Nothing prepared the HigherEd market for the announcement of Elsevier acquiring Interfolio on April 21st. It is indeed rare that a smaller player (#2 in this case) would purchase the leader of a product category. But when we look at the two companies, it makes total sense why Elsevier would purchase Interfolio.

Summary of the Company Profiles

Founded in 1999, Interfolio is recognized by its competitors, its clients and the HigherEd market in general as the precursor of faculty information systems. Its solutions include faculty information systems, lifecycle management, faculty search, tenure track, and faculty activity reporting. When its solutions do not revolve around faculty members, it targets their research through Researchfish. As stated on its website, “Interfolio is on a mission to empower the global academic community to fully support and understand scholars’ journeys.” Its products are used by over 700,000 active scholars in 400 HigherEd institutions from 15 countries.

Elsevier, although smaller in the faculty information system category in comparison to Interfolio, represents a larger corporation. It exists for almost 150 years and is known for publishing several scientific journals (The Lancet, Cell) as well as maintaining Scopus – a citation database to name a few products. In addition to the academic world, Elsevier is well established in healthcare. Compared to Interfolio, Elsevier is a giant with 8,600 employees and over £2.6 billion in revenue in 2019. It offers services to all steps of the publishing business: the authors, the editors, the reviewers and the librarians. Although it is 142 years old, the company seeks to offer new technologies in its portfolio like open access and webshop solutions.

