Student retention, sometimes referred to as persistence or student success, was historically linked to student satisfaction. In the previous century, we used to say that if students were happy about their programs, their courses, and their college social life, they would stay in school until graduation. We now know that this formula is not as simple.

November 2021 Update

We first published this article in October 2020. Since this publication, the retention product category saw several mergers and acquisitions. At the end of October 2021, Anthology completed a merger with Blackboard, creating the most comprehensive and modern Edtech ecosystem. Both companies already offered retention systems among other solutions like e-learning systems and portals.

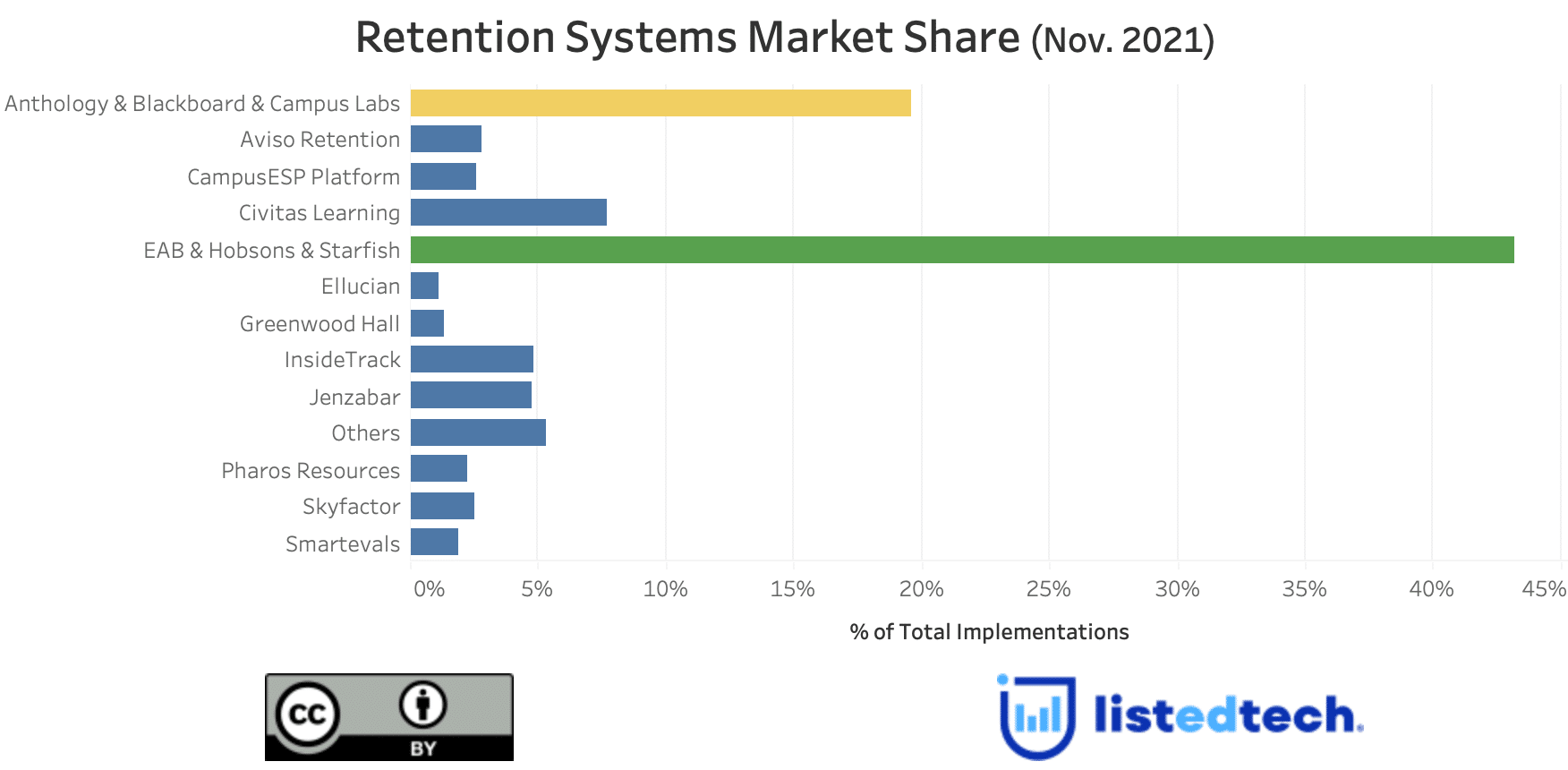

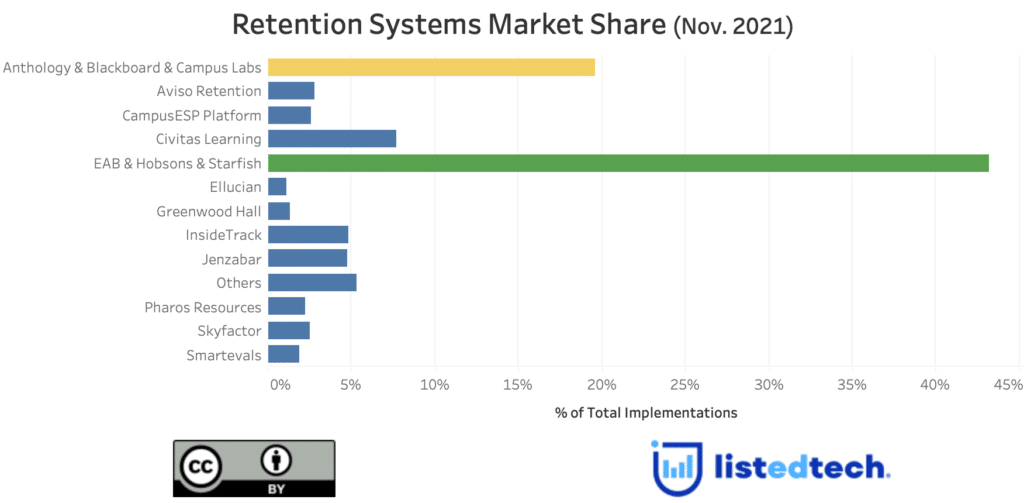

Another important transaction that impacted the retention product category is the distribution of Hobsons’ products between PowerSchool and EAB. With this transaction, EAB gained Hobsons Starfish. Before the acquisition, EAB represented roughly 15% of the market share and Starfish just under 25%. As of February 2021, EAB controls 40% of the market share in the retention category and is now the market leader.

Also, in January 2021, RNL purchased Helix Education and its predictive retention technology. RNL’s objective was “to improve every aspect of the adult student lifecycle […] through an end-to-end marketing, enrollment, and retention technology platform.”

In addition to these changes in the retention industry, we have added 575 product lines in the student retention category. We are thrilled to present you with an update on this post.

Vince Tinto, a distinguished professor at Syracuse University, studied student retention for most of his career. Thanks to his research, we can define more precisely some conditions that will help students graduate: expectation, advice, support, involvement, and learning. To keep track of students’ risk of dropout or success, institutions often support their in-person strategies with computer systems.

