Key Takeaways:

- Sustainability of Growth: While post-pandemic funding surges catalyzed the initial wave of LMS adoption, the challenge now lies in keeping these systems relevant and effective as districts adapt their strategies.

- Competitive Shifts: Canvas continues to dominate larger districts, while Schoology and Classroom compete fiercely for mid-sized and smaller districts.

- Vendor Strategies: Successful providers are focusing on ease of use, interoperability, and responsive customer support.

The Learning Management System (LMS) landscape for K-12 schools in North America has undergone remarkable changes in the last few years. Driven by factors such as the pandemic and funding surges, the market has seen rapid evolution. With 9,658 LMS implementations across the United States and Canada in our database, digital learning platforms have become a cornerstone of modern education.

A Brief History of LMS Growth in K-12

The K-12 LMS market saw steady adoption within school districts until 2020, when the pandemic fundamentally reshaped the landscape. That year alone, the sector experienced a threefold increase in new implementations, most of which came from first-time LMS adopters. This surge was fueled by the US $2 trillion Congressional aid package, which earmarked funds for school districts to adopt and expand digital learning tools.

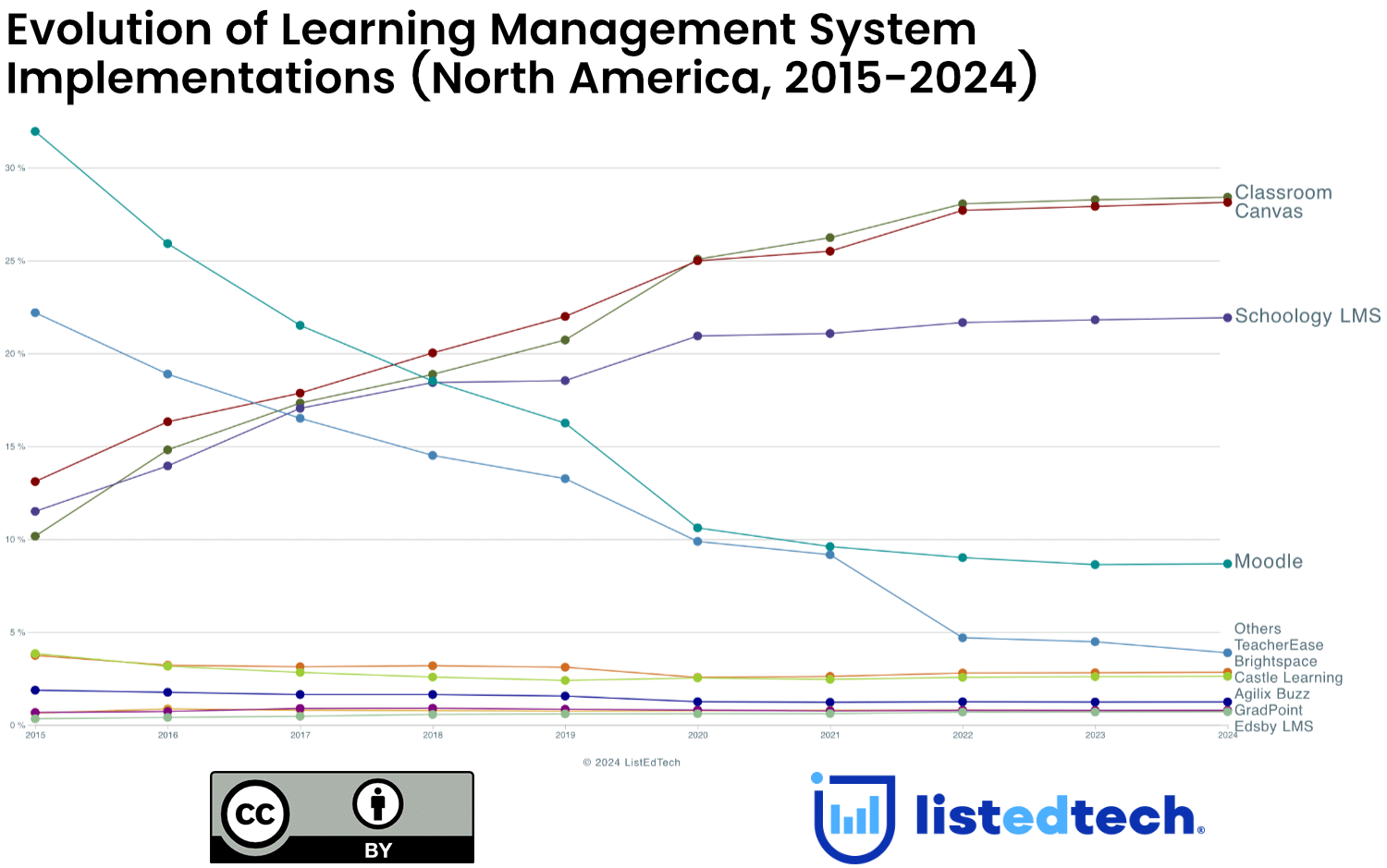

In 2019, the market share among key players was relatively even, with Classroom, Canvas, and Schoology each holding between 19% and 22%. By 2020, Canvas and Classroom surged to 25% market share each, while Schoology climbed to 21%. This increase came largely at the expense of Moodle and other smaller systems.

Current LMS Market Share by Implementation

The current breakdown of implementations reveals a dynamic and competitive marketplace:

- Classroom: 28%

- Canvas: 28%

- Schoology: 22%

These adoption rates highlight a highly competitive environment, with Canvas and Classroom steadily increasing their market share in recent years.

Market Share by Enrollment: A Different Perspective

When analyzing market share based on enrollment rather than the number of implementations, the story shifts:

- Canvas: 32%

- Schoology: 21%

- Classroom: 19%

This data underscores Canvas’s dominance in larger school districts, while Schoology and Classroom maintain strong traction in smaller and mid-sized schools.

Five-Year Trends: Who’s Winning and Why?

Over the past five years, we’ve identified clear trends among leading LMS providers:

- Canvas:

- Gains market share primarily by onboarding clients transitioning from Moodle, Schoology, and Blackboard.

- Continues to appeal to large districts, emphasizing robust features and scalability.

- Schoology:

- Captures users from systems like Moodle, PowerSchool’s legacy platforms, and Blackboard.

- Prioritizes teacher-friendly tools and seamless integration with district infrastructure.

- Classroom:

- Attracts clients seeking simplicity and integration with the broader Google ecosystem.

- Gains market share at the expense of Moodle, Schoology, and Blackboard.

What’s Next?

The K-12 LMS market in 2024 is more competitive and dynamic than ever. As schools look to future-proof their digital learning infrastructure, vendors that prioritize innovation, teacher support, and seamless integrations will lead the way.

To explore these trends further and see how they could shape the future of your institution, visit the LMS product category on our data portal.