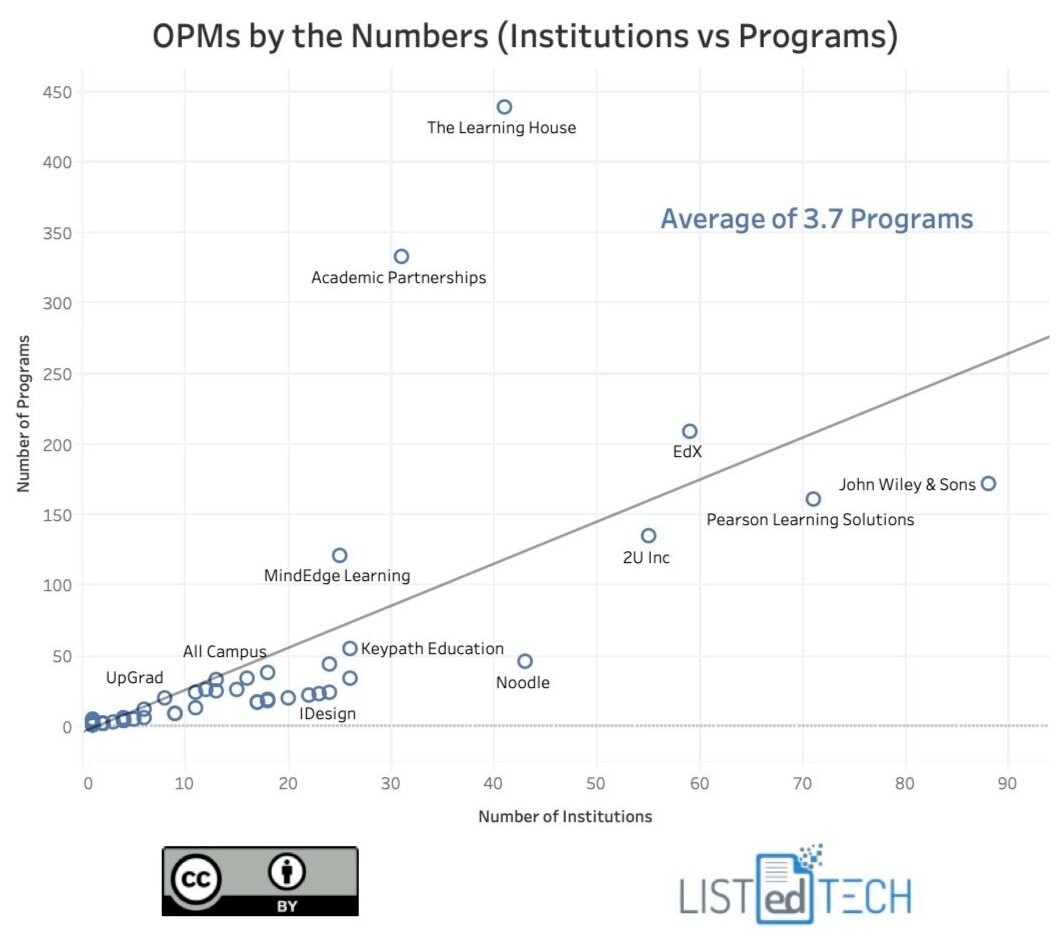

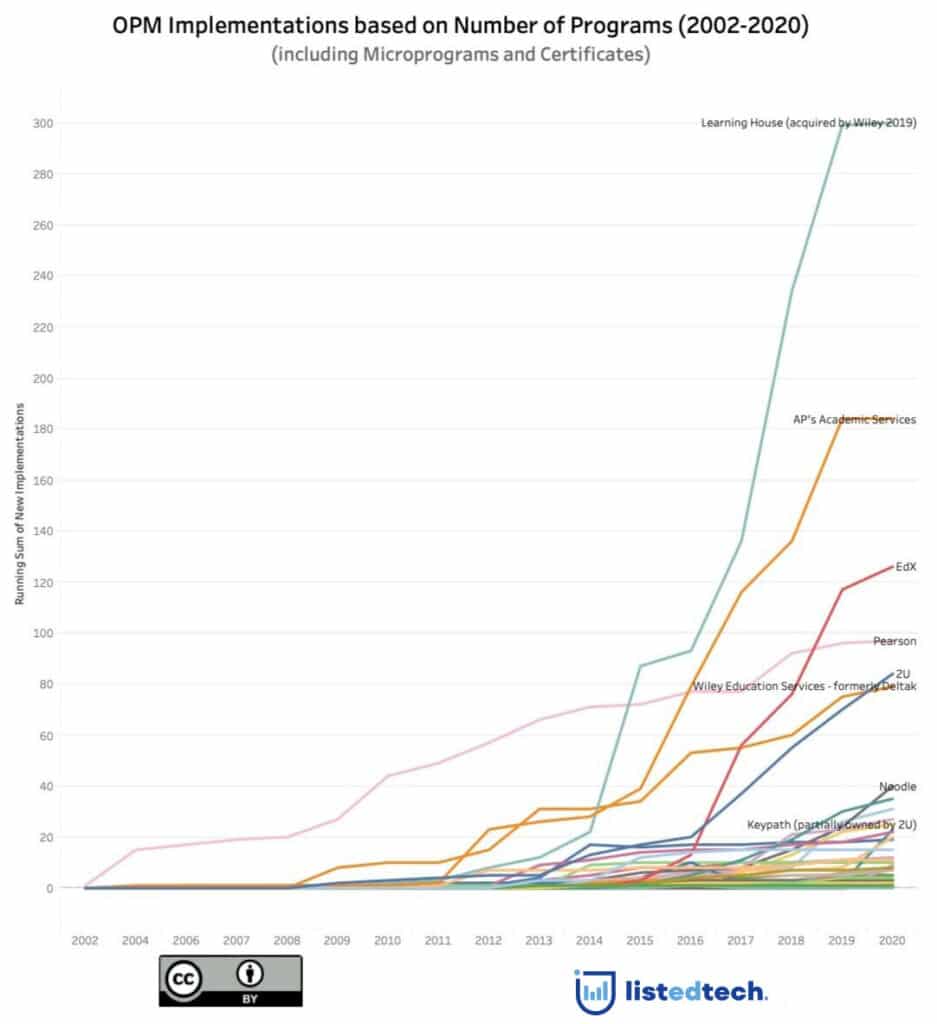

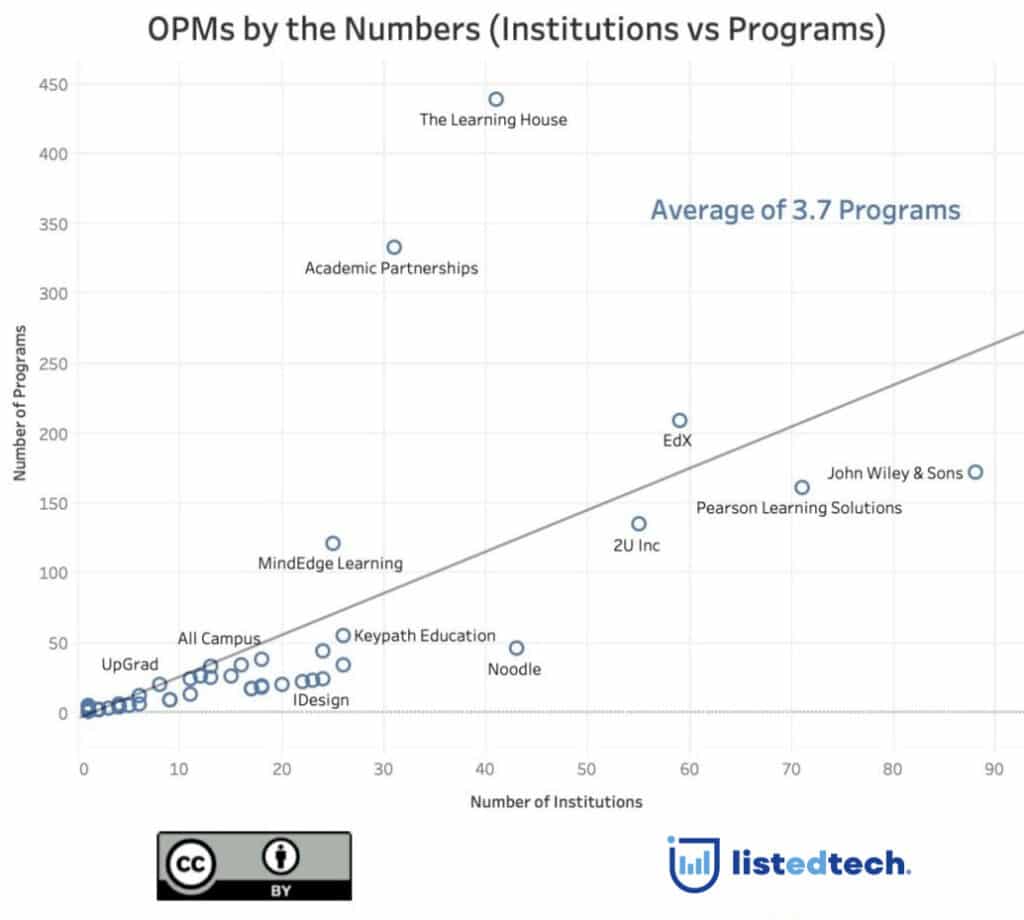

Note to add emphasis: The data below is looking at all types of programs: microprograms, certificates, and full programs like bachelors, master, and Ph.D.

While several things seems to have been put on hold in 2020, the Online Program Management Systems (OPMs) have not been. Last week (November 18, 2020), Joshua Kim, Director of Online Programs and Strategy at the Dartmouth Center for the Advancement of Learning, published a blog post on his read-through highlights of the 2U Transparency Report (published on the same day). We believe it’s a good time to look into some of our data and update our graphs on OPM Systems.

As you can see from the graph, this product category has changed drastically since 2002. Led by a few companies until 2010, it saw an explosion of new players since 2014. The OPM market is a very diverse one (as most of the players have 50 product implementations or less) but also a fairly young one (as several of the companies were established in the past five years). The main companies in this product category are The Learning House, Academic Partnerships, EdX, Pearson, and 2U. These five competitors retain more than 60% of the whole OPM market. Outside the data analytics, we can mention that this product category saw some acquisitions in the past two years:

The Learning House (the biggest player) was acquired by Wiley Education Services (2018)

Looking at the graph above, The Learning House and Academic Partnerships have both an average of more than 10 programs per implementation and placed themselves on the peripheries of the 3.7 program per implementation trend line. If we look at those under the trend line, we see John Wiley (just under 2), Pearson (just over 2), 2U (about 2.5), and Noodle (just over 1). Even if they are below the trend line, three out of the four have contracts with more than 50 institutions (John Wiley having nearly 90).