An Acquisition That Reinforces The Oligopoly

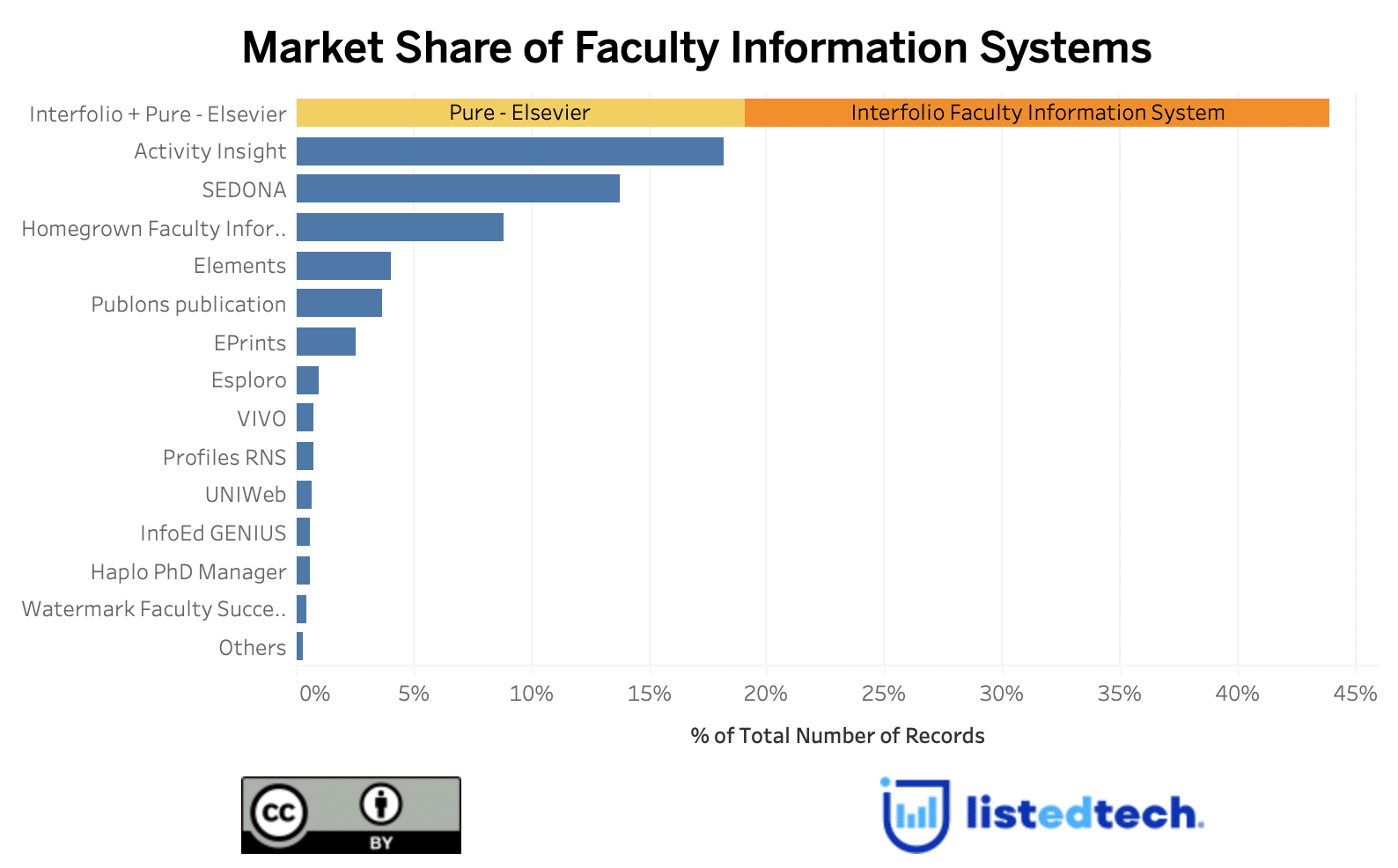

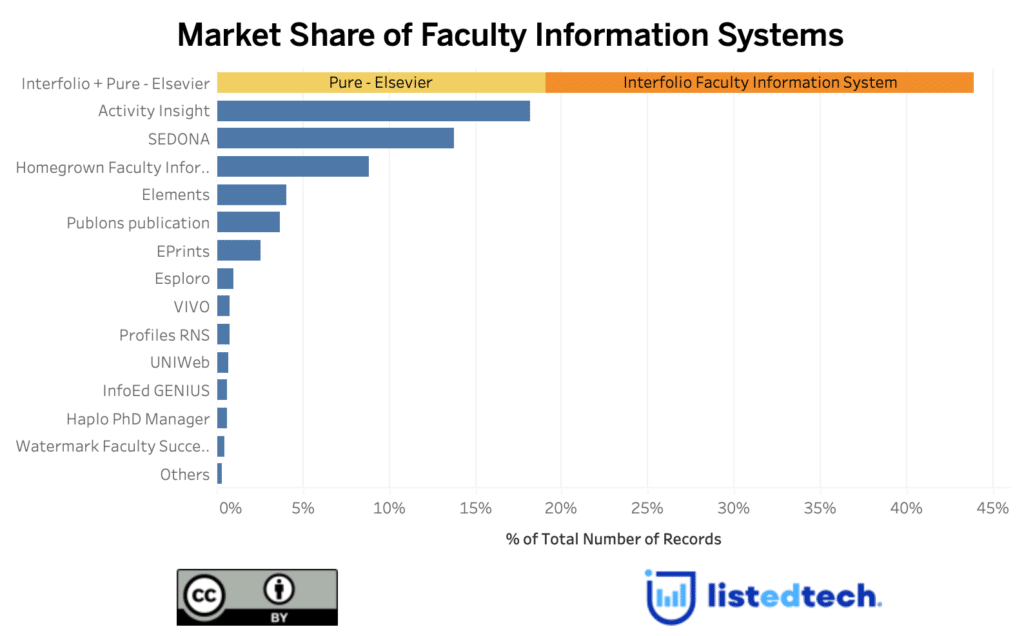

The Faculty Information System category is one of few solutions. Before the Acquisition of Interfolio by Elsevier, the product group did not offer much variety with regard to the array of available solutions. In fact, there were four solutions over 10% of market shares: Interfolio (24%), Elsevier and Activity Insight (both at 18%) and SEDONA (13%). With the acquisition, the dominant Elsevier will amass 43% of the HigherEd worldwide market share.

The acquisition, if deemed successful, will also solidify Elsevier’s enviable position in the market for portals and services targeting research offices of universities around the globe. It will ensure that its products are known and used even more by researchers and scholars. For decades, Elsevier generated revenues with textbooks and other publishing content. Since 2012, Elsevier is very active in acquisitions. It bought the reference management system Mendeley in 2013, the cloud-hosted repository software bepress in 2017, and the workflow management solution Aries Systems in 2018. These three examples show how much Elsevier, while keeping its hard-copy publishing products, wants to diversify its revenues.