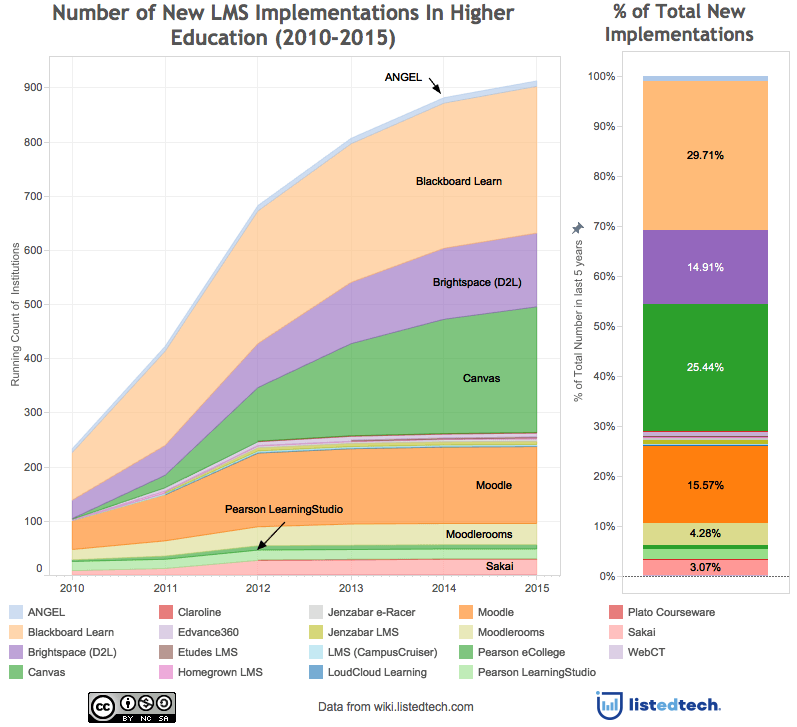

As I discussed in my last post (LMS Market Share – LMS Trends), the Canvas Learning Management System (LMS) is the fastest growing LMS in Higher Education. Its market share is increasing considerably and is currently getting over 25% of new implementations. It’s an impressive feat considering that it has only been in the LMS HigherEd market for less than 5 years. The ListEdTech wiki currently lists almost 400 colleges and universities that are using Canvas. Of those, 376 are currently using this system as their main LMS and are Canadian or USA institutions.

The Canvas Learning Management System is growing at whose expense?

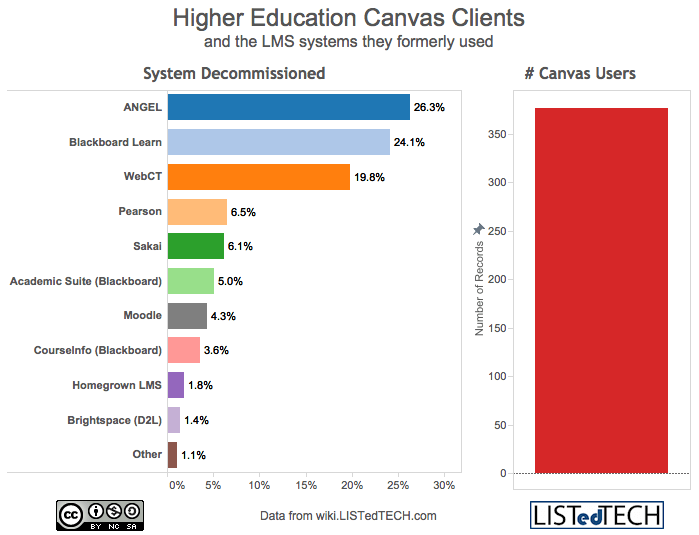

As you can see in the graph below, Blackboard is the one taking the majority of the hit. If you combine all its LMS products (ANGEL – 26%, Learn – 24%, WebCT – 20%, Academic Suite (BB) – 5%, CourseInfo (BB) – 4%), it represents almost 80% of the decommissioned systems that have been replaced by Canvas. The other non-Blackboard LMS system that are being replaced by Canvas are Pearson – 6%, Sakai – 6%, Moodle – 4%, Homegrown – 1% and Brightspace (D2L) – 1%.

