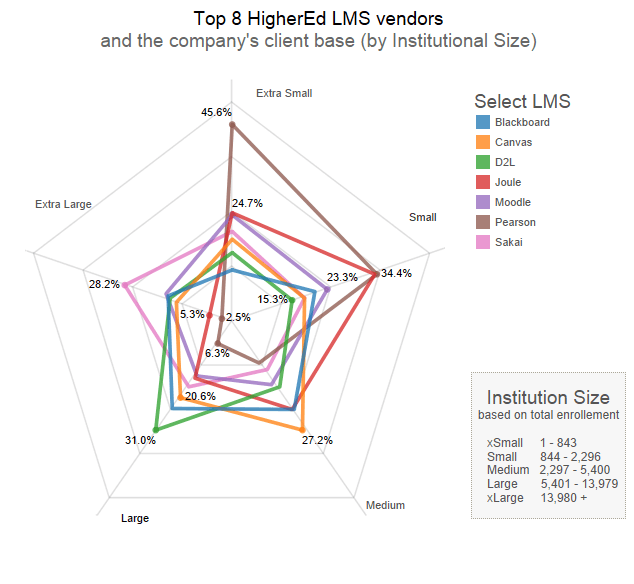

We’ve previously looked at how the LMS market evolved over time (here and here), providing insights into which vendor will dominate in the near future. But what is the current state of the market? Who are the LMS vendors’ clients? In this post, we want to look at the LMS vendors’ client base to see if the enrolment size of institutions can give us a better understanding of the company. For example, in which segments does Blackboard have more clients? Small, large or extra large institutions? Do some vendors have a majority of extra small and small higherEd clients?

Let’s have a look at the top 8 higher education vendors and how their client base is segmented based on institution’s total enrolment size.

A few worthwhile observations…

Blackboard client base is pretty equally dispersed in all sizes of university and colleges, although it does have a bigger % of larger-sized institutions.

Canvas’ clients are more medium size institutions.

The Pearson LMS is a good example of a LMS that has a client base dominated by a very specific segment of the market, in this case smaller-sized institutions.

D2L’s client base leans towards the large institutions

Joule and, at a lesser extent, Moodle both have a high percentage of smaller institutions as clients

Sakai’s clients are more apt to be extra-large institutions.

Except for Blackboard and Moodle who have a fairly well sprayed out client base across all segments, all other vendors tend to lean towards a specific market group.

A note on our approach…

We took all our active LMS present in our database and separated them in 5 equal groups based on Enrolment size. We then took the top 8 LMS (based on # users) and calculated the products overall % users specifically for that product in each of the five groups.