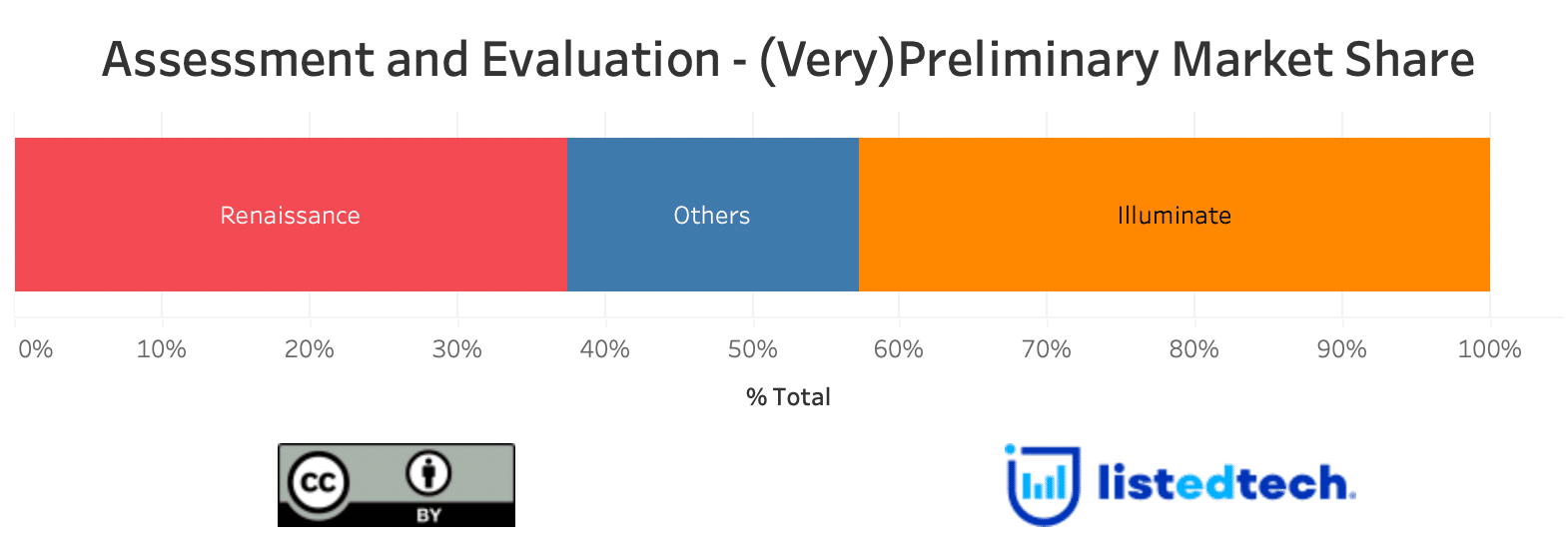

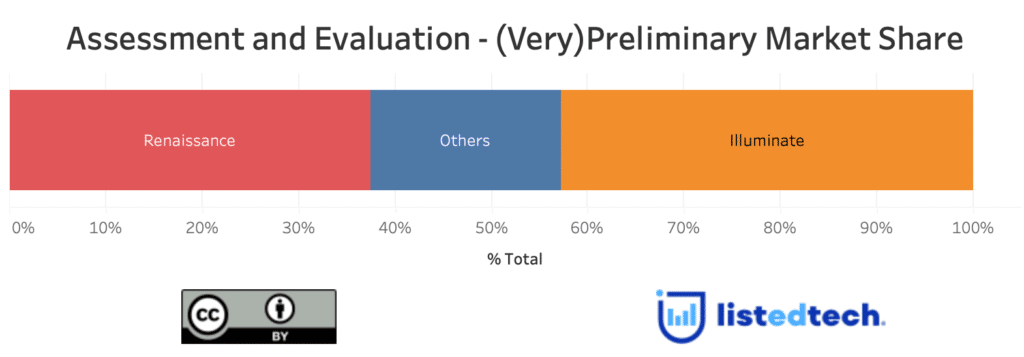

NOTE: Our “assessments and evaluations” product group is still in development. The data referencing this should be considered preliminary.