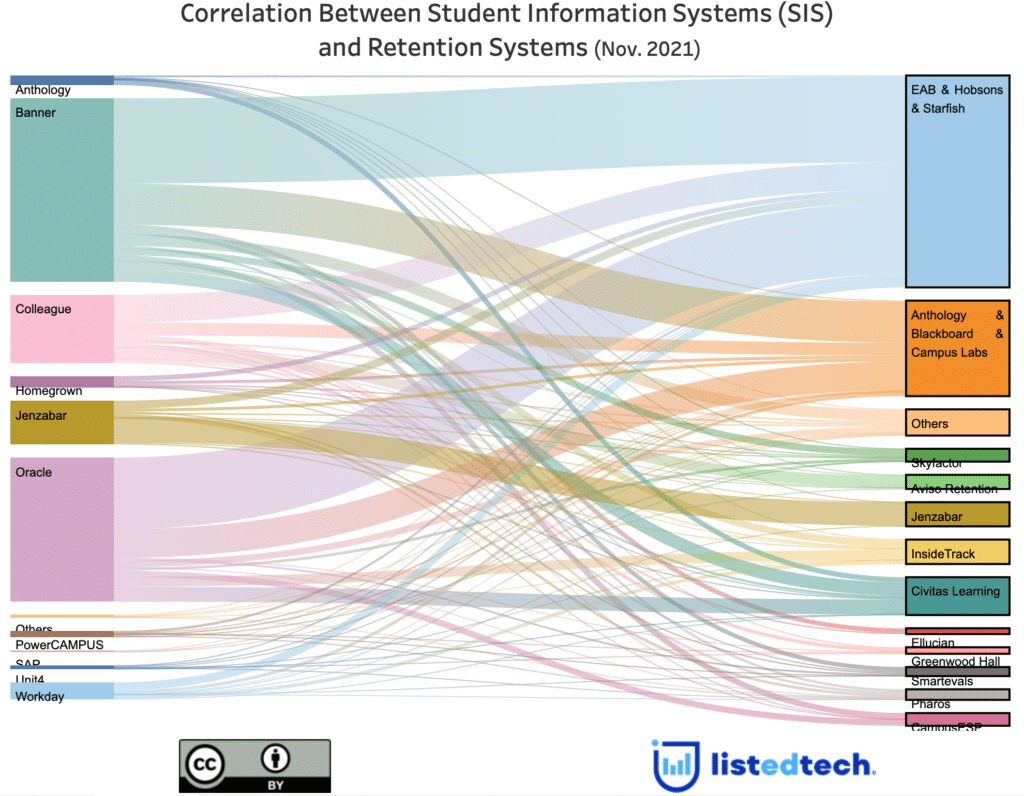

We wanted to explore several aspects of the retention systems. In the first graph below, where we show the correlation between retention and SIS systems, we don’t see direct relations between products. In fact, we observe that the spider web goes in all directions. Even in the case that a company offers both retention and SIS systems like Jenzabar, it still has connections to other companies in both product categories.

Solution Distribution by Enrollment Size

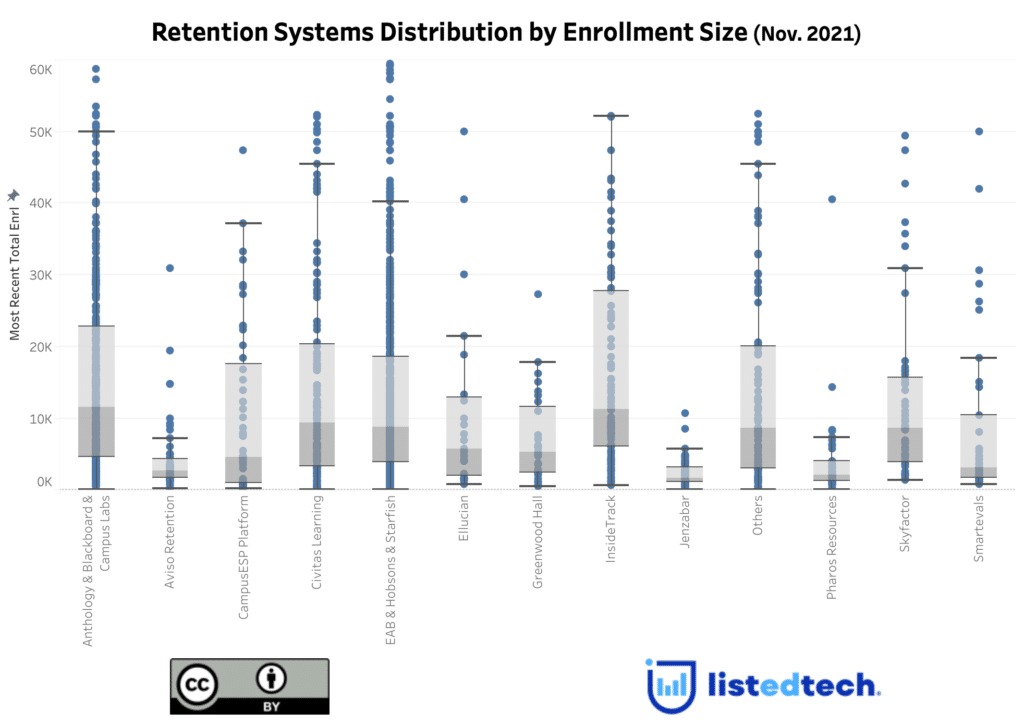

Another interesting graph to look at is the retention products used by enrollment size. We have created a box plot graph to illustrate this product category. We encourage you to consult this article if you don’t know how to read a box plot.

