America based on the CRM vendors (not the different CRM products). Only the vendors with over 10% CRM market share appear in the graph below.

The Top CRM Vendors graph shows an interesting point of information: the only market subcategory led by Vendors and not the Others group is the Alumni subcategory. My assumption is that in this category we have older players like Blackbaud, that is almost 40 years old, and Ellucian who has a lion share of the ERP market. We also have fewer players offering services in this segment.

Contrary to other product categories, the CRM market share keeps a strong Others grouping over the past decade. We often see acquisitions in this product category but since each smaller player represents only a few percentage points, the acquisitions do not lead to a monopoly.

Send me an email if you are interested in getting our CRM subscription.