With the end of the summer came another acquisition: Renaissance acquired Illuminate Education on August 24, 2022. Now merging, these two K-12-centric companies will accentuate their leading presence in the assessments and evaluations product category. Let’s have a look at these two players.

Illuminate Education

Since its inception in 2009, Illuminate Education has had one objective: to collaborate with teachers and school districts to enhance student performance through a holistic approach and adaptative learning tools. As per its mission, this company focuses on K-12. Its website mentions that it offers its solutions to more than 17 million students across 5,200 schools and school districts in 50 states. Over the years, Illuminate has united with companies to support its purpose. The big merger happened in July 2018 when Illuminate bought Alpine Achievement, IO Education, SchoolCity and Key Data Systems.

At the time of the merger, Illuminate Education, through its PE owner Insight Venture Partners, described what each company brings to the table:

- Illuminate Education’s core offerings help educators capture and visualize a wide array of data on attendance, academics, behavior, demographics and special needs;

- IO Education offers data integration, analytical tools, assessment services;

- SchoolCity specializes in creating assessment tools for K-12 students;

- Alpine Achievement offers tools that integrate and visualize student data;

- Key Data Systems helps schools and districts capture and take action on student achievement data.

It was pretty much all about data. One year later, FastBridge, “a research-driven assessment platform that transforms the way teachers measure and monitor student progress,” was absorbed by Illuminate.

In our ListEdTech database, we track four products under Illuminate: two SIS (eSchoolData and Illuminate Student Information), one BI (EduCLIMBER) and one Assessment & Evaluation. The company’s website breaks down the assessment offering into four products: FastBridge, DnA, Content and SchoolCity. Like many other companies in edtech, Illuminate packages its offering under one umbrella product: the MTSS (multi-tiered system of support) management solution.

Renaissance Learning

Renaissance Learning has a much longer history, as its creation dates back to 1986. At first, it was a tool (Accelerated Reader) designed to incite children to read more books. Thirty-five years later, this company is now considered one of the leaders in education technology for the K-12 submarket. The company claims that “more than 40 percent of US schools rely on Renaissance solutions for data and insights to equitably move learning forward.” In the ListEdTech database, we currently track two products: Schoolzilla (Business intelligence) and Renaissance Star 360 (Assessment and evaluation).

Renaissance has grown thanks to several acquisitions. Here are some acquisition milestones (most recent at top):

| Date | Name of the acquiree | Product Groups and Notable Products | Notes |

| August 24, 2022 | Illuminate Education | Assessments and Evaluation; SIS; BI | |

| March 28, 2022 | KeyPhonics | Early literacy assessment data (phonics-based reading instruction) | |

| March 22, 2021 | Lalilo | Early literacy skills targeted to the specific needs of each learner. | |

| February 19, 2021 | Nearpod | Educational materials for K-12; Flocabulary | Acquired for $650M |

| October 29, 2019 | Schoolzilla | Business Intelligence | |

| May 20, 2019 | Freckle Education | Adaptive learning tool to help children learn mathematics | |

| April 8, 2019 | Early Learning Labs | Curriculum-based assessment and early learning tools | |

| March 19, 2018 | myON | Student-centred, personalized digital library | |

| February 19, 2015 | UClass | Cloud-based storage and content management service | |

| July 1, 2013 | Subtext | E-reading platform | |

| 2005 | AlphaSmart | Advanced keyboards for the classroom | Production discontinued in 2013 |

Similarities and Differences Between Renaissance and Illuminate

The two companies aim to serve the K-12 submarket, emphasizing the assessment and evaluation product category. Before the acquisition, Illuminate had an outreach of 17M users (students) in 5,200 school districts. Renaissance, thanks to its Accelerated Reader and Star Assessments software, is known by more than 35,000 users in over 60 countries. Our preliminary data show that Renaissance and Illuminate are neck and neck in North America. Merged, they represent the leader in this product category.

Our database still does not include K-12 data on the international market. When we compare both companies, the reach outside of the US is almost inexistent for Illuminate, while Renaissance has clients and employees outside the American continent due to acquisitions (Lalilo, for instance) and growth.

Because of its history of acquisitions, the only question that remains is: what will be the next target for Renaissance?