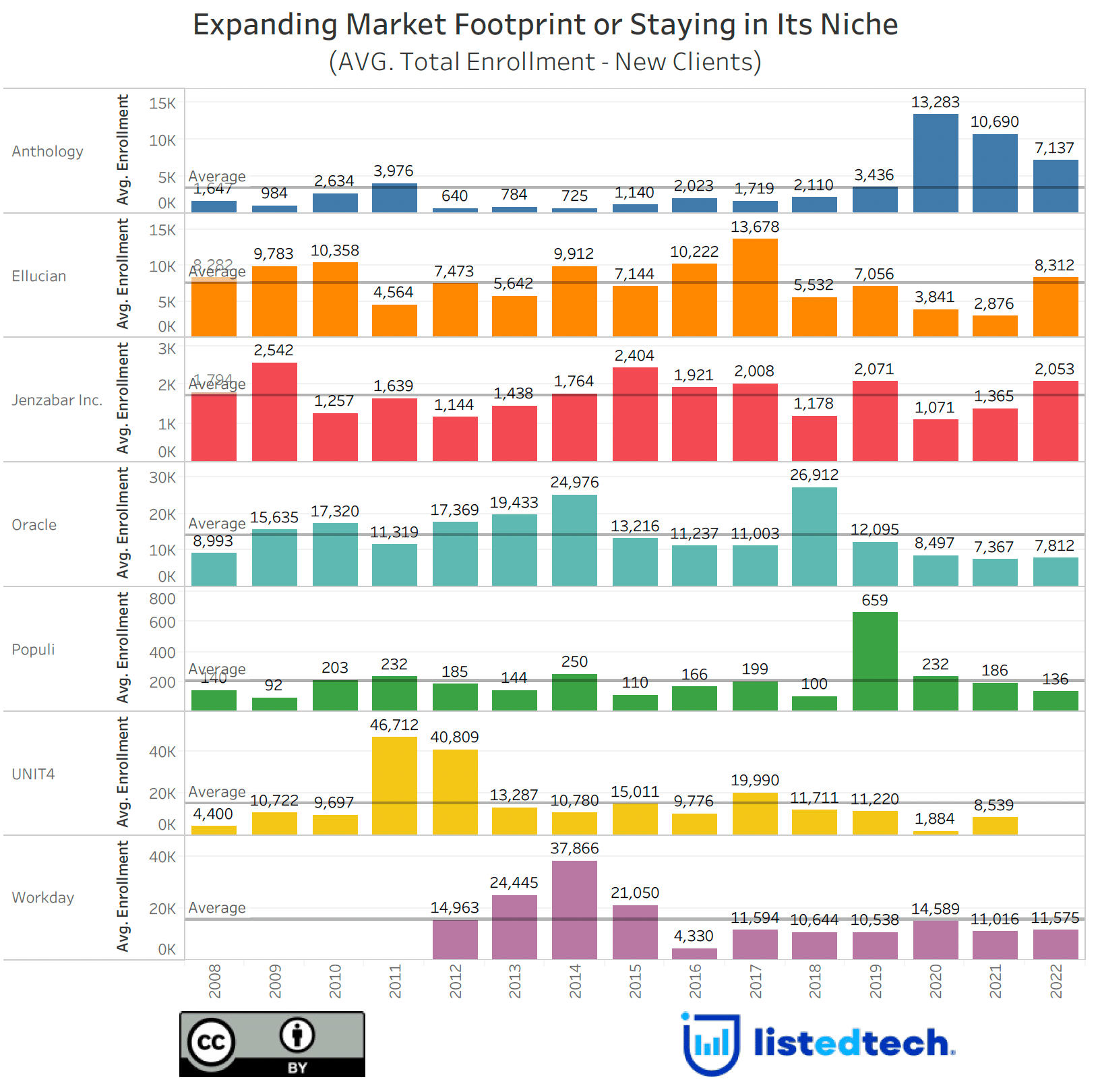

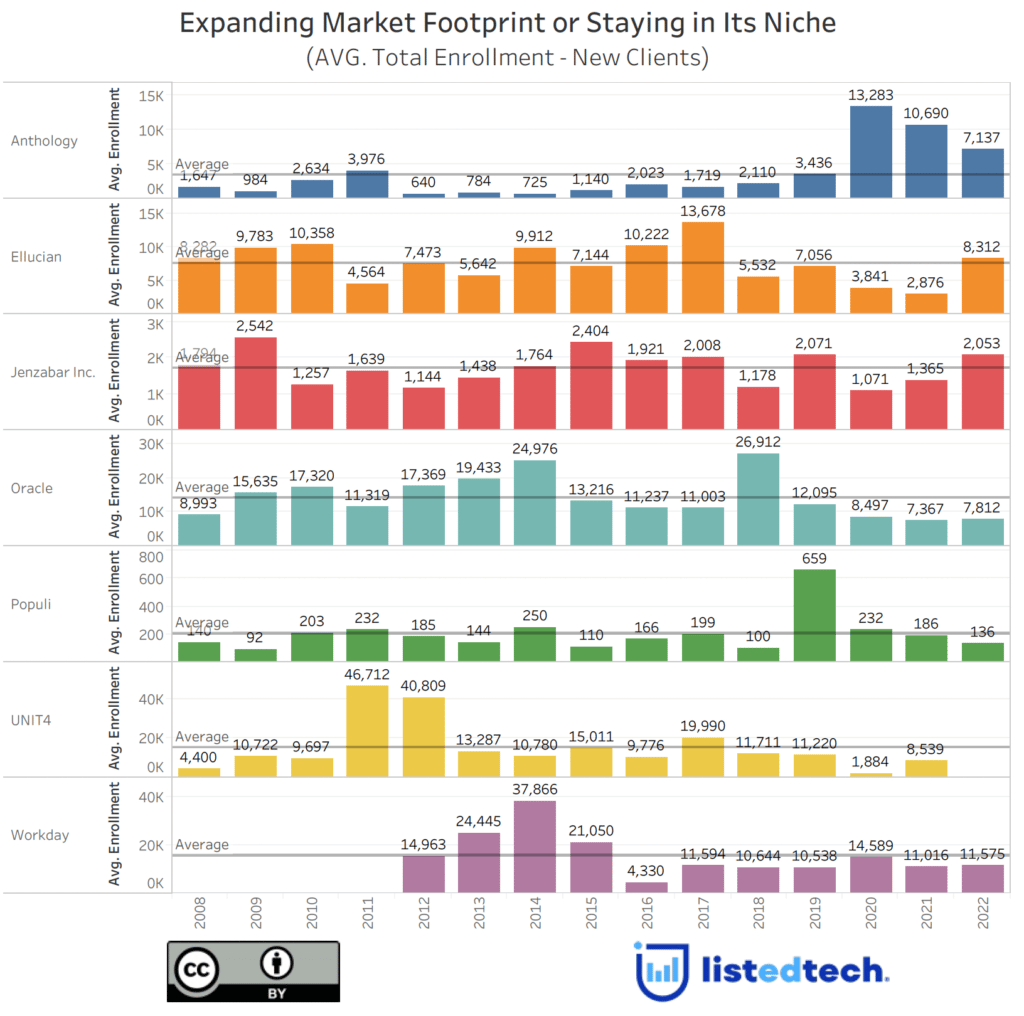

We often believe that companies enter a product category and their client base remains the same over the years. Even if this is true for some companies, others see diversification in their client profiles. In the past, we have produced an analysis of SIS product niches. Today, we expand this analysis of market niches to the whole ERP (HR, Finance and SIS). Will we see similar trends observed for SIS?

Contrary to our previous analysis, we present the data by company instead of by enrollment size. This view offers a better understanding of the market niche for each corporation. Before digging into the data, let’s contextualize the ERP market over the past decade:

- In early 2020, Veritas Capital acquired Campus Management and Edcentric to eventually form Anthology when it added iModules and Campus Labs to the newly formed corporation. Then in September 2021, Anthology bought Blackboard.

- UNIT4 purchased Three Rivers in 2015. Since then, the different SIS maintained by the company are all regrouped under the name Thesis. We have grouped them all under UNIT4.

