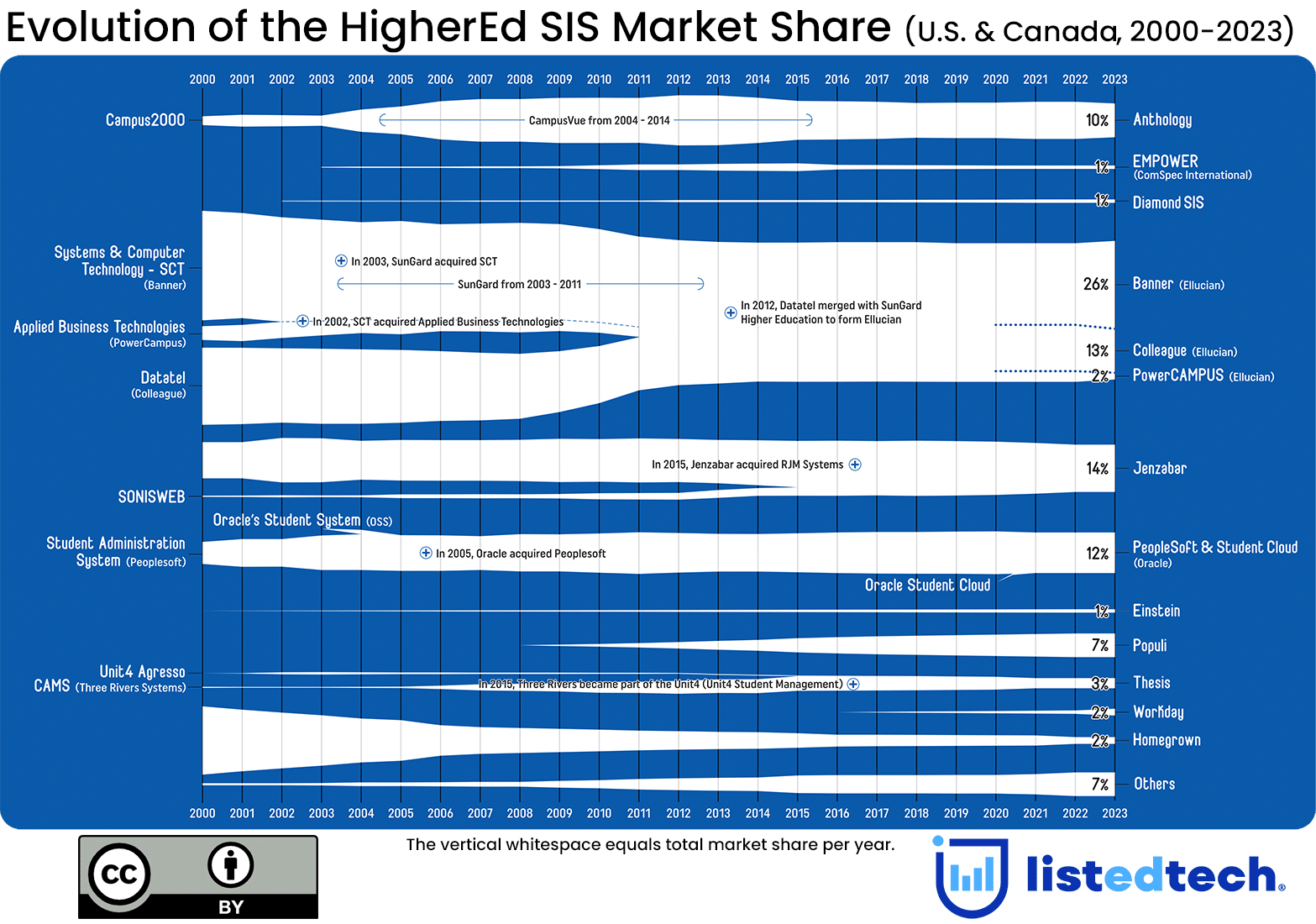

It’s the time of year when we present our update on the evolution of the SIS market share for the U.S. and Canada. Since the pandemic hit, the HigherEd SIS market share has remained stable. However, we would like to give you additional information on specific data.

Over the years, we have amassed data on more than 4,750 North American institutions to create this graph. Our team has added new product implementations to over 250 North American HigherEd institutions for this year alone.

When looking at the graph, we notice that the HigherEd SIS market is well-balanced between market leaders and smaller players. The four SIS vendors with the most significant market share represent almost 80%. The overall market hasn’t seen important changes between 2022 and 2023. After two years of decline, Jenzabar has stabilized its market share at 14%. Implemented in smaller institutions, Populi has seen a slowdown in its expansion over the past few years and has stabilized its market share at 7%. After we performed some revisions in our numbers last year, Workday has seen a slight increase and is now at 2%.

We have to remind our readers that we have modified Workday’s market share in 2022 because Workday has signed several contracts indicating an SIS implementation. Still, these implementations were never finalized. Due to various difficulties, institutions have backed off, paused the implementation, or selected another solution. We have discussed this situation in a previous blog post.