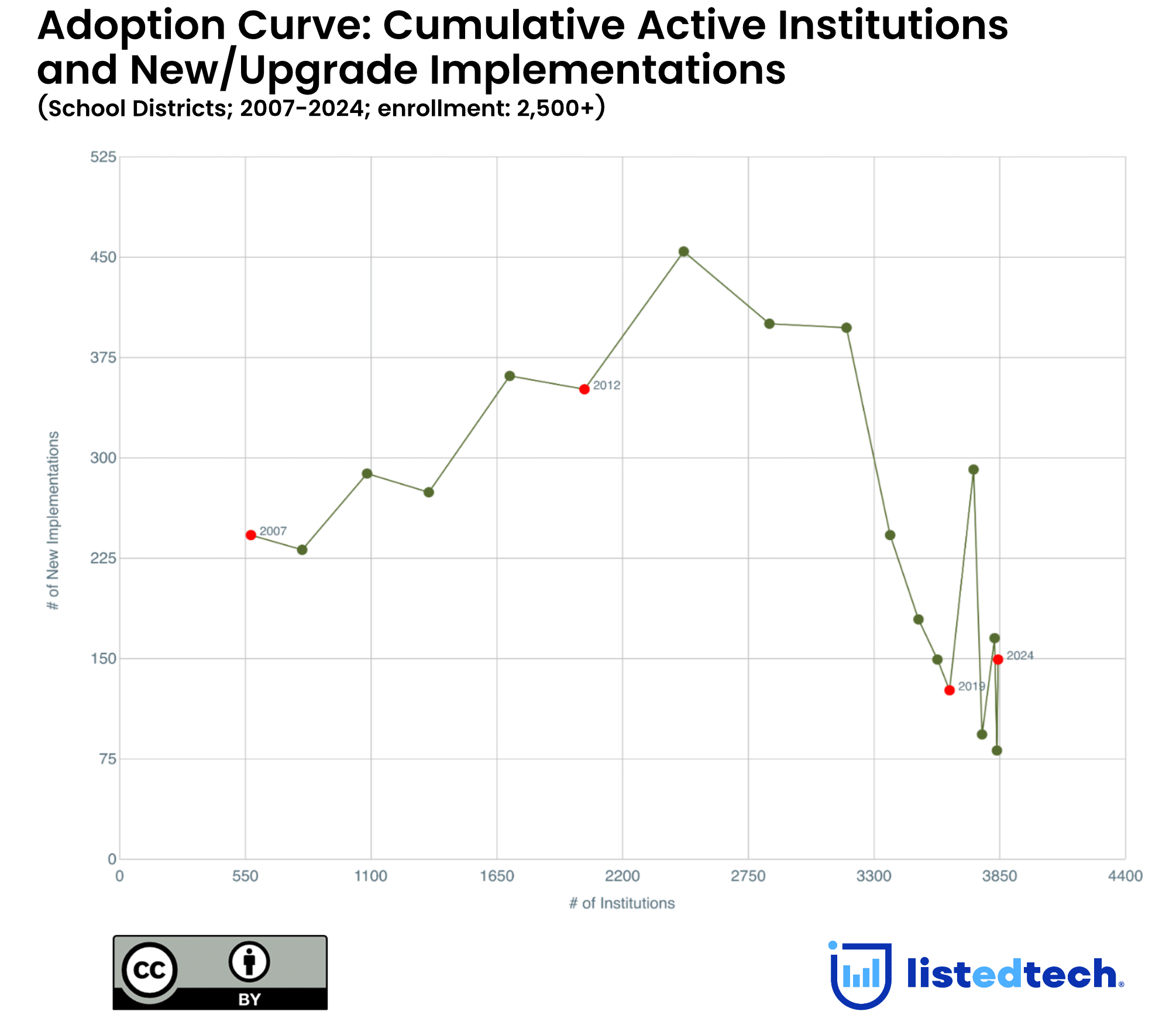

This New Clients graph shows the number of new clients signed every year. It is important to note that if an institution signed a contract with an OPM company in 2010, any new future programs with the same company will not count as we only count first-time clients for whom we have implementation dates. As mentioned before, this clearly shows the increasing number of HigherEd institutions signing up with OPM companies, especially since 2015.

As the pandemic continues, more people choose to study online either for a few courses or for an entire program. It will be interesting to follow the group of smaller players to see what they become: stronger with more clients, being bought by larger competitors, or simply vanishing with time. One thing is certain, OPMs are there to stay.

Note: The data is for all countries in our database. Some of the graphs are based on the implementation dates for about 70% of the over 2,300 listed OPMs in this category.