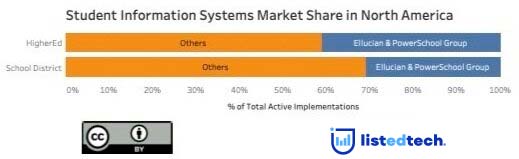

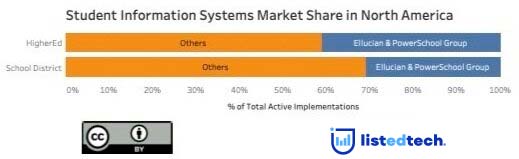

In 2019, we mentioned in our newsletter that TPG Capital and Leonard Green were getting ready to sell Ellucian in a potential $5 billion-plus sale. After 18 months, on June 14, Blackstone and Vista Equity announced that they would soon acquire this major player in the higher education ERP industry. With this acquisition, Vista Equity will become the leader of the SIS market, thanks to its full ownership of PowerSchool and partial ownership of Ellucian.

Historical Evolution of Ellucian

Ellucian’s history dates back to the 1960s when Datatel was created but it has been linked to higher education since the mid 1970s via its Colleague products. It’s been an important player in this industry and controlled nearly 60% of the entire North American market in 2000. Since the new millenium, the Datatel/SunGard Higher Education market share has declined (2000-2014) but has somewhat stabilized its shares since 2015 when it was acquired by TPG Capital and Leonard Green & Partners, L.P. (its current owners).

Investing in Education Technology

For Vista Equity, it seems that 2021 is the year to increase its investments in education. Through its companies PowerSchool and EAB, it bought Hobsons (career readiness and student success solutions) back in February. Now controlling about 40% of student success market shares, it is aligned to be as dominant in the SIS market with PowerSchool (K-12) and Ellucian (HigherEd).

The Future of Ellucian

The question remains: will this acquisition be the spark for Ellucian? Will it see growth in the near future? Since 2015, PowerSchool has become THE player in the K-12 North American market. It acquired complementary systems like Schoology, Haiku Learning, SunGard K-12 and Hoonuit to try and offer its customers the all-in-one solution when it comes to the student management life cycle. Is it Vista Equity’s goal to replicate PowerSchool’s domination in the HigherEd sphere?