Ellucian has the same overall market share, but we can see that the Banner product is increasing while Colleague and PowerCampus are slowly decreasing. Anthology is another company that has reduced its North American market share since 2022. On the other hand, we have noticed an expansion in the international market for its Anthology Student.

Download a PDF version of the previous evolution graphs:

- Evolution of the HigherEd SIS Market Share, 2000-2022

- Evolution of the HigherEd SIS Market Share, 2000-2021

- Evolution of the HigherEd SIS Market Share, 2000-2020

Populi looks to be a preferred choice for smaller institutions (it has about 10% in the smallest enrollment category (1-2,499)). Although it continues to earn market shares globally, it doesn’t make significant gains in bigger enrollment bands.

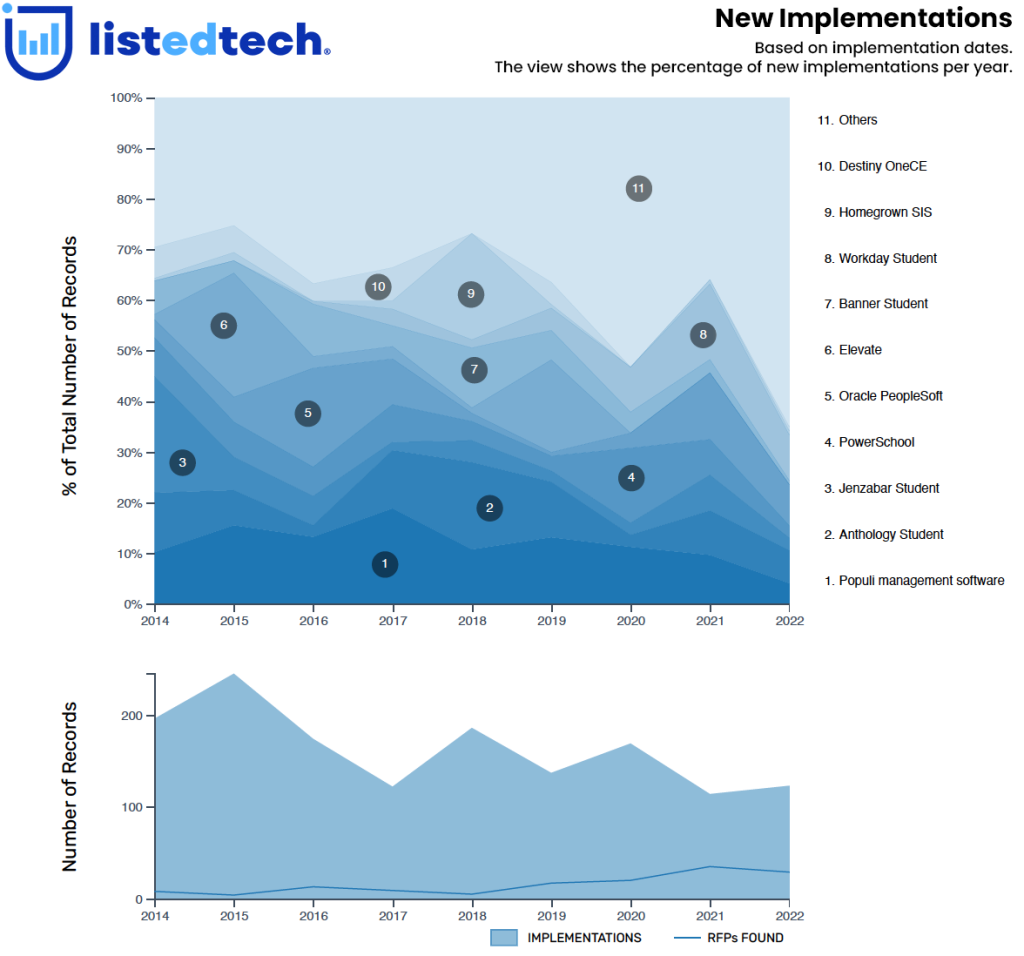

New SIS Implementations Expected to Resume Soon

In previous posts, we mentioned that institutions were waiting on commitments from SIS companies to select a new solution. We expect market shares to change over the next five years as revised offerings become available. Schools would also move from the reflection stage to active RFPs and procurements.

Since 2018, we have seen a downward trend in new implementations (this excludes upgrades) for the HigherEd SIS submarket. Nonetheless, based on our predictions, we might see more implementations in the next two to three years. We believe that the few homegrown systems that are still active will continue to be slowly decommissioned to one of the hosted solutions. This solution switch is to avoid the maintenance cost of an internal system.

With the pandemic came the urge to implement several solutions to support online learning and evaluation. When updated SIS products hit the market, many schools assumed they would quickly move to their new SIS systems. But, similar to other business sectors, qualified implementation consultants were and are in high demand. Now that most pandemic-oriented implementations are behind us, we should soon see a return to normalcy in SIS implementations.