We can appreciate that the mergers created a broader audience for the newly formed companies. Anthology (CampusLabs and Blackboard) is now represented in smaller institutions. EAB follows the same pattern as Anthology although it is usually implemented in smaller universities and colleges. The two merged companies are now represented in all enrollment sizes.

In addition to Anthology and EAB, other solutions have implementations in larger establishments. Civitas Learning and InsideTrack are often implemented on campuses between 18,000 and 28,000 students. For the whole product category, some solutions are only implemented in smaller colleges and universities. Watermark Insights (previously Aviso Retention), Pharos Resources, and Jenzabar are usually not present in institutions that have more than 5,000 students.

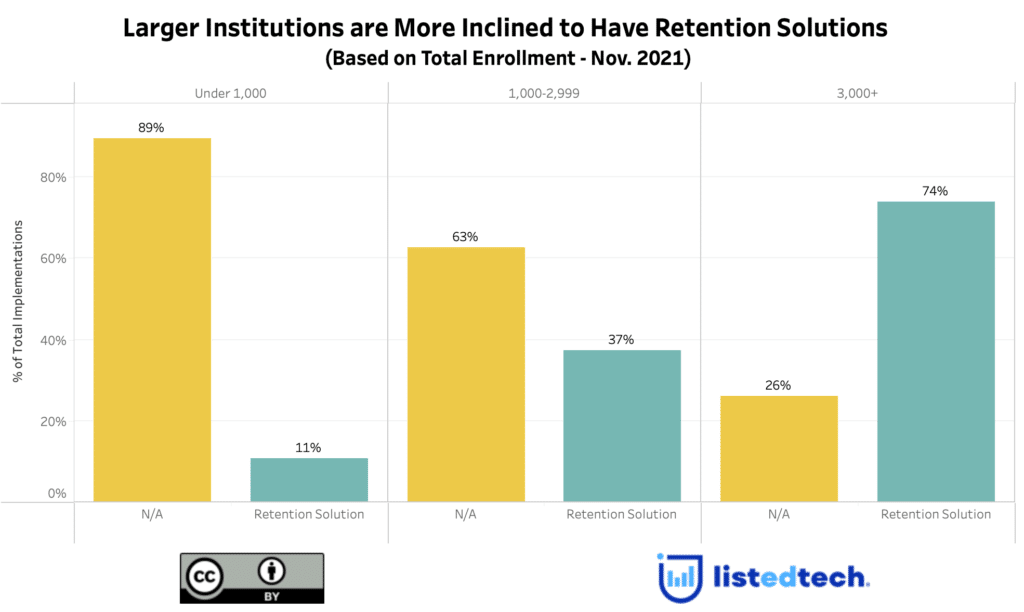

When we break down the use of retention systems by enrollment size, we notice that the bigger they get, the most likely institutions are to use retention systems. The reason is fairly easy to explain: when students are in smaller institutions, they are often in smaller classrooms and have more direct contact with professors and support staff. Therefore, if a student struggles with a course, an in-person support system will be put in place quickly. However, when professors teach a few hundred instead of a few dozens, it’s more likely that they won’t have time or the capacity to reach out individually to the struggling students.

Since last year, we noticed an increase in implementations of student retention systems in all enrollment size institutions. This could be explained by the fact that with distance education, it is more difficult to track students in difficulty or that student retention becomes more important to the administration of institutions. The biggest increase is in larger institutions (+21% in one year).

The student retention category has seen a lot of movement since October 2020. This resulted in the creation of an oligopolistic situation: EAB has more than 40% of the market shares and Anthology has just under 20%. The closest competition (Citvitas Learning) does not pass the 10% mark and the other solutions are all under 5%. Unless we see more mergers and acquisitions, we can expect little change in this product category.

Are you interested in getting more information about retention systems subscription or data downloads? Send us an email.