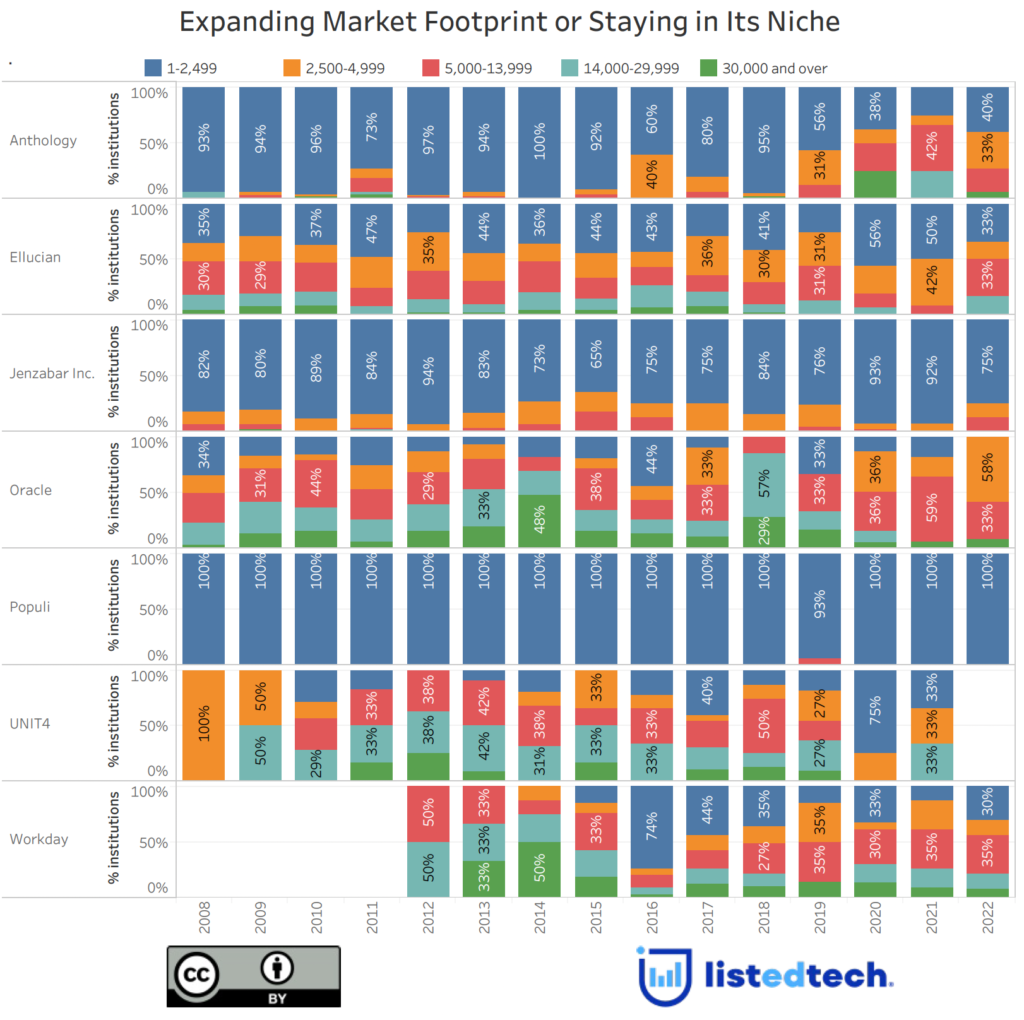

What the Graph Shows on Market Niches

- Before the creation of Anthology, Campus Management was primarily successful in smaller institutions (1-2,499). Since 2020, the client profiles have been much more balanced. We also see more implementations in larger institutions.

- Ellucian was somewhat stable up to the pandemic. In 2020 and 2021, the smaller institutions were 50% of its business. The year 2022 sees a return to a well-spread enrollment representation (except in the 30,000+ category). We must note that Ellucian has three products (Banner, Colleague and PowerCampus) covering different institution sizes.

- Jenzabar has most of its clients in the smallest enrollment category. It saw peaks up to 94% of its clients being in the smallest enrollment category in 2012 and the “pandemic years” (2020 and 2021).

- Oracle signs contracts and implements its solutions with the biggest enrollment band. In 2014, we saw that 48% of its implementations were in the 30,000+ enrollment band.

- Our Populi company profile mentioned that most of Populi’s clients are small U.S. colleges. Our most recent data confirms that the trend keeps up with the historical data.

- For UNIT4, there have been no trends throughout the years. The company implements its systems in all institution sizes. Although, we have to mention that the year 2020 was one of implementations in smaller institutions for UNIT4. Also, the year 2022 shows no implementations for this company.

- Since 2018, Workday has implemented its solutions in medium-sized institutions (5,000-12,999). These implementations represented one-third of all its business, even though Workday implements its solutions in all institution sizes.

When looking at the data of the past 15 years, we can attest that companies have succeeded with the same client types. The pandemic has shaken things up, but nothing big enough to change their market niches except for Anthology, which has started diversifying its clientele to target larger institutions.

Note: to create this graph, we only took the new implementations (including upgrades) of the three systems (SIS, Finance and HR) in HigherEd for North America.