What institution profile distinguishes a Canvas college or university?

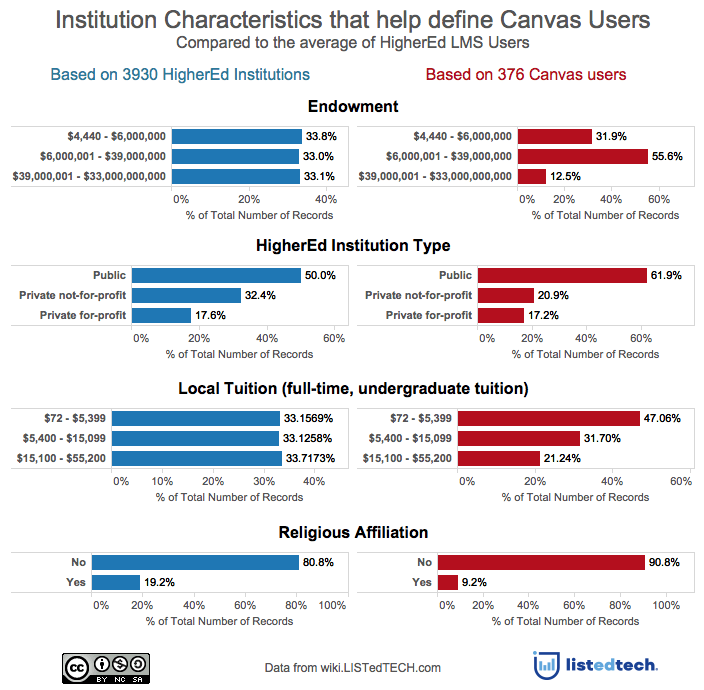

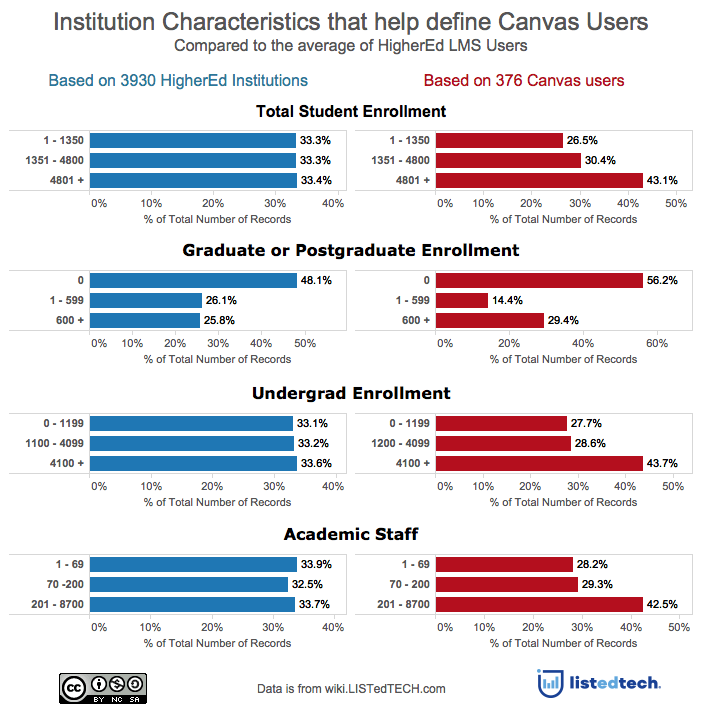

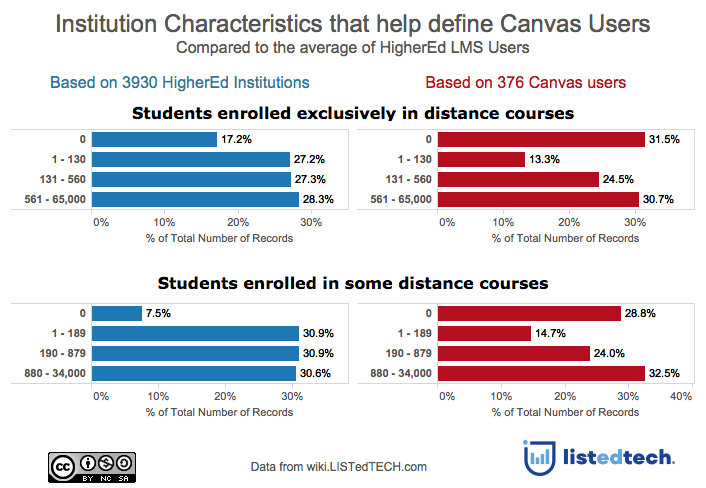

To compare or find the distinguishing characteristics of a Canvas client in HigherEd, we have created a baseline by looking at the 3,930 colleges and universities in our wiki.ListEdTech.com that are using a LMS and are American or Canadian. This group of users also includes the 376 Canvas users. The graphs below show 14 different characteristics of the institutions:

- Country

- Degree type

- Average ranking (based on 8 World rankings)

- Endowment

- HigherEd institution type

- Local tuition (full-time, undergraduate tuition)

- Religious affiliation

- Total student enrollment

- Graduate or postgraduate enrollment

- Undergraduate enrollment

- Academic staff

- Students enrolled exclusively in distance courses

- Students enrolled in some distance courses

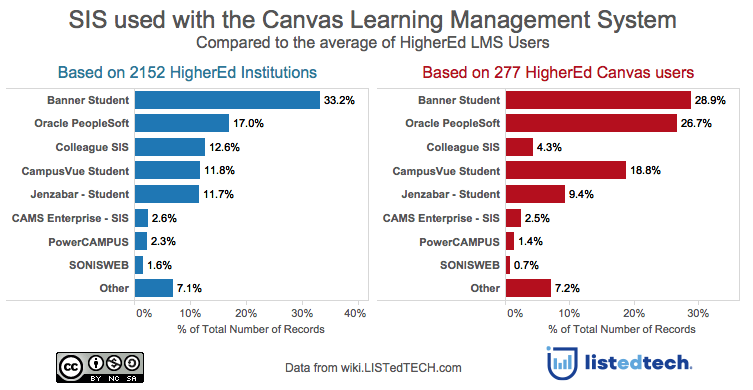

- Student information systems

On the left side, you will find the baseline created by the 3,930 institutions. When possible, we have grouped the number of institutions in 3 almost equal groups to better compare the data.

In the first graph you can see that a college or university country, degree type and rankings tell us nothing. They have the same profile as the other LMS users.

In the second graph, you will see that the Canvas Learning Management system users are however:

- more likely to be public institutions and half as likely to be private not-for-profit institutions;

- more likely to have lower tuition fees (full-time, undergraduate tuition);

- half as likely to have high endowments, but more likely to have average size endowments;

- also less likely to have religious affiliations.

In the third graph we compare institution size attributes. A Canvas LMS user:

- is more likely to have a higher student enrollment vs a smaller one;

- has a better chance of having no graduate enrollment;

- has a high number of undergraduate students;

- will have a higher number of academic staff.

In the 4th graph, we look at distance education enrollment. This shows us that Canvas LMS institutions:

- have a distance enrollment (students that are exclusively registered online) that is more likely to be nil;

- have a number of students that are registered in some distance courses that is also more likely to be nil.

In the 5th and last graph, we look at student information systems that are in use at colleges and universities using the Canvas LMS. As you can see, they are more inclined to:

- use Peoplesoft and CampusVue student information systems;

- use less the Colleague SIS.

Key findings of Canvas Learning Management System clients show that they are:

- more likely to be public institutions;

- to have lower tuition fees;

- half as likely to have high endowments;

- more likely to have a high number of enrolled students;

- having less distance enrollments (students that are registered exclusively or partially to online classes). Can anyone say